National taxes

IRS insists destruction of 30 million files of taxpayer data won’t affect payers

alfexe | iStock | Getty Images Filers won’t be affected by the IRS decision to destroy data for millions of taxpayers, the agency said in a statement Thursday. The IRS tossed an estimated 30 million so-called paper-filed information returns in March 2021, according to an audit by the Treasury Inspector General for Tax Administration. The […]

Read More

Tax professionals ‘horrified’ by IRS decision to destroy data on 30 million filers

courtneyk | E+ | Getty Images An audit by the Treasury Inspector General for Tax Administration revealed the IRS has tossed data for millions of payers, sparking anger from the tax community. The material, known as paper-filed information returns in accounting parlance, is sent yearly by employers and financial institutions, and covers taxable activity, such […]

Read More

Over 60 million tax returns could be completed automatically, study shows

Tom Werner | DigitalVision | Getty Images The IRS may have the ability to automate nearly half of tax returns, according to a working paper from the National Bureau of Economic Research. The agency could correctly auto-fill an estimated 62 million to 73 million returns with information it already has, covering 41% to 48% of […]

Read More

Here’s what to do if you missed the April 18 tax filing deadline

Sergey Mironov | Moment | Getty Images If you missed the April 18 tax deadline, you may cut back on penalties by filing your return promptly, according to the IRS. While it’s too late to request an extension, you can still reduce monthly late fees. Failure to file costs 5% of unpaid taxes per month and late payments incur […]

Read More

What we learned from the Biden, Harris tax returns, according to experts

President Joe Biden and Vice President Kamala Harris after Biden signed H.R. 55, the “Emmett Till Antilynching Act,” in Washingtonon March 29, 2022. Samuel Corum | Bloomberg | Getty Images President Joe Biden and Vice President Kamala Harris have released their 2021 tax returns, and there are a few key takeaways for the average American, experts […]

Read More

How companies like Amazon, Nike and FedEx avoid paying federal taxes

The current United States tax code allows some of the biggest company names in the country to not pay any federal corporate income tax. In fact, at least 55 of the largest corporations in America paid no federal corporate income taxes on their 2020 profits, according to the Institute on Taxation and Economic Policy. The […]

Read More

There’s a growing interest in wealth taxes on the super-rich. Here’s why it hasn’t happened

Sen. Ron Wyden, D-Ore., speaks during a Senate Finance Committee nomination hearing on Feb. 23, 2021. Greg Nash | Pool | Reuters Americans increasingly favor a wealth tax on the ultra-rich. But despite an uptick in proposals, these policies have struggled to gain traction. President Joe Biden in March unveiled the latest federal wealth tax […]

