Government taxation and revenue

Embryos can count as dependents on Georgia state tax returns: For many families ‘there is no benefit at all,’ says analyst

Anti-abortion activists demonstrate outside the Supreme Court of the United States in Washington, June 13, 2022. Evelyn Hockstein | Reuters Residents of Georgia may now claim embryos as dependents on their state income tax returns. Any “unborn child with a detectable human heartbeat” may qualify for a $3,000 state income tax deduction for 2022, effective […]

Read More

Koch network pressures Sens. Manchin, Sinema to oppose $739 billion tax-and-spending bill

Sen. Kyrsten Sinema, D-Ariz., and Sen. Joe Manchin, D-W.Va., board an elevator after a private meeting between the two of them on Capitol Hill on Thursday, Sept. 30, 2021 in Washington, DC. Jabin Botsford | The Washington Post | Getty Images The political network backed by billionaire Charles Koch launched an ad blitz targeting Sens. […]

Read More

Employee stock purchase plans can carry ‘a big risk,’ says advisor. What to know before buying in

How employee stock purchase plans works Typically offered to all employees, ESPPs may allow you to purchase company stock at a discount of up to 15%, capped at $25,000 per year for tax-qualified plans. The plan collects after-tax contributions from each paycheck during an “offering period,” and uses the funds to buy company stock on […]

Read More

House Democrats push for Biden’s billionaire minimum income tax

Erik McGregor | LightRocket | Getty Images As Democrats plow forward with a slimmed-down reconciliation package, House lawmakers are separately pushing another piece of President Joe Biden’s agenda: taxing the ultra-wealthy. Reps. Don Beyer, D-Va., and Steve Cohen, D-Tenn., have introduced the Billionaire Minimum Income Tax Act, calling for a 20% levy on households worth […]

