National taxes

IRS commissioner nominee to ‘ensure that America’s highest earners comply with tax laws.’ Here are the key takeaways from Senate hearing

Senate Finance Committee Chairman Ron Wyden, D-Ore., questions IRS Commissioner Charles Rettig at a Senate Finance Committee hearing. Tom Williams | Pool | Reuters President Joe Biden’s nominee to lead the IRS answered questions during a Senate Finance Committee hearing this week, highlighting key issues from lawmakers on both sides of the aisle. Daniel Werfel, […]

Read More

How to pay 0% capital gains taxes with a six-figure income in 2023

vitapix | E+ | Getty Images Planning to sell some investments this year? It’s less likely to affect your 2023 tax bill, experts say. Here’s why: The IRS made dozens of inflation adjustments for 2023, including the long-term capital gains brackets, applying to investments held for more than one year. This means you can have […]

Read More

The IRS has issued nearly 8 million tax refunds. Here’s the average payment

Bill Oxford | E+ | Getty Images The tax season is underway, and the IRS has issued nearly 8 million refunds worth about $15.7 billion as of Feb. 3, the agency reported. The average refund amount was $1,963, down from last year’s payment of $2,201 at the same point in the filing season. Of course, […]

Read More

House lawmakers relaunch the SALT caucus. Here’s what to know about the $10,000 deduction limit for state and local taxes

Rep. Bill Pascrell, D-N.J., speaks at a news conference announcing the state and local taxes caucus outside the Capitol on April 15, 2021. Sarah Silbiger | Bloomberg | Getty Images A group of bipartisan House representatives relaunched the SALT caucus last week, calling for relief from the $10,000 limit on the federal deduction for state […]

Read More

Pre-tax vs. Roth 401(k): Deciding which to use for retirement is trickier than you think

Prathanchorruangsak | Istock | Getty Images Whether you’re starting a new job or updating retirement savings goals, you may need to choose between pre-tax or Roth 401(k) contributions — and the choice may be more complex than you think. While pre-tax 401(k) deposits offer an upfront tax break, the funds grow tax-deferred, meaning you’ll owe […]

Read More

IRS: Residents of more than a dozen states do not need to report ‘special payments’ for welfare, disaster relief on their federal return

The IRS on Friday issued federal tax guidance for millions of Americans who received state rebates or payments in 2022. The announcement came about a week after the agency had urged those taxpayers to hold off on filing while it determined if the funds are taxable on federal returns. “The IRS has determined that in […]

Read More

Biden to revisit ‘billionaire minimum tax’ in State of the Union address

President Joe Biden delivers the State of the Union address on March 1, 2022. Win Mcnamee | Getty Images President Joe Biden will again call for a “billionaire minimum tax” during his State of the Union address on Tuesday. While details haven’t been released, Biden previously proposed a billionaire minimum tax in his 2023 federal […]

Read More

When it makes sense to buy extra paper Series I bonds with your tax refund, according to experts

Jetcityimage | Istock | Getty Images If you’re trying to max out the yearly purchase limit for Series I bonds, your tax refund offers an opportunity to buy even more. However, you should consider your goals and weigh alternatives first, experts say. An inflation-protected and nearly risk-free investment, I bonds are currently paying 6.89% annual […]

