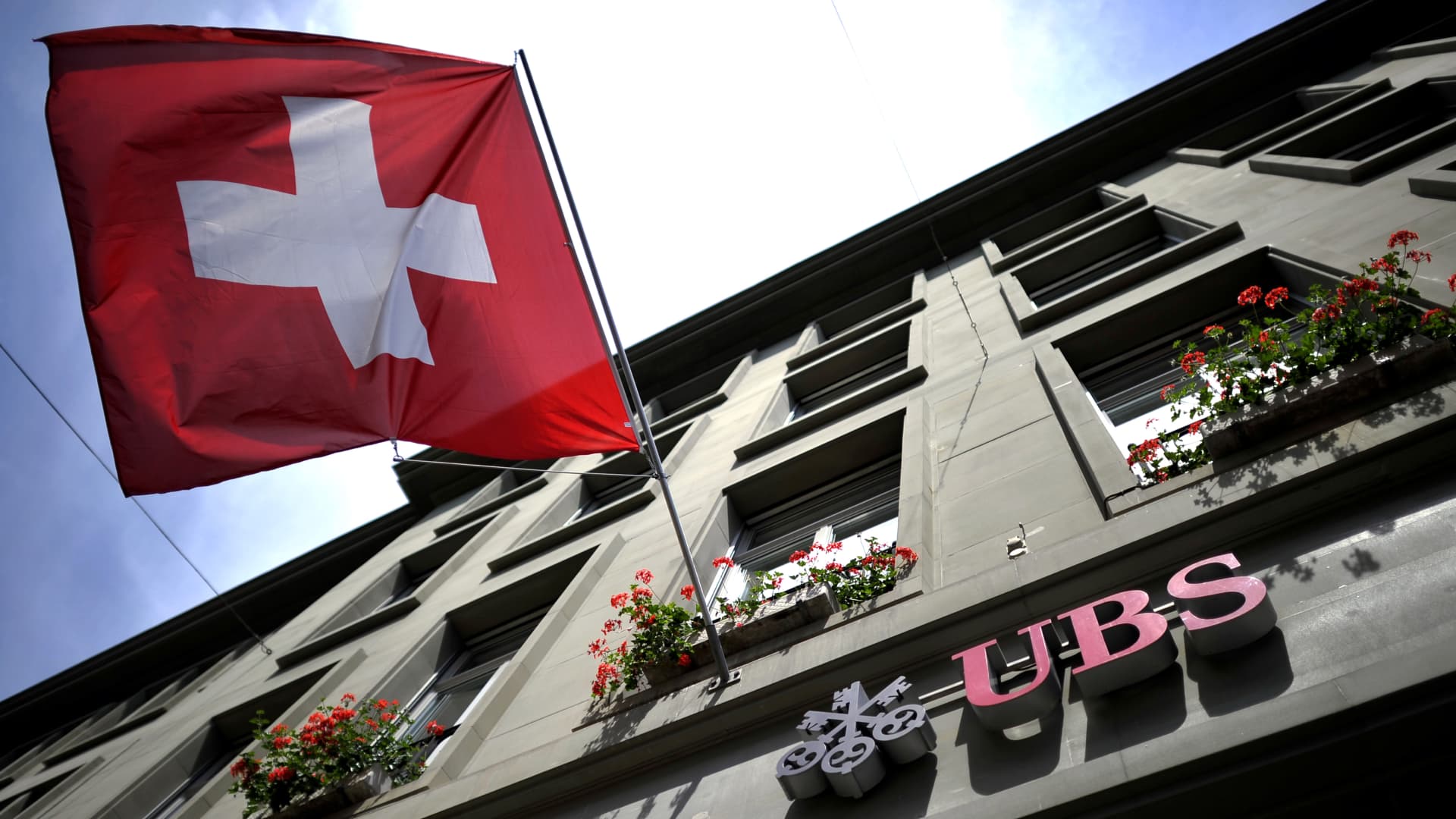

UBS Group AG

As Wall Road turns bearish on the U.S., here is in which the professionals say to devote

