Government taxation and revenue

Billionaire Ken Griffin sues the IRS after his tax records were disclosed

Ken Griffin, Citadel, at CNBC’s Delivering Alpha, Sept. 28, 2022. Scott Mlyn | CNBC Hedge-fund billionaire Ken Griffin has sued the IRS and the Treasury Department over the “unlawful disclosure” of his tax information, escalating the battle in Washington over leaked tax filings of super-wealthy people including Warren Buffett and Jeff Bezos. In a complaint […]

Read More

‘It could be a blessing and a curse.’ Here are 3 unexpected financial pitfalls unmarried couples need to know

Petri Oeschge | Getty Images SEATTLE — If you’re living together before marriage or committed long-term without plans to tie the knot, you’ll need to prepare for the future — or you may face challenges later, experts say. There are “rising rates of cohabitation,” with many couples skipping marriage because “they don’t see the benefit,” […]

Read More

‘Early filers’ should wait to submit their tax return in 2023, the IRS warns. Here’s why

If you’re eager to file your 2022 tax return in January or early February, the IRS has a warning: You’ll need to wait for “key documents” before filing in 2023. In a release last week, the IRS urged “early filers” to watch for Form 1099-K, which reports income for third-party payment networks such as Venmo […]

Read More

What the pro-business tax agenda is chasing in a changing Congress

Sunrise hits the U.S. Capitol dome on September 30, 2021 in Washington, DC. Chip Somodevilla | Getty Images News | Getty Images Main Street could find itself stuck in gridlock next year in terms of advancing pro-business tax objectives. For House Republicans, legislative priorities are likely to include extending business-friendly provisions of The Tax Cuts […]

Read More

You may get a 1099-K for Venmo and PayPal payments. Here’s how to prepare — and shrink your tax bill

Charday Penn | E+ | Getty Images If you’ve accepted payments via apps such as Venmo or PayPal in 2022, you may receive Form 1099-K, which reports income from third-party networks, in early 2023. But there’s still time to reduce your tax liability, according to financial experts. “There’s no change to the taxability of income,” […]

