JPMorgan Chase & Co

These big bank stocks could rise 30% if economy avoids recession, Credit Suisse says

Big U.S. banks are on track to meet analysts’ third-quarter earnings expectations, thanks to good loan growth and rising interest rates, according to Credit Suisse . With a few weeks remaining in the quarter, analysts led by Susan Roth Katzke examined key data points for the group. Loan balances for the industry are heading for […]

Read More

4 takeaways from the Investing Club’s ‘Morning Meeting’ on Thursday

Every weekday the CNBC Investing Club with Jim Cramer holds a “Morning Meeting” livestream at 10:20 a.m. ET. Here’s a recap of Thursday’s key moments. July’s soft PPI is welcome news for growth stocks Disney just crushed it Quick mentions: QCOM, AAPL, DIS, AMZN We need to be nimble in oil 1. July’s soft PPI […]

Read More

Stocks making the biggest moves midday: Six Flags, Disney, Sonos and more

Customers are socially distanced on rides like the Wonder Woman: Lasso of Truth at Six Flags Great Adventure in Jackson, New Jersey. Kenneth Kiesnoski/CNBC Check out the companies making headlines in midday trading. Six Flags — Shares dropped more than 22% after the theme park company sharply missed second-quarter earnings expectations. Six Flags reported earnings […]

Read More

These small banks are a good bet ahead of any possible recession, Piper Sandler says

Bank investors are in a bit of a conundrum. While many banks look cheap on a valuation basis and the industry’s results have held up relatively well as economic growth slowed, the concern remains that if the U.S. enters a recession, the group’s earnings will decline and their shares could fall further. That’s why investors […]

Read More

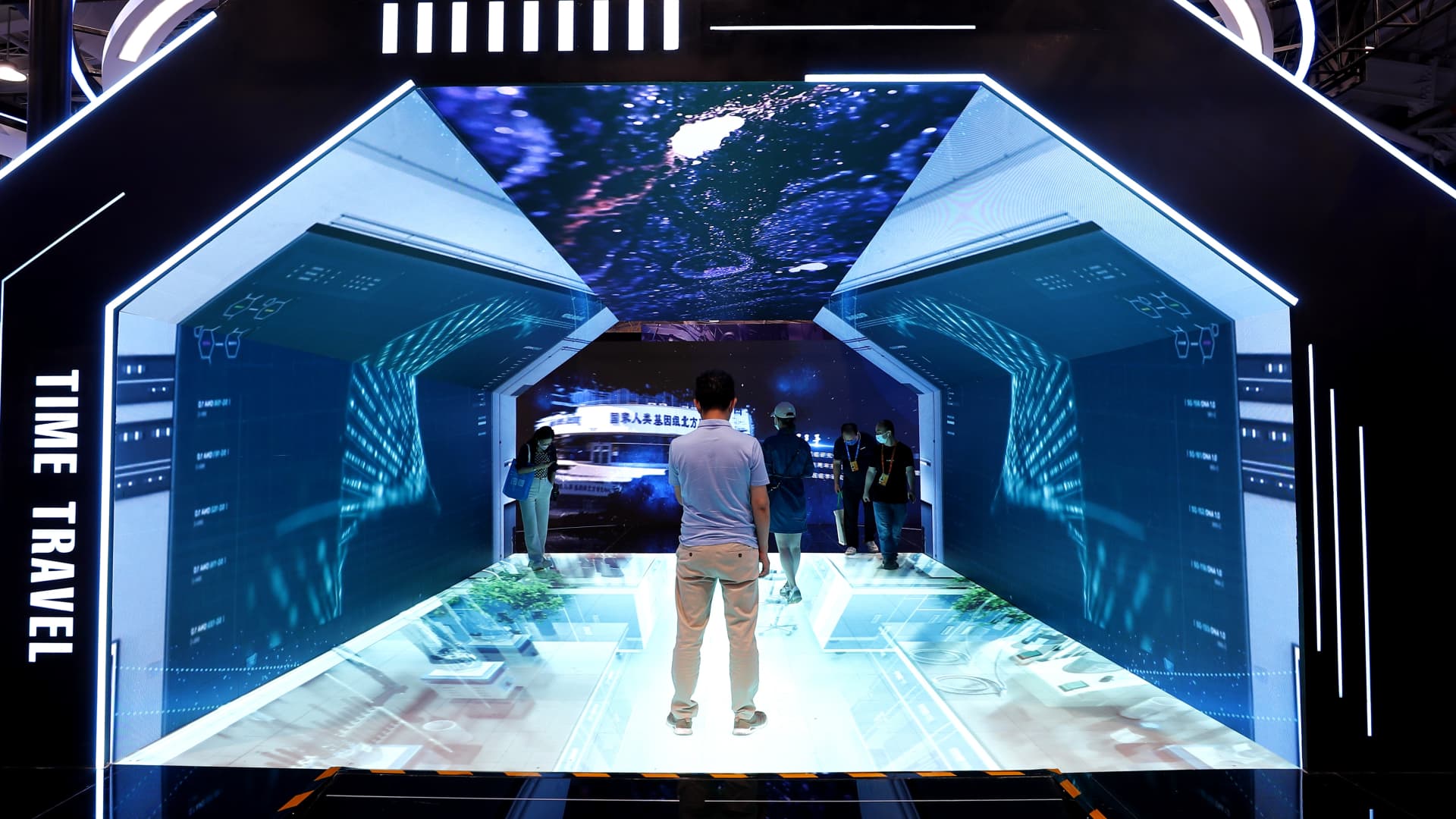

Cramer’s lightning round: Dropbox is a pass

Dropbox Inc: “Nothing ever happens to the stock, and I think that that’s because nothing’s going to happen to the stock. … I’m going to have to say, pass.” 23andMe Holding Co: “The stock has no mojo. That’s a technical term for ‘not going anywhere.’” Source

Read More

A ‘shakeout’ among mortgage lenders is coming, according to CEO of bank that left the business

A sign hangs from a branch of Banco Santander in London, U.K., on Wednesday, Feb. 3, 2010. Simon Dawson | Bloomberg via Getty Images Banks and other mortgage providers have been battered by plunging demand for loans this year, a consequence of the Federal Reserve’s interest rate hikes. Some firms will be forced to exit […]

Read More

Bank stocks are ‘too cheap’ and could outperform S&P 500 after recession strikes, Oppenheimer says

Bank stocks have sold off this year on fears that a looming recession will rock the sector with surging loan defaults. But that reflex is an example of recency bias and ignores a few key differences in the U.S. financial industry after the 2008 financial crisis, Oppenheimer analyst Chris Kotowski said Friday in a research […]

Read More