Read More

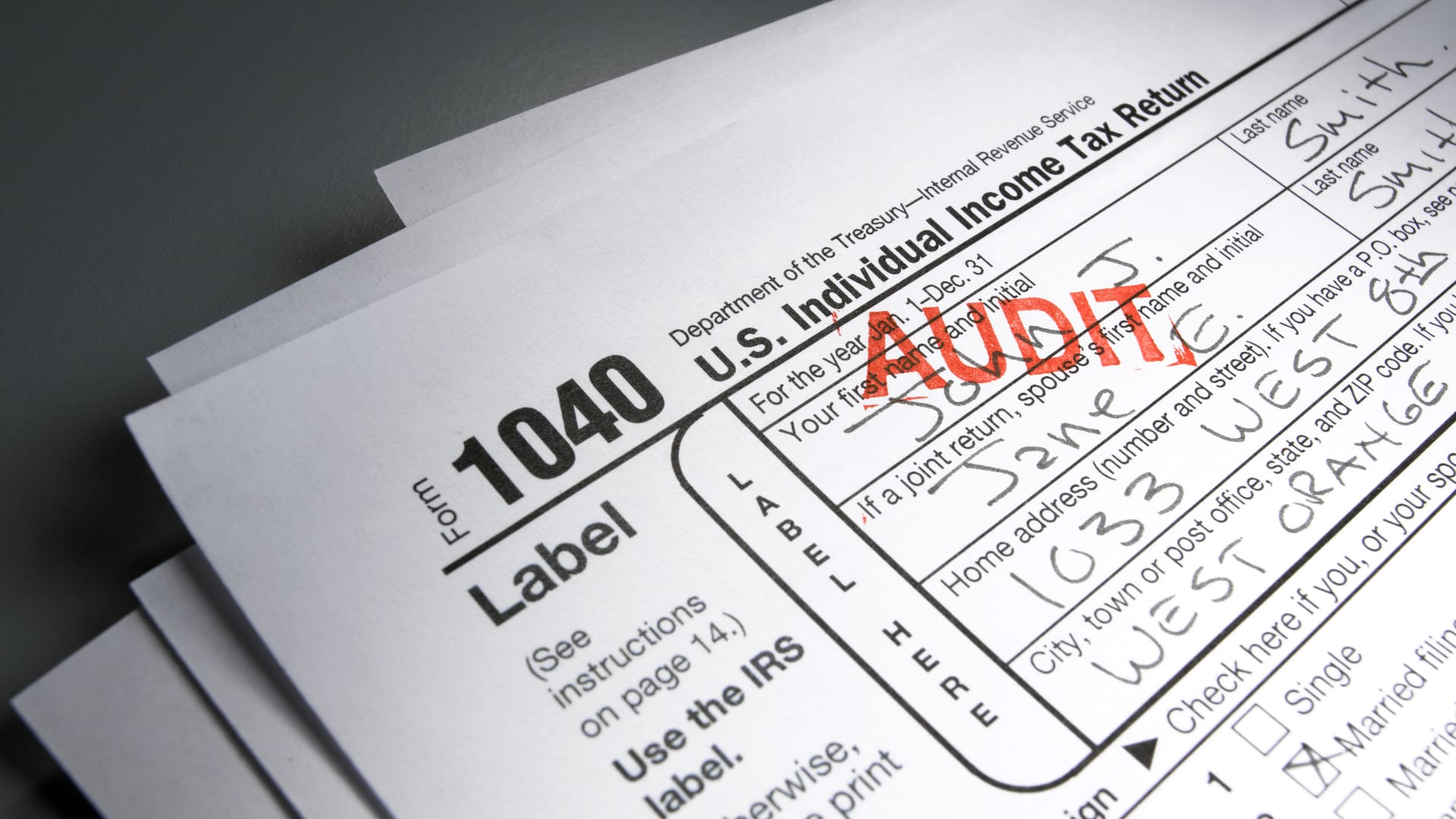

Don’t risk a tax audit. Here are four reasons the IRS may flag your return

dmphoto | E+ | Getty Images Tax season is underway, and there’s been increased scrutiny of the IRS as it starts deploying part of the nearly $80 billion in funding approved for the agency by Congress in August. While Treasury Secretary Janet Yellen has said goals include boosting customer service and improving technology, critics have […]

Read More

IRS about 3 to 5 times more likely to audit Black Americans’ tax returns, study finds

Jeffrey Coolidge | Photodisc | Getty Images Black Americans are roughly three to five times more likely to face an IRS audit than other taxpayers, according to a new study. While there isn’t evidence of explicit discrimination from the IRS or its revenue agents, the findings show the disparity stems from a faulty software algorithm […]

Read More