People stroll by the New York Stock Trade (NYSE) on February 14, 2023 in New York Metropolis.

Spencer Platt | Getty Visuals

A banking disaster that erupted significantly less than two months back now seems to be significantly less a big broadside to the U.S. financial state than a sluggish bleed that will seep its way by and act as a likely catalyst for a a great deal-anticipated recession afterwards this 12 months.

As banks report the impression that a run on deposits has experienced on their functions, the image is a combined 1: More substantial institutions like JPMorgan Chase and Lender of The usa sustained considerably fewer of a hit, though lesser counterparts such as To start with Republic experience a a lot more durable slog and a battle for survival.

That indicates the funds pipeline to Wall Street remains mainly alive and very well although the condition on Key Road is substantially additional in flux.

“The modest banking companies are going to be lending significantly less. Which is a credit history strike on Center The us, on Major Road,” mentioned Steven Blitz, chief U.S. economist at TS Lombard. “That’s adverse for expansion.”

How destructive will occur to light-weight each in the approaching days and months months as information flows by way of.

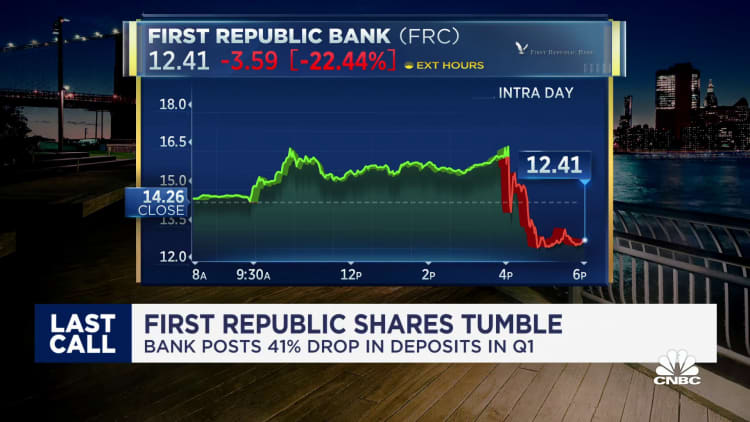

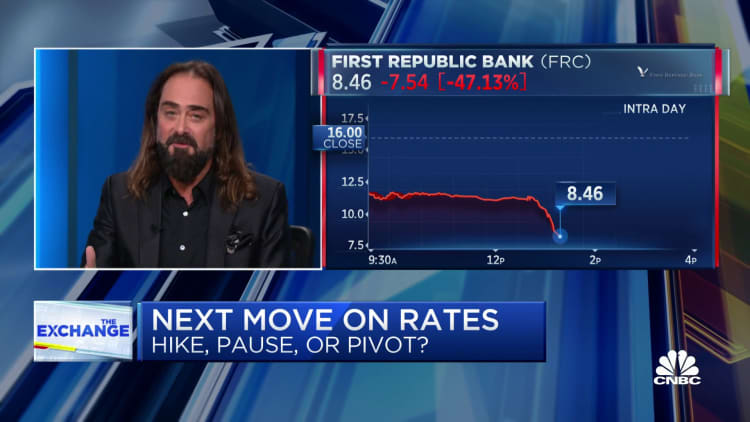

1st Republic, a regional loan company observed as a bellwether for how difficult the deposit crunch will strike the sector, posted earnings that conquer anticipations but reflected a battling firm or else.

Financial institution earnings largely have been decent for the initial quarter, but the sector’s foreseeable future is unsure. Stocks have been underneath pressure, with the SPDR S&P Lender ETF (KBE) off a lot more than 3% in Tuesday afternoon trading.

“Relatively than bringing regarding new info, this week’s earnings are confirming that the banking strain stabilized by the finish of March and was contained at a limit established of banks,” Citigroup worldwide economist Robert Sockin reported in a shopper take note. “That’s about the greatest macro outcome that could have been hoped for when stresses emerged final thirty day period.”