Read More

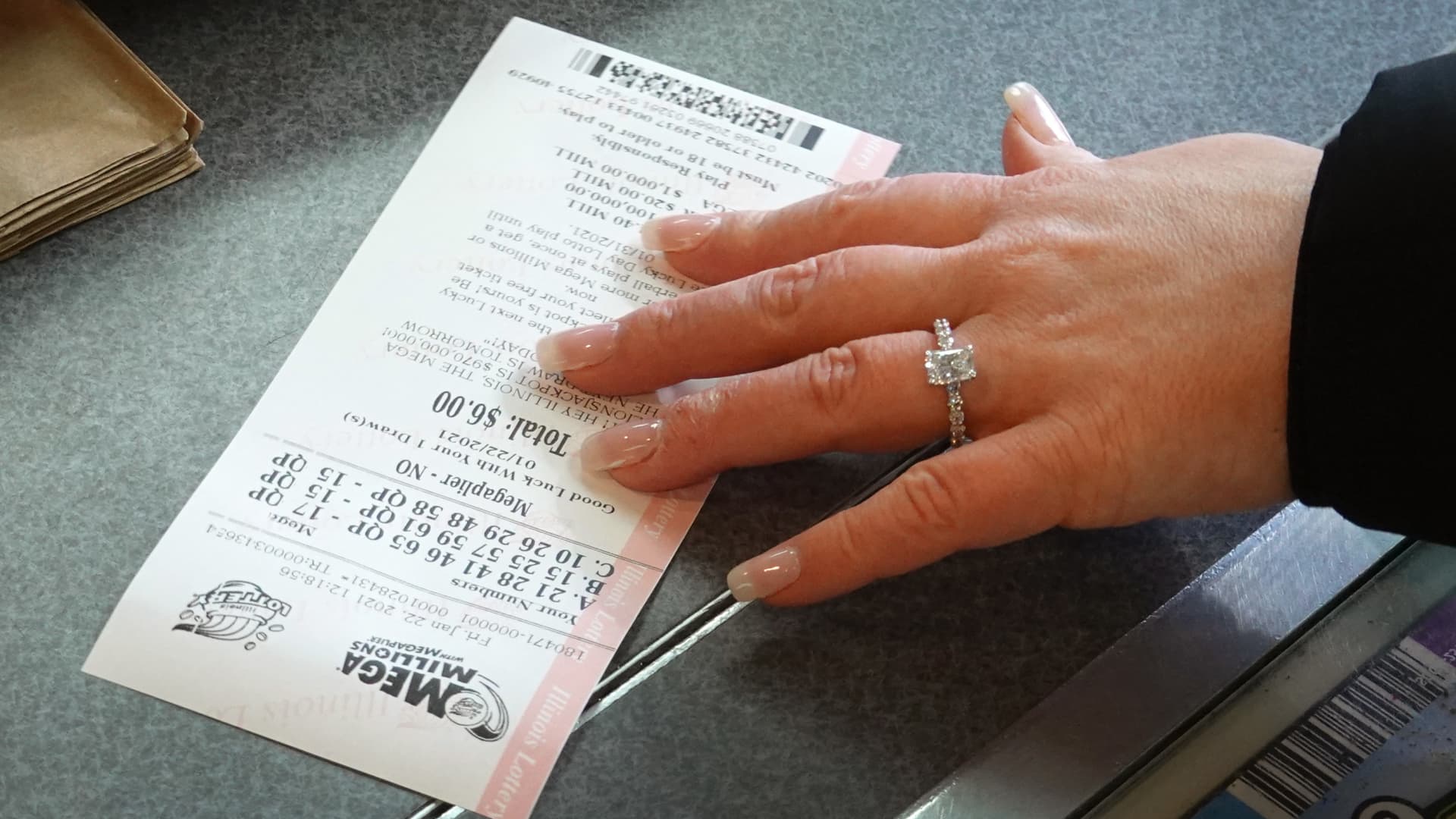

The Mega Millions jackpot has now surged to $1.02 billion. Here’s the tax bill if you win

MARK RALSTON | AFP | Getty Images One way to reduce your tax bill is to think charitably, according to the American Institute of CPAs: You can contribute cash, up to 60% of your adjusted gross income, to a public charity or a donor-advised fund and get a tax deduction for the amount in the […]

Read More

The Mega Millions jackpot is now $790 million. Here’s how much would go to taxes if there’s a winner

Scott Olson | Getty Images If you manage to beat the odds and land the next Mega Millions jackpot, don’t forget that Uncle Sam will snatch a slice of the windfall. The top prize has surged to $790 million for Tuesday night’s drawing after no ticket matched all six numbers pulled Friday night. If won […]

Read More

The wealthy now have more time to avoid estate taxes, thanks to an IRS change

If your family has significant wealth, it’s now easier to avoid federal estate taxes, thanks to recent changes from the IRS. The IRS improved a strategy known as “portability,” used by high-net-worth married couples expecting to owe federal estate taxes when the second spouse dies. Here’s how it works: While a spouse may inherit all […]

Read More

If Trump was ‘Joe Blow from Kokomo,’ he would have been charged with crimes, former New York prosecutor says

Former President Donald Trump Jonathan Ernst | Reuters A former special New York prosecutor who quit a criminal investigation of ex-President Donald Trump after his boss declined to lodge charges at the time said that if Trump “had been Joe Blow from Kokomo, we would have indicted without a big debate.” “I believe that Donald […]

Read More

If you win the $630 million Mega Millions jackpot, here’s how much would go to taxes

MARK RALSTON | AFP | Getty Images So you didn’t win the $555 million Mega Millions jackpot Tuesday night. The glass half-full view? Phew! You dodged a huge tax bill. Of course, you get another shot in the next drawing to land a windfall — and then give a boatload of it to Uncle Sam. […]

Read More

Investors have put $43 billion in dividend-paying funds this year. Before you ‘chase dividends,’ here’s what to know

With increased fears of a possible recession, investors seeking steady income may turn to stocks paying quarterly dividends, which are part of company profits sent back to investors. Historically, dividends have significantly contributed to an asset’s total return, sometimes providing a boost during economic downturns. From 1973 to 2021, companies paying dividends earned a 9.6% […]

Read More