A container delivery truck heads for a person of the terminals at the Port of Prolonged Seashore in Prolonged Beach front, California.

Frederic J. Brown | AFP | Getty Images

Technologies companies supplying important semiconductor chips to the financial state have started off shifting cargo shipments from railroads to vehicles with a countrywide freight rail strike looming. The moves are currently being built, DHL Global Forwarding tells CNBC, in an exertion to stay away from any pre-strike rail preparations that would power freight rail organizations to prioritize cargo.

The tech cargo becoming sent to vehicles include semiconductor chips significant to the superior-tech sector and auto business.

“This is tech cargo originating out of California,” reported Goetz Alebrand, head of ocean freight for the Americas at DHL International Forwarding. Alebrand reported there is now additional truck potential than there had been when a rail strike was very first threatened in September as a result of fewer containers ships general coming in to U.S. ports.

“There are a lot more vans and chassis, but that does not mean there are adequate trucks to go all rail cargo onto vans,” Alebrand reported.

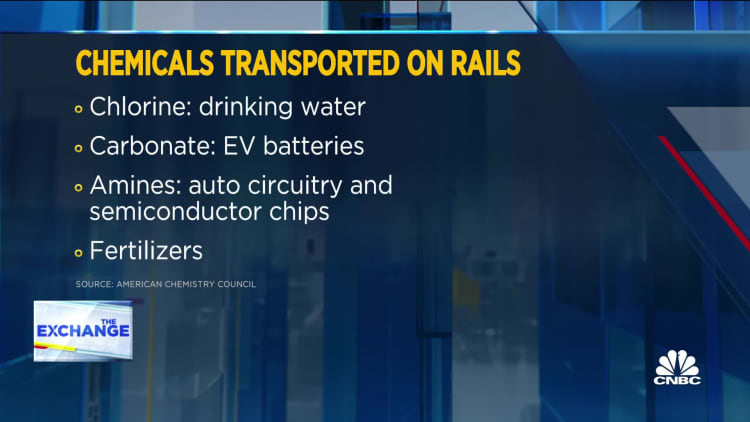

According to federal protection actions, railroad carriers commence prepping for a strike seven days in advance of the strike date. The carriers start to prioritize the securing and motion of stability-sensitive products like chlorine for consuming h2o and dangerous materials in the rail winddown.

Ninety-6 hrs before a strike date, substances are no for a longer period transported. According to the American Chemistry Council, railroad marketplace info shows a drop of 1,975 carloads of chemical shipments all through the week of September 10 when the railroads stopped accepting shipments because of to the former threat of a strike.

The Association of American Railroads would be anticipated to release its preparing steps, very similar to what it announced in September.

Alebrand explained is a client’s cargo is not characterised as perishable or hazardous, it waits to be moved. On common, it usually takes about two to 3 times to crystal clear up a single working day of backup. The September pre-strike containers that ended up held up for approximately 48 hours took 6 times to apparent.

Delays incurred by a rail strike would only insert to the late expenses shippers spend the railroads on late cargo.

“DHL International Forwarding has suggested consumers of the severe impact that a rail strike could have on their functions, such as delays and related detention and demurrage prices,” Alebrand mentioned. “Our initial precedence has been to make them aware of this scenario so that they can put together for the hazard of delays in getting the goods,” he additional.

DHL World Forwarding is also seeking at container destinations and, as a contingency, it is going import bins out of rail yards to the extent feasible, and examining all import and export flows working with rail to verify no matter if trucking is an solution in the occasion of a strike, Alebrand reported.

Areas of worry for DHL include things like Dallas and Fort Really worth, which acquire cargo from the Port of Houston. The Port of Houston has processed historic volumes of cargo as trade moves absent from the West Coast ports to the Gulf and East Coast ports out of fears of a strike among West Coast port personnel. The other inland port the place DHL sees congestion is El Paso, a major place for cargo heading in and out of Mexico.

“Congress is again in session upcoming 7 days,” Alebrand said. “We now wait around to see what occurs.”

A rail strike could start out on Dec. 9 if no agreement is attained amongst unions and rail companies. Congress can intervene utilizing its electric power by means of the Constitution’s Commerce Clause to introduce laws to quit a strike or a lockout, and to established terms of the agreements in between the unions and the carriers.