Interest Rates

What this ‘play the recovery’ strategy says about the hot bond market’s future

A recent trend in the exchange-traded funds market suggests bond demand is far from cooling. Corporate, government and high-yield bond ETFs saw inflows last month after lower bond prices and higher yields contributed to the deceleration of fund outflows in May. Andrew McOrmond of WallachBeth Capital, an institutional execution service provider, believes the inflows can […]

Read More

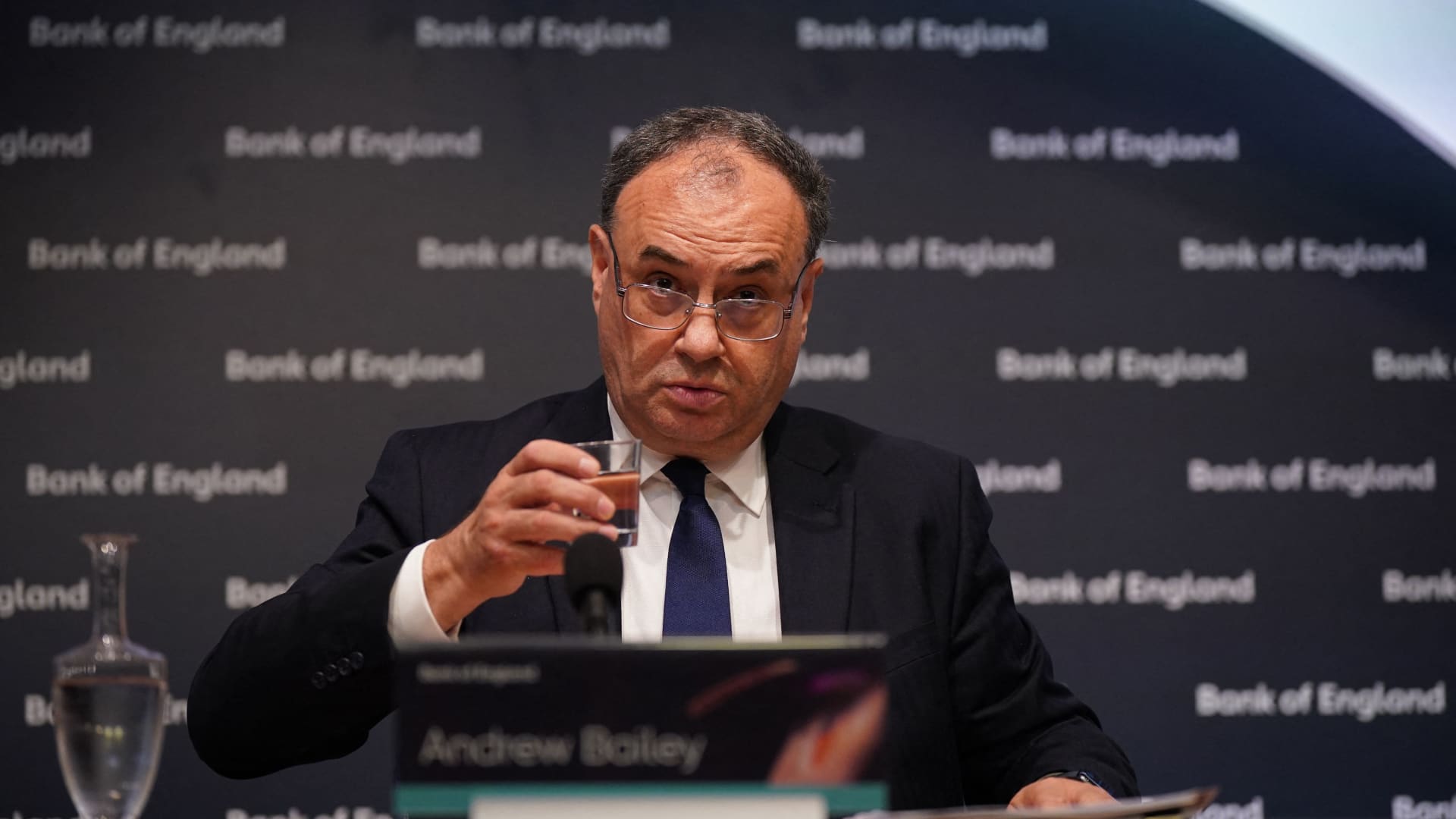

Bank of England’s Bailey warns UK faces ‘very big’ inflation shock, defends historic rate hike

