Interest Rates

UK economy ‘one of the most vulnerable’ in the world right now due to mortgage trends, strategist says

George Clerk | E+ | Getty Images There’s an economic idiosyncrasy in the U.K. that makes it “one of the most vulnerable countries in the world right now,” according to an investment strategist. Mike Harris, the founder of Cribstone Strategic Macro, argues that a major problem for Britain is that its mortgage market is “heavily […]

Read More

Kevin O’Leary says there are plenty of good places to ‘hide’ as interest rates rise

As interest rates in the U.S. rise, investors can put their money to work by looking at companies in the S&P 500 that can “increase their prices” and “maintain margins,” Kevin O’Leary told CNBC. “There’s plenty of them. That’s a good place to hide when you’re getting a 2% dividend yield,” the celebrity investor said […]

Read More

Your cash savings may finally yield a higher return — but only at certain banks

Guido Mieth | DigitalVision | Getty Images Banks are starting to pay a higher return on your cash — good news for savers who’ve seen their stockpiles languishing from a gruesome combination of low interest rates and high inflation. However, some banks are moving faster than others. Some, particularly traditional brick-and-mortar shops, may not budge […]

Read More

David Tepper calls Fed’s tightening signal an ‘unforced error’ that’s brought ‘unhinged’ markets

David Tepper said the market turmoil this week was partly caused by the Federal Reserve’s messaging on its aggressive tightening schedule. Source

Read More

Stocks could see more tumult next week, especially if bond yields continue to scream higher

After a week of extraordinary turbulence, stocks are likely to remain volatile as investors await fresh data on inflation and watch the course of bond yields. The big report for markets is Wednesday’s April consumer price index. Economists expect a high inflation reading, but it should moderate from the 8.5% year-over-year pace of March. A […]

Read More

5 things to know before the stock market opens Friday

Here are the most important news, trends and analysis that investors need to start their trading day: 1. Futures drop after worst day for Dow, Nasdaq since 2020 A trader works on the trading floor at the New York Stock Exchange (NYSE) in New York, May 5, 2022. Andrew Kelly | Reuters U.S. stock futures […]

Read More

Why the market is taking Powell’s ‘soft-ish’ economic language so hard: Former Fed official Roger Ferguson

Roger Ferguson Michael Nagle | Bloomberg | Getty Images Anyone who read a Fed chair coining the term “soft-ish” for an economic landing, as Jerome Powell did on Wednesday, as a bullish signal, has a transitory understanding of how much significance to give to any single day’s trading action. Stocks tanked on Thursday after the […]

Read More

Bank of England hikes interest rates to 13-year high, sees inflation hitting 10%

BOE Governor Andrew Bailey has warned the Bank is walking a “narrow path” between growth and inflation. Bloomberg | Bloomberg | Getty Images LONDON — The Bank of England on Thursday raised interest rates to their highest level in 13 years in a bid to tackle soaring inflation. In a widely expected move, policymakers at the […]

Read More

Rising interest rates mean higher loan costs when you go to buy a car. Monthly payments already average $650

Newsday Llc | Newsday | Getty Images On top of elevated prices for new and used cars, financing the purchase of one is about to get more expensive. With the Federal Reserve boosting a key interest rate by half a percentage point on Wednesday, borrowing costs are poised to head higher on a variety of […]

Read More

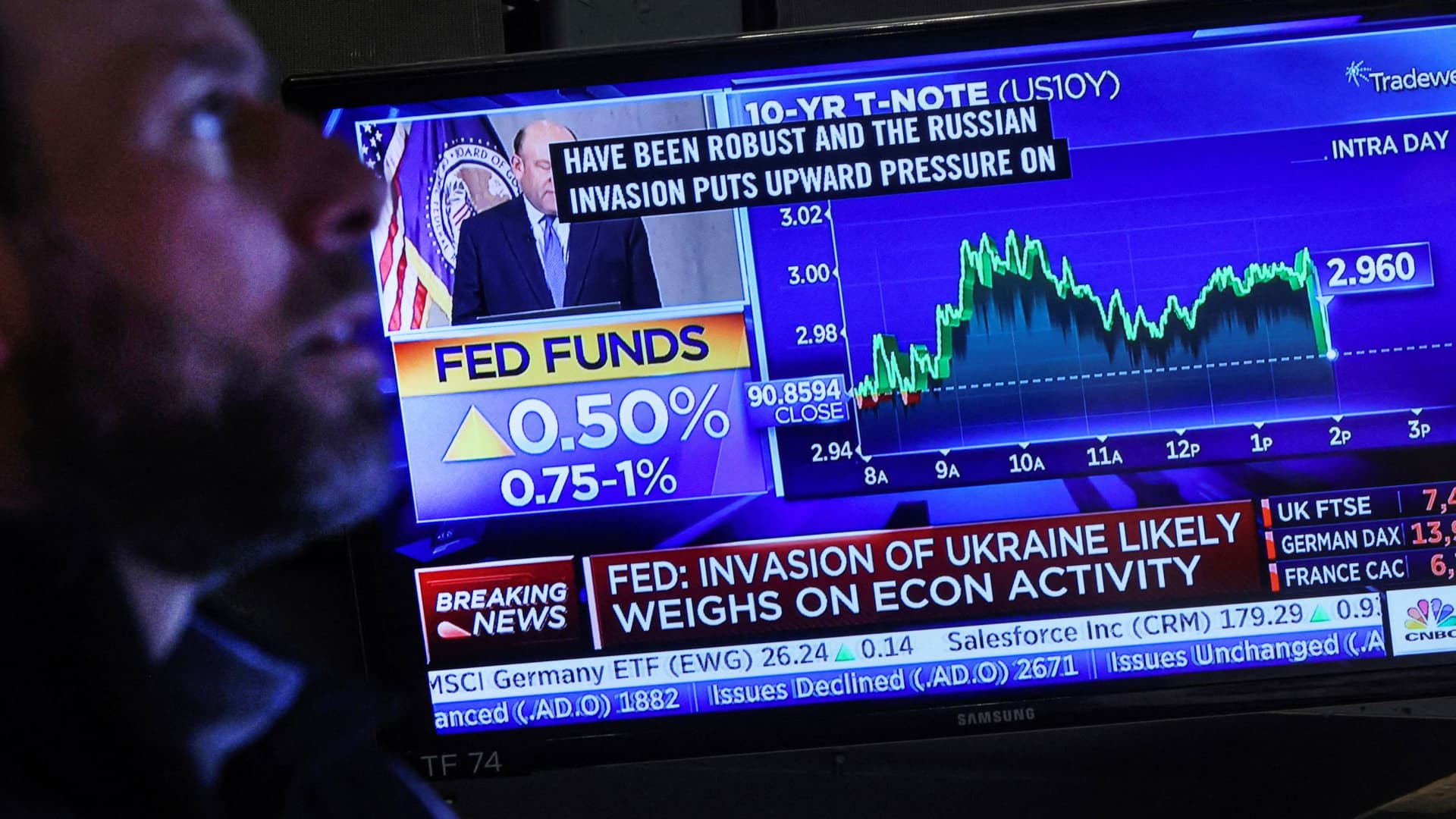

5 things to know before the stock market opens Thursday

Here are the most important news, trends and analysis that investors need to start their trading day: 1. Wall Street set to drop after a strong Fed-driven relief rally A screen displays the Fed rate announcement as a trader works inside a post on the floor of the New York Stock Exchange (NYSE) in New […]

Read More