Read More

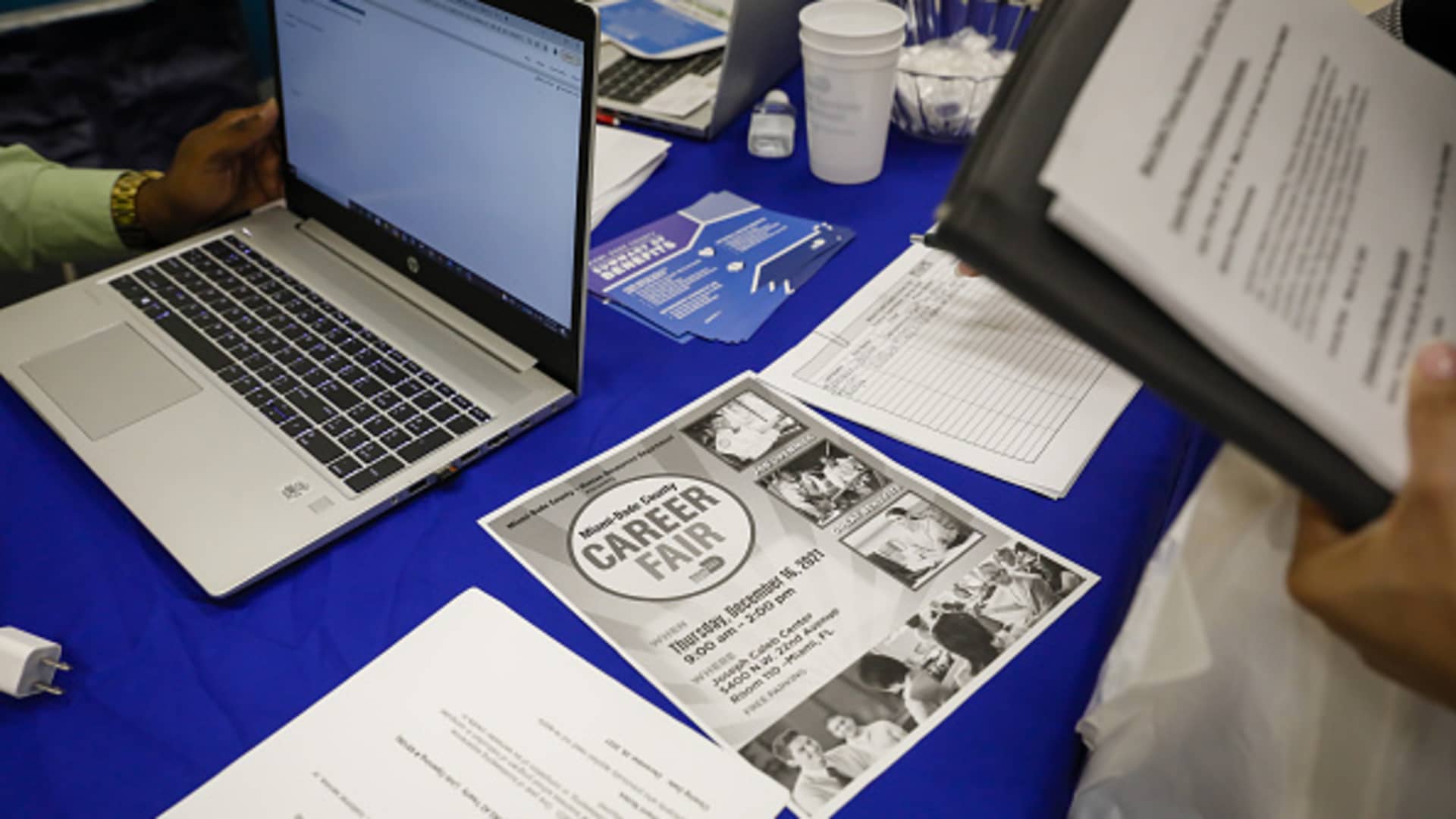

Many Americans face big tax bills on 2021 unemployment benefits

A Miami-Dade County job fair in Miami on Dec. 16, 2021. Eva Marie Uzcategui/Bloomberg via Getty Images Many Americans who collected unemployment benefits in 2021 may be on the hook for big bills this tax season. The federal government and most states treat unemployment benefits as taxable income. However, tax wasn’t collected on about 60% […]

Read More

Why Biden’s billionaire minimum income tax may be a tough sell

Josh Gottheimer, D-N.J., talks to reporters in Washington, Nov. 4, 2021. Elizabeth Frantz | Reuters President Joe Biden has proposed a new tax on the ultra-wealthy as part of his 2023 federal budget, aiming to reduce the deficit by about $360 billion. Some experts say it’s unlikely to gain traction in Congress. The “billionaire minimum income tax” calls […]

Read More

Biden’s budget proposes tax hike on married filers making more than $450,000

President Joe Biden introduces his budget request for fiscal year 2023 on March 28, 2022 in Washington. Anna Moneymaker | Getty Images President Joe Biden released his 2023 federal budget request on Monday, calling to hike the top marginal income tax rate to 39.6% from 37%, a proposal floated by the administration last year. The […]

Read More