LONDON — The Bank of England on Thursday defended its decision to hike interest rates at the fastest clip in 27 years, saying the U.K. faces a “very big” shock to inflation. BOE Governor Andrew Bailey said that the risks of high inflation becoming persistent had risen since the Bank’s previous meeting in June, prompting […]

Read More

Fed’s Bullard sees more interest rate hikes ahead and no U.S. recession

St. Louis Federal Reserve President James Bullard said Wednesday that the central bank will continue raising rates until it sees compelling evidence that inflation is falling. The central bank official said he expects another 1.5 percentage points or so in interest rate increases this year as the Fed continues to battle the highest inflation levels […]

Read More

Fed’s James Bullard expresses confidence that the economy can achieve a ‘soft landing’

James Bullard Olivia Michael | CNBC St. Louis Federal Reserve President James Bullard said Tuesday that he still thinks the economy can avoid a recession, even though he expects the central bank will need to keep hiking rates to control inflation. “I think that inflation has come in hotter than what I would have expected […]

Read More

Fed’s Daly says ‘our work is far from done’ on inflation; Evans sees ‘reasonable’ chance for smaller hike

Mary Daly, President of the Federal Reserve Bank of San Francisco, poses after giving a speech on the U.S. economic outlook, in Idaho Falls, Idaho, U.S., November 12 2018. Ann Saphir | Reuters The Federal Reserve still has a lot of work to do before it gets inflation under control, and that means higher interest […]

Read More

Typical job switcher got a pay raise of nearly 10%, study finds

Morsa Images | DigitalVision | Getty Images Many workers who changed jobs recently saw raises from their new paychecks outpace inflation by a wide margin — by nearly 10% or more, according to a new study by the Pew Research Center. The typical American who changed employers in the year from April 2021 to March […]

Read More

Bitcoin hits 6-week high topping $24,000 in a post-Fed rally

Bitcoin prices have been under pressure in 2022 after the collapse of algorithmic stablecoin terraUSD and subsequent bankruptcy filings from lender Celsius and hedge fund Three Arrows Capital. Nicolas Economou | Nurphoto | Getty Images Bitcoin hovered around $24,000 on Friday, hitting a 6-week high as it continues to follow stock markets higher. The world’s […]

Read More

Market jump after Fed rate hike is a ‘trap,’ Morgan Stanley’s Mike Wilson warns investors

Morgan Stanley is urging investors to resist putting their money to work in stocks despite the market’s post-Fed-decision jump. Mike Wilson, the firm’s chief U.S. equity strategist and chief investment officer, said he believes Wall Street’s excitement over the idea that interest rate hikes may slow sooner than expected is premature and problematic. “The market […]

Read More

Here’s how advisors are shifting clients’ portfolios as the Federal Reserve again hikes rates by 75 basis points

The Good Brigade | DigitalVision | Getty Images Here’s how portfolio allocations have shifted “We’re attempting to address both inflation and recession concerns,” said certified financial planner John Middleton, owner of Brighton Financial Planning in Flemington, New Jersey. For stock allocations, he likes companies paying a high dividend, and value stocks, which typically trade for […]

Read More

Fed hikes interest rates by 0.75 percentage point for second consecutive time to fight inflation

The Federal Reserve on Wednesday enacted its second consecutive 0.75 percentage point interest rate increase as it seeks to tamp down runaway inflation without creating a recession. In taking the benchmark overnight borrowing rate up to a range of 2.25%-2.5%, the moves in June and July represent the most stringent consecutive moves since the Fed […]

Read More