Viewing expansion forward

In the quick upcoming, the looking through on 1st-quarter financial expansion is predicted to be mostly favourable even with the banking issues.

When the Commerce Division releases its preliminary estimate on gross domestic solution gains for the 1st three months of the year, it really is predicted to clearly show an raise of 2%, according to the Dow Jones estimate. The Atlanta Fed’s info tracker is projecting an even superior achieve of 2.5%.

That development, though, is just not expected to past, owing mostly to two interconnected components: the Federal Reserve fascination level hikes aimed purposely at cooling the financial state and bringing down inflation, and the constraints on small-bank lending. First Republic, for a person, documented that it endured a far more than 40% decline in deposits, element of a $563 billion drawdown this yr amongst U.S. banking companies that will make it harder to lend.

Still Blitz and lots of of his colleagues continue to be expecting any recession to be shallow and short-lived.

“Everything retains telling me that. Can you have a recession that is not led by autos and housing? Sure, you can. It can be a recession established by a loss of property, a decline of earnings and that at some point flows through to anything,” he said. “Once again, it truly is a delicate economic downturn. A 2008-2009 economic downturn happens every single 40 a long time. It is not a 10-calendar year event.”

In point, the most latest recession was just two years in the past in the early times of the Covid crisis. The downturn was historically steep and short, ended by an similarly unparalleled fusillade of fiscal and financial stimulus that carries on to circulation through the financial system.

Purchaser investing has appeared to hold up quite well in the confront of the banking crisis, with Citigroup estimating excessive personal savings of about $1 trillion even now offered. Nevertheless, delinquency costs and balances are each mounting: Moody’s noted Tuesday that credit card demand-offs ended up 2.6% in the initial quarter, mounting by .57% from the fourth quarter of 2022, when balances soared 20.1% on an yearly basis.

Individual financial savings fees also have tumbled, slipping from 13.4% in 2021 to 4.6% in February.

But the most complete report introduced so far that will take into account the time period when Silicon Valley Lender and Signature Lender have been shuttered indicated that the damage has been confined. The Federal Reserve’s periodic “Beige Reserve” report released, April 19, indicated only that lending and desire for financial loans “frequently declined” and standards tightened “amid enhanced uncertainty and fears about liquidity.”

“The fallout from the disaster appears to be considerably less major than I had expected just a couple weeks back,” claimed Mark Zandi, main economist at Moody’s Analytics. The Fed report “was a whole lot considerably less hair-on-fireplace than I experienced predicted. [The banking situation] is a headwind, but it truly is not a gale-power headwind, it truly is just type of a nuisance.”

It truly is all about the purchaser

Where matters go from here depends considerably on the customers who account for a lot more than two-thirds of all U.S. economic exercise.

Whilst the demand from customers for providers is catching up to pre-pandemic levels, cracks are forming. Together with the increase in credit rating card balances and delinquencies is possible to come the additional obstacle of tightening credit rating expectations, equally by requirement and by way of an elevated chance of more durable regulation.

Reduce-revenue buyers have been going through strain for several years as the share of prosperity held by the top rated 1% of earners has ongoing to climb, up from 29.7% when Covid strike to 31.9% as of mid-2022, in accordance to the most new Fed knowledge out there.

“Right before any of this definitely began unfolding in early March, you were being by now starting up to see symptoms of contraction and reining in of credit rating,” stated Jim Baird, main financial commitment officer at Plante Moran Financial Advisors. “You happen to be viewing decreased demand for credit rating as customers and businesses start out to pull in the deck chairs.”

Baird, although, also sees odds slender for a steep economic downturn.

“When you appear at how all the forward-wanting details traces up, it truly is difficult to visualize how we sidestep at minimum a insignificant recession,” he claimed. “The true concern is how considerably can the energy of the labor financial system and even now-sizeable cash reserves that numerous households have propel customers forward and preserve the economic system on monitor.”