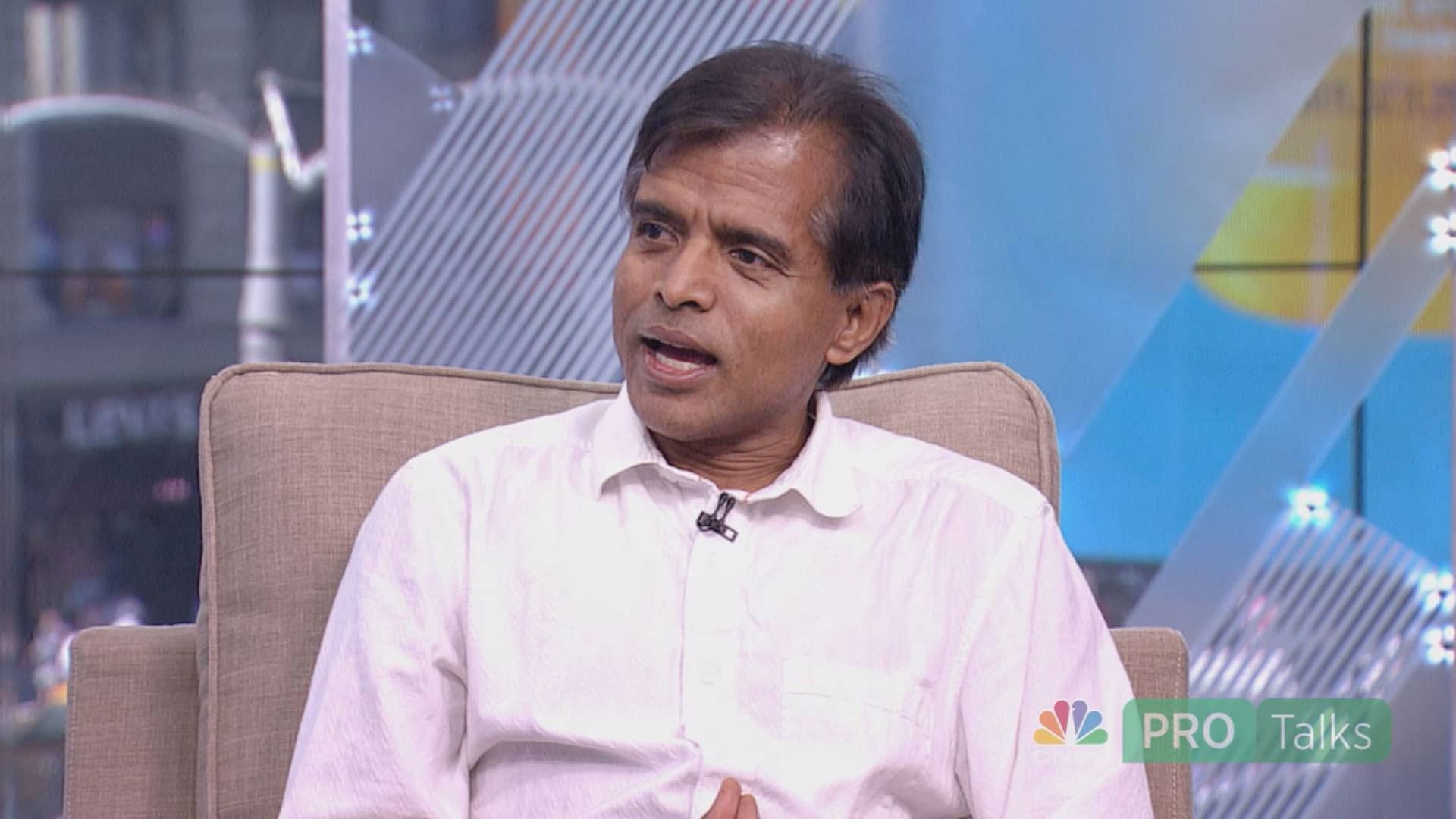

Know-how stocks are most likely overvalued just after substantial runups, in accordance to Aswath Damodaran. The New York College Stern College of Small business finance professor stated tech giants including Apple , Microsoft and Alphabet have seen these types of huge gains so far in 2023 and shares are perhaps in the middle of a “increase and bust” interval. “On a pricing foundation, when you’ve got [seen] as a great deal of a operate-up as you’ve had, you are a lot more most likely to be overvalued than undervalued,” Damodaran advised CNBC’s “Closing Bell” on Thursday. “You will not get a 40% operate-up on companies of this dimensions with no expecting some diploma of overvaluation.” Shares of Apple and Microsoft have just about every obtained just about 38% from the begin of the year, though Alphabet and Nvidia have soared 53% and 216%, respectively. That was not normally the circumstance, Damodaran included. As a short while ago as January, some of the more substantial players in the tech sector ended up skewed to an undervaluation, he claimed. As the conclusion of the calendar year methods, the pattern could change, he claimed, even if trader sentiment stays sturdy more broadly. “I consider that if the industry is going to be tearing for the relaxation of the 12 months, I you should not consider these organizations can do it,” he extra.