The S & P 500 notched an outstanding effectiveness in the initial quarter, getting 7% irrespective of turmoil in the banking sector and a sequence of curiosity price hikes. But Wall Road strategists look unconvinced that U.S. shares are the very best location to be hunting forward, citing tighter monetary problems, declining corporate earnings, and […]

Read More

Stocks making the biggest moves midday: Tesla, Marathon Oil, WWE, UnitedHealth and more

In this article MRO APA FSLR UBS WWE TSLA Follow your favorite stocksCREATE FREE ACCOUNT A vehicle charges a Tesla Supercharging station in Corte Madera, California, US, on Thursday, March 2, 2023. David Paul Morris | Bloomberg | Getty Images Check out the companies making the biggest moves midday: Tesla — Shares dropped 6% after […]

Read More

Swiss prosecutor reportedly investigates Credit history Suisse takeover by UBS

This photograph taken on March 24, 2023 in Geneva, exhibits a indication of Credit rating Suisse lender. Fabrice Coffrini | AFP | Getty Photographs Switzerland’s Federal Prosecutor has opened an investigation into the point out-backed takeover of Credit Suisse by UBS, the Fiscal Times reported on Sunday. The Bern-dependent prosecutor is on the lookout into […]

Read More

Goldman Sachs’ major inventory picks in Europe include 3 with in excess of 100% upside

Fears of contagion in the world wide financial method and uncertainty around curiosity prices have weighed on investor sentiment in the latest weeks, but options stay amid the current market volatility, in accordance to Goldman Sachs . “The macro backdrop stays unsure … That reported, we see scope for alpha opportunities with returns dispersion throughout […]

Read More

Stocks generating the greatest moves midday: Bed Bath & Over and above, EVgo, UBS and extra

In this article EVGO CROX GPN NFLX BBBY Abide by your preferred stocksProduce Free ACCOUNT A Bed Tub & Beyond retail store in the Brooklyn borough of New York, US, on Monday, Feb. 6, 2023. Bed Bathtub & Past Inc. stated it would shutter an additional 87 suppliers in addition to the 150 closures it […]

Read More

European shares shut increased as banking issues proceed to relieve H&M up 16%

European markets shut better Thursday, with most sectors putting up gains as concerns around the banking sector relieve. Source

Read More

Stocks making the biggest premarket moves: RH, Charles Schwab, Walmart and more

In this article WMT PM SCHW RH Follow your favorite stocksCREATE FREE ACCOUNT Interior Design area of the Restoration Hardware store in the Meatpacking District of New York. Source: RH Check out the companies making the biggest moves in premarket trading: RH — The high-end furniture chain dropped 6.2% after reporting adjusted earnings per share […]

Read More

EU regulators distance them selves from Credit score Suisse bond writedowns

Switzerland’s 2nd premier bank Credit score Suisse is observed here subsequent to a Swiss flag in downtown Geneva. Fabrice Coffrini | AFP | Getty Visuals BRUSSELS — European regulators distanced them selves from the Swiss determination to wipe out $17 billion of Credit Suisse‘s bonds in the wake of the bank’s rescue, indicating they would write […]

Read More

Stocks making the biggest moves midday: Lululemon, Micron, Carnival, Foot Locker & more

In this article PLAY PSX SLB EBS WOOF Follow your favorite stocksCREATE FREE ACCOUNT A view of a Canadian athletic apparel retailer Lululemon logo seen at one of their stores. Alex Tai | LightRocket | Getty Images Check out the companies making headlines in midday trading Wednesday. Lululemon – Shares of the athleticwear company soared more […]

Read More

Stocks making the biggest moves premarket: Lululemon, Paychex, Micron Technology and more

In this article UBS UBSG-CH CS CSG.N-CH PAYX MU BBWI FL ROST BURL URBN CCL LULU Follow your favorite stocksCREATE FREE ACCOUNT A Lululemon store in New York, US, on Tuesday, March 28, 2023. Stephanie Keith | Bloomberg | Getty Images Check out the companies making headlines before the bell. Lululemon – Lululemon shares surged […]

Read More