Read More

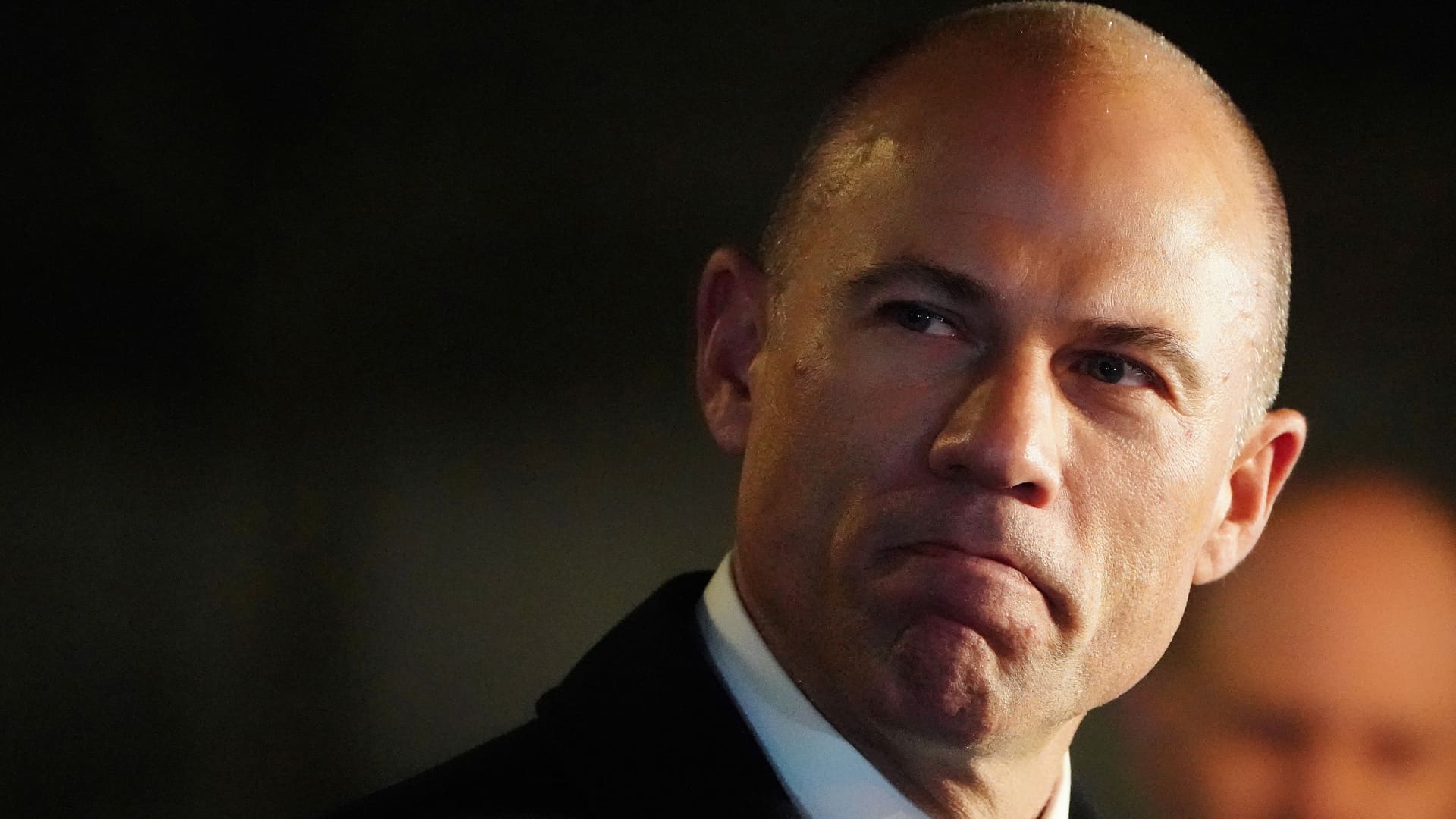

Trump foe Michael Avenatti sentenced to 14 a long time in jail for stealing tens of millions from customers

Lawyer Michael Avenatti speaks to the media just after he walks out of federal court in New York, New York, U.S., March 25, 2019. Carlo Allegri | Reuters CNBC Politics Read through far more of CNBC’s politics protection: The tax demand similar to his striving to interfere with the IRS’s effort and hard work to […]

Read More

‘You can control your tax-reporting destiny’. 4 key year-end tax moves

seksan Mongkhonkhamsao | Moment | Getty Images 1. Boost your 401(k) contributions If you haven’t maxed out your workplace 401(k), there may still be time to boost your contributions for 2022, said Guarino. The move may lower your adjusted gross income while padding your retirement savings, but “time is of the essence,” he said. With […]

Read More

‘A lot of people are going to see less money in their pocket.’ Here are must-know tax changes for 2022

Tom Werner | DigitalVision | Getty Images Certain tax credits have been reduced One possible reason for a smaller tax refund is the child tax credit and the child and dependent care tax credit have been reduced for 2022, explained certified financial planner Cecil Staton, president and wealth advisor at Arch Financial Planning in Athens, […]

Read More

Tax ‘refunds may be smaller in 2023,’ warns IRS. Here’s why

If you’re expecting a tax refund in 2023, it may be smaller than this year’s payment, according to the IRS. Typically, you get a federal refund when you’ve overpaid yearly taxes or withheld more than the amount you owe. Your annual balance is based on taxable income, calculated by subtracting the greater of the standard […]

Read More

If you’re still missing your tax refund, you’ll soon receive 7% interest from the IRS — but it’s taxable

Bill Oxford | E+ | Getty Images If your tax refund is still in limbo, there’s good news: Your balance may be accruing interest, and the rate increases to 7% from 6% on Jan. 1, according to the IRS. As of Nov. 18, there were 3.4 million unprocessed individual returns received in 2022, including filings […]

Read More