Nucor Corp

Cramer’s lightning round: I like Entegris

Entegris Inc: “I like Entegris. It’s very out of favor, it’s got a little too high multiple, but it does a lot of nuts and bolts that you need to make semis, so that’s okay by me.” Henry Schein Inc: “I like the company. It’s very plain vanilla, nothing really exciting about it, but that’s […]

Read More

Cramer’s final thoughts for the year: Making sense of multiples amid a looming recession

The price-to-earnings multiples say recession. But the multiples said similar things in 2022. So how long can the multiples stay this low? We have all read dozens of articles about what 2023 will bring us. I think most are sincere. Their only drawback, as usual, is that they don’t touch on stocks themselves. They might […]

Read More

Jim Cramer says he likes Corteva and Nucor for 2023

CNBC’s Jim Cramer on Monday offered investors two stocks they should consider adding to their portfolios. Stocks in the materials sector tend to be highly cyclical, meaning they could get hammered if the Federal Reserve’s interest rate hikes tip the economy into a recession, he explained. And while it’s far from the best-performing sector in […]

Read More

Cramer’s lightning round: I wouldn’t buy World Wrestling Entertainment at this level

Cleveland-Cliffs Inc: “I think the numbers may be too high in Cliffs. The numbers may be too low in Nucor.” Disclaimer: Cramer’s Charitable Trust owns shares of Danaher. Jim Cramer’s Guide to Investing Click here to download Jim Cramer’s Guide to Investing at no cost to help you build long-term wealth and invest smarter. Source

Read More

Cramer’s lightning round: BRC Inc is not a buy

“Mad Money” host Jim Cramer rings the lightning round bell, which means he’s giving his answers to callers’ stock questions at rapid speed. Source

Read More

Jim Cramer says these 6 cyclical ‘smokestack’ stocks may be worth owning

CNBC’s Jim Cramer on Monday offered investors a list of cyclical stocks that have “caught fire” recently, making them potential great additions to portfolios. “Sell the techs into any strength … because they’re right in the middle of the Federal Reserve’s blast zone. But as for the cyclical smokestack stocks? Many of them could be […]

Read More

Jim Cramer says these 10 ‘old guard’ stocks are making a comeback

CNBC’s Jim Cramer on Tuesday offered investors a list of 10 companies that he believes are rising to the top as tech stocks collapse. “It’s the revenge of the old guard right now, right here. All sorts of boring, conventional companies are taking back the market while the digitizers and disruptors are being burned,” he […]

Read More

Cramer’s lightning round: Stay with Vertex Pharmaceuticals

Getty Images Holdings Inc: “I think down here at $4, I’m not a SPAC guy, okay, but this one may be actually worth looking at.” Jim Cramer’s Guide to Investing Click here to download Jim Cramer’s Guide to Investing at no cost to help you build long-term wealth and invest smarter. Source

Read More

Inflation is dominating the dialogue on earnings phone calls. Here is what execs are declaring

Pepsi merchandise are shown for sale in a Target retail outlet on March 8, 2022 in Los Angeles, California. Mario Tama | Getty Photographs 1 detail is obvious at the begin of the company earnings time: Inflation continues to be a scorching matter for businesses. About two-thirds of corporations in the S&P 500 that reported […]

Read More

Stocks making the biggest moves midday: Allstate, AT&T, IBM, Tesla and more

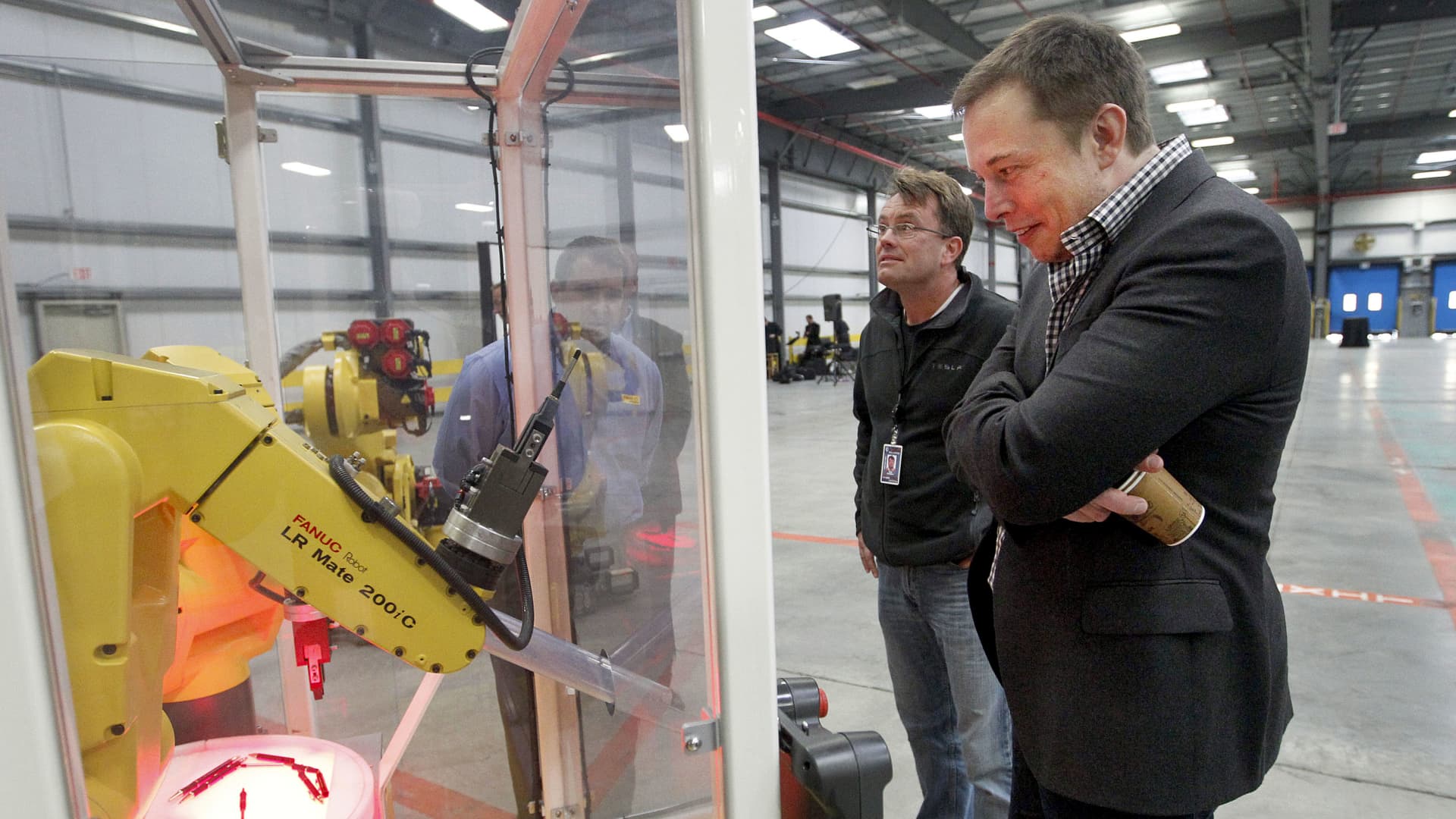

In this article IBM ALL T NVDA TSLA DDOG KMI Follow your favorite stocksCREATE FREE ACCOUNT Elon Musk looks at a robot display during a tour of the new Tesla Motors auto plant, formerly operated New United Motor Manufacturing Inc. (NUMMI), in Fremont, California, U.S., on Wednesday, Oct. 27, 2010. Bloomberg | Bloomberg | Getty […]

Read More