Government taxation and revenue

Biden condemns GOP criticism of college student loan personal debt forgiveness

U.S. President Joe Biden speaks about administration options to forgive federal university student bank loan debt throughout remarks in the Roosevelt Space at the White Residence in Washington, U.S., August 24, 2022. Leah Millis | Reuters President Joe Biden slammed congressional Republicans who criticized college student financial loan forgiveness soon after passing tax cuts for […]

Read More

IRS to refund a ‘very welcome’ $1.2 billion in late-filing fees for nearly 1.6 million taxpayers

Ekaterina Goncharova | Moment | Getty Images The IRS on Wednesday announced it will waive penalties for many Americans who late-filed tax returns during the pandemic. Nearly 1.6 million filers will automatically receive a collective $1.2 billion-plus in penalty refunds or credits, according to the federal agency, with many payments expected to come by the […]

Read More

Trump PAC paid nearly $1 million to protection lawyers in July by itself as Georgia and New York probes heated up

Former President Donald Trump’s political motion committee, Help save America, paid practically $1 million to civil and prison defense attorneys in July on your own as investigations into him and the Trump Corporation heated up, a new Federal Elections Fee filing by the PAC reveals. And Trump’s lawful costs could rise even more this month and […]

Read More

Biden signs Inflation Reduction Act into law, setting 15% minimum corporate tax rate

After more than a year of debate over costs, taxes, tax credits and regulations, President Joe Biden finally signed his sweeping tax, health and climate bill into law — albeit a significantly reduced version of the $1.75 trillion Build Back Better plan he was pushing for last year. The president signed the newly renamed Inflation Reduction […]

Read More

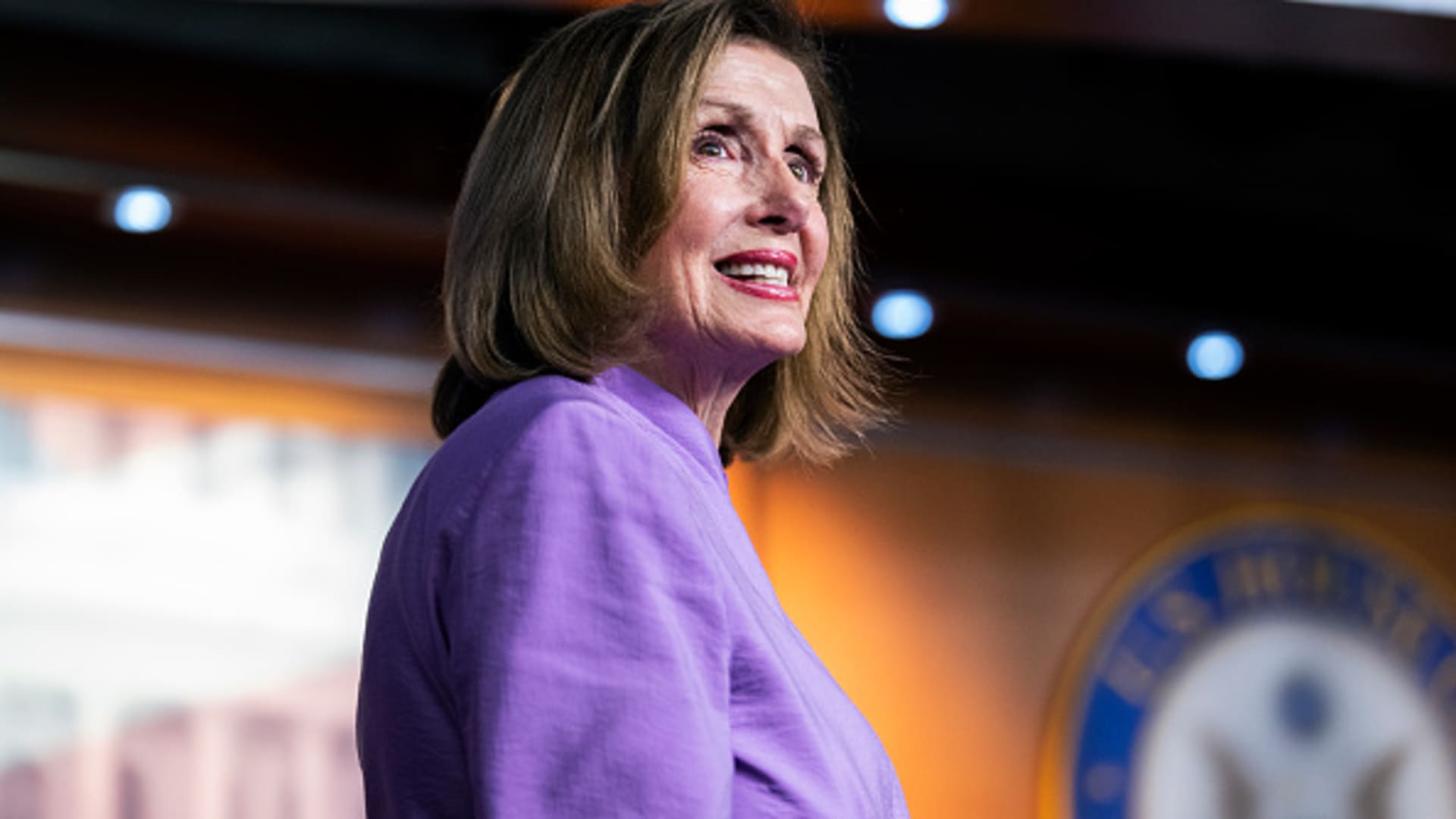

House to vote on major climate, tax and health bill, teeing up huge win for Biden

Speaker of the House Nancy Pelosi, D-Calif., arrives for a news conference with members of the Congressional delegation who traveled to Taiwan and the Indo-Pacific region, in the Capitol Visitor Center on Wednesday, August 10, 2022. Tom Williams | CQ-Roll Call, Inc. | Getty Images The House is expected to pass a sweeping tax, health […]

Read More

State, local relief not in cards for residents of high-tax states as House assesses Inflation Reduction Act

Rep. Tom Suozzi, D-N.Y., speaks during a news conference announcing the State and Local Taxes (SALT) Caucus outside the U.S. Capitol on April 15, 2021. Sarah Silbiger | Bloomberg | Getty Images After fighting to repeal the $10,000 limit on the federal deduction for state and local taxes, known as SALT, a group of House […]

Read More

How Detroit moved on from its legendary bankruptcy

A new wave of development is rippling through downtown Detroit. “Walking around Detroit in 2008 or 2009 is not the same as walking around in 2022,” said Ramy Habib, a local entrepreneur. “It is absolutely magnificent what happened throughout those 15 years.” Between 2010 and 2019, just 708 new housing structures went up in the […]

Read More

Buying a car and want to go electric? Inflation Reduction Act extends $7,500 tax credit — but with price, income caps

David Madison | Photodisc | Getty Images A federal tax break that’s available to car buyers for going electric may work differently starting next year. Under the Inflation Reduction Act — which received Senate approval on Sunday and is expected to clear the House this week — a tax credit worth up to $7,500 for […]

Read More

Inflation Reduction Act extends ‘pass-through’ tax break limits for 2 more years. Here’s what that means for entrepreneurs

Senate Majority Leader Chuck Schumer, D-N.Y., discusses the Inflation Reduction Act on Aug. 7, 2022 in Washington, D.C. Kent Nishimura | Los Angeles Times | Getty Images Senate Democrats curtailed a tax break for certain pass-through businesses as part of the Inflation Reduction Act passed Sunday. A pass-through or flow-through business is one that reports […]

Read More