A UPS seasonal employee delivers packages on Cyber Monday in New York on Nov. 27, 2023.

Stephanie Keith | Bloomberg | Getty Photos

November’s reliable jobs report did not assure that the economic system will appear in for a gentle landing, but it did enable to obvious the runway a small more.

Immediately after all, you will find almost nothing about a 3.7% unemployment level and an additional 199,000 positions that even whispers “economic downturn,” enable alone screams it.

At minimum for now, then, the U.S. economic climate can acquire an additional win with a modest “W” as it appears to be like to navigate by what had been the best inflation amount in more than 40 several years — and a continue to-unsure path in advance.

“Total, the work opportunities industry is performing its part to get us to a soft landing,” mentioned Daniel Zhao, guide economist at jobs score web-site Glassdoor. “It is boring in all the proper methods. Which is a welcome alter immediately after a few many years of less-dull studies.”

In truth, irrespective of a substantial amount of stress heading into the Labor Department’s nonfarm payrolls report, the specifics have been fairly benign.

The degree of job creation was just previously mentioned the Wall Street estimate of 190,000. Average hourly earnings rose 4% from a yr in the past, accurately in line with expectations. The unemployment price unexpectedly declined to 3.7%, easing worries that it could bring about a historically dead-on signal recognized as the Sahm Rule, which coordinates boosts of the unemployment rate by fifty percent a share place to recessions.

Still, the solid report could not dispense the lingering experience that the economic system is not out of the woods nevertheless. The panic principally will come from concerns that the Federal Reserve’s intense desire charge raises have not exacted their total toll and nonetheless could induce a agonizing downturn.

“The critical uncertainty for the labor current market in 2024 is irrespective of whether work progress slows to a a lot more sustainable speed, or whether the economic climate moves from month-to-month career gains to every month occupation losses. The former would be regular with the Fed’s tender-landing circumstance, even though the latter would suggest economic downturn,” reported Gus Faucher, chief economist at PNC Fiscal Providers. “PNC however thinks recession is the a lot more most likely end result in 2024, but it is a near contact.”

All about people and inflation

Key to whether the so-named landing is gentle or difficult will be the customer, who collectively accounts for approximately 70% of all U.S. financial exercise.

On that front, there was a different round of great information Friday: The University of Michigan’s intently watched buyer sentiment study showed that inflation anticipations, a vital economic variable for rates, plummeted in December. Respondents place 1-year inflation expectations at 3.1%, a spectacular 1.4 share stage fall.

Even so, such gauges can be “fluky” and are not in line with some other alerts coming from shoppers, mentioned Liz Ann Sonders, chief investment decision strategist at Charles Schwab. Debates in excess of soft landings and inflation anticipations and fascination price outlooks are inclined to pass up bigger factors, Sonders added.

Prior to 2023, Sanders and Schwab had been stressing the idea of “rolling recessions,” indicating that contractions could strike sure sectors independently though not dragging down the economic climate as a total. The distinction may perhaps however apply heading into 2024.

“The recession compared to comfortable landing debate kind of misses the needed nuances of this exceptional cycle,” Sonders mentioned. “A finest-case situation is not so much a smooth landing, because that ship has now sailed for [some] segments. It truly is that we go on to roll by this sort of that if and when products and services will get strike much more than the brief ding so considerably and it usually takes the labor current market with it, you’re now in stabilization or recovery manner in places that currently took their significant hits.”

Having to the gentle landing, then, very likely will need navigating some of all those peaks and valleys, none far more so than establishing assurance that inflation actually has been vanquished and the Fed can just take its foot off the brake. Inflation, according to the Fed’s favored gauge, is working at 3.5% per year, effectively over the central bank’s 2% goal, nevertheless is continually falling.

Continue to nervous about rates

There was one other great piece of inflation news Friday: Rental fees nationally declined .57% in November and had been down 2.1% 12 months in excess of 12 months, the latter becoming the biggest slide in far more than 3½ decades, in accordance to Lease.com.

Nevertheless, 1 attention-grabbing enhancement from the most current economic info was a little bit considerably less marketplace assurance that the Fed will be cutting interest charges very as aggressively as traders previously believed.

Whilst the traders in the fed funds futures area however roundly hope that the Fed is performed climbing, it now expects only about a 45% possibility of a formerly predicted reduce in March, according to CME Group info. Traders formerly had been expecting 1.25 percentage details value of cuts in 2024 but lowered that outlook as nicely to a toss-up with just a entire point of decreases pursuing the knowledge releases.

That could in itself seem to be like only a nuanced adjust, but the go in pricing demonstrates uncertainty in excess of no matter if the Fed keeps speaking hard on inflation, or concedes that policy no more time desires to be as limited. The fed cash charge is targeted in a assortment amongst 5.25% and 5.5%, its optimum degree in much more than 22 many years.

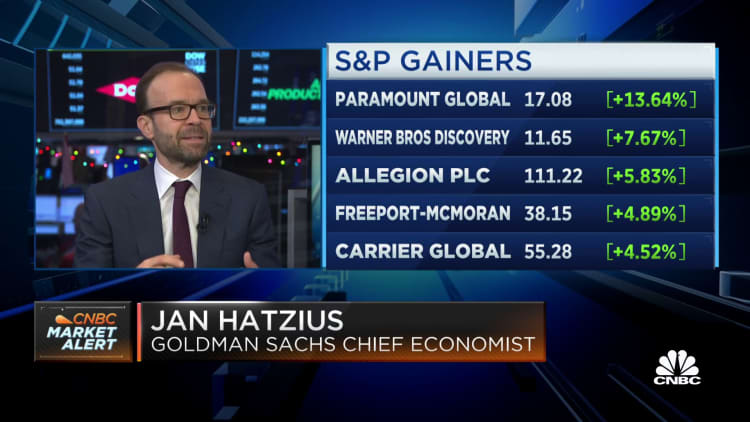

“The critical matter nevertheless, from a broader viewpoint, is that they can reduce if the financial state were being to see much more of a slowdown than we assume. Then the Fed could reduce, could give some assistance,” Jan Hatzius, chief economist at Goldman Sachs, mentioned Friday on CNBC’s “Squawk on the Street.” “That signifies the danger of recession is in my see really minimal.”

Goldman Sachs thinks you can find about a 15% prospect of a recession up coming 12 months.

If that forecast, which is about the standard likelihood presented usual financial disorders, holds up, it will involve ongoing strength in the labor sector and for customers.

Intervals of labor unrest this yr show, however, that not all may possibly be well on Main Road.

“If points have been going terrific, then persons would not be marching in the chilly and rain because they want far more pay out simply because the charge of dwelling is going up,” mentioned Giacomo Santangelo, an economist at task search internet site Monster.

Personnel will not likely have to have economists to inform them when the economic system has landed, he extra.

“The alleged definition of a gentle landing is to provide inflation down to 2% to 2½% and have unemployment go up to that total work level. That’s genuinely what we’re seeking for, and we are not there still,” Santangelo explained. “When you’re on an plane, you know what it feels like when a plane lands. You do not need the individual in the cockpit to arrive on and go, ‘Alright, we are heading to be landing now.”

You should not skip these stories from CNBC Pro: