Taiwan performs a vital function in the AI chip revolution and the world semiconductor market, the main govt of the Taiwan Inventory Exchange explained to CNBC in an special job interview.

Sherman Lin, chairman and CEO of Taiwan Stock Exchange Company attributed the strong gains on the Taiwan Weighted Index to “the AI revolution.”

“It is just mainly because [of] the large demand of the substantial-finish chip, and also the server source chain. That’s why our inventory current market is going up,” he said.

The Taiex has risen 27.93% in the past 12 months, but gave up some gains on Friday after most main marketplaces in the area sank amid climbing Middle East tensions.

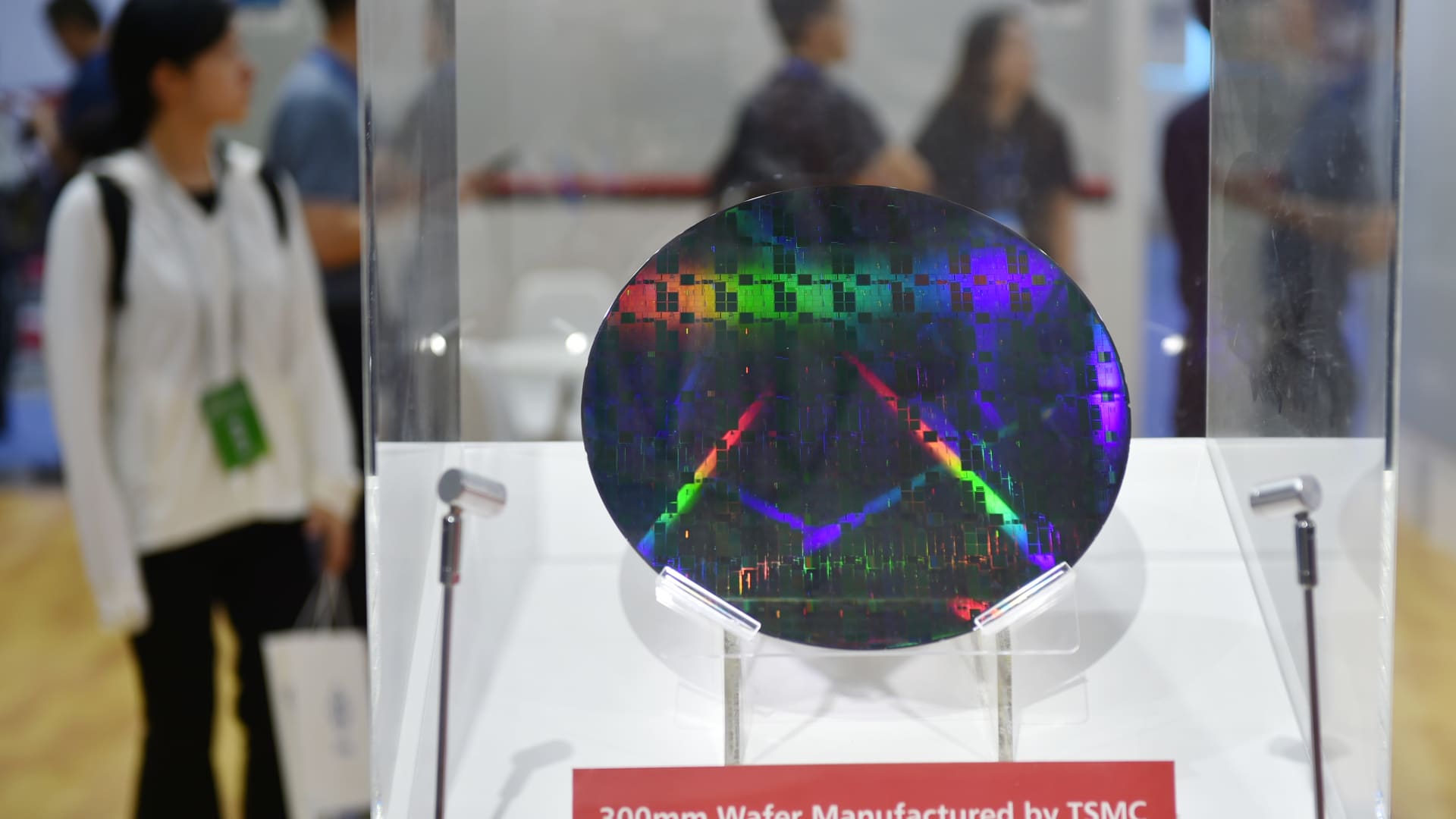

A lot of Taiwan’s dominance in the worldwide semiconductor marketplace can be attributed to Taiwan Semiconductor Manufacturing Co, the world’s major agreement chipmaker that generates advanced processors for clientele like Apple and Nvidia. TSMC is the key manufacturer of Nvidia’s powerful AI processors.

“I feel this is a ton of attraction for traders … So it implies, actually, Taiwan performs [a] really important purpose in AI supply chain and also the semiconductor business,” explained Lin.

Taiwan’s chip dominance

In 2023, Taiwan led highly developed chip producing technologies, which include 16- or 14-nanometer and additional innovative procedures, with 68% worldwide potential share, according to TrendForce data. This was adopted by the U.S. (12%), South Korea (11%), and China (8%), the details showed.

Taiwan also held practically 80% current market share in extreme ultraviolet era procedures, this kind of as 7-nanometer and much more highly developed technological innovation, explained TrendForce. The more compact the nanometer size, the extra impressive the chip is. EUV tools are significant in the creation of the world’s most advanced processors.

“We have really excellent fundamentals of ICT industries. So we can have the toughness to facilitate, leveraging the achievements of the ICT and engineering industries, new economic system small business,” claimed Lin.

Quake and geopolitical hazards

Before this month, Taiwan was strike by its strongest earthquake in 25 years. TSMC explained design sites ended up regular on original inspection, even though employees from some fabs ended up briefly evacuated. Those people employees subsequently returned to their workplaces.

“Taiwan exhibits extremely very good resilience … I understand that some shown providers that report to the TWSE – they had incredibly very little influence on their productions,” said Lin.

“The kind of the obstacle for Taiwan is the tests for our small business continuity plan. We basically did very effectively. And we refreshed, we responded really quickly. So you can see in the capital sector, you can see the modified rebound quite before long,” reported Lin.

“Correct now, it’s nevertheless in the uptrend in the money sector right after the earthquake.”

On the end result of the U.S. elections and armed service conflicts, Lin explained these types of predicaments “will constantly affect some money markets” as properly as the Taiwan market.

“But [as] you can see, it will go again to the fundamentals. So I assume Taiwan has superior fundamentals, [has] resilience and [responds] rapidly. I am fairly assured about our cash markets,” mentioned Lin.