Government taxation and revenue

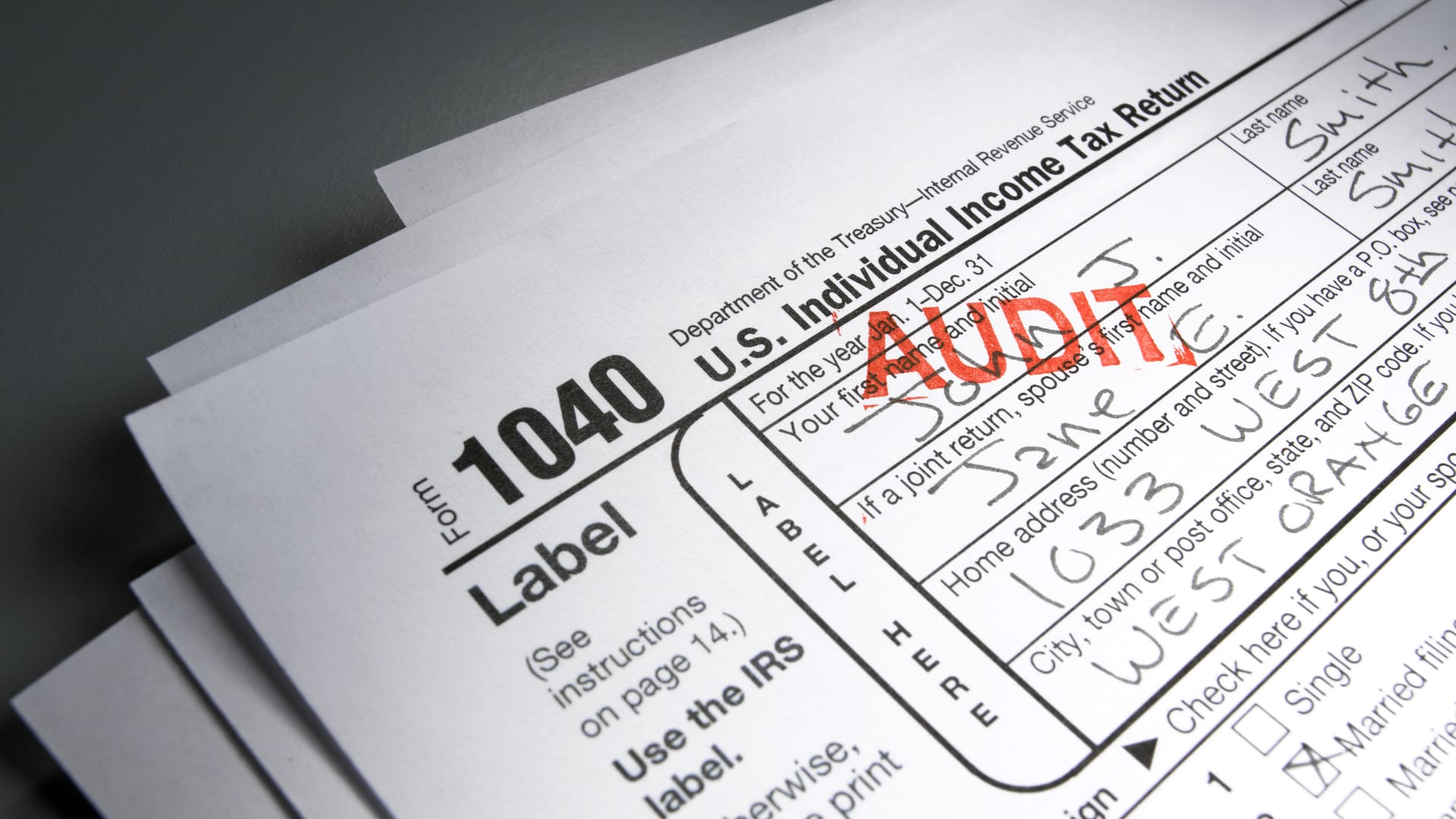

Don’t risk a tax audit. Here are four reasons the IRS may flag your return

dmphoto | E+ | Getty Images Tax season is underway, and there’s been increased scrutiny of the IRS as it starts deploying part of the nearly $80 billion in funding approved for the agency by Congress in August. While Treasury Secretary Janet Yellen has said goals include boosting customer service and improving technology, critics have […]

Read More

IRS about 3 to 5 times more likely to audit Black Americans’ tax returns, study finds

Jeffrey Coolidge | Photodisc | Getty Images Black Americans are roughly three to five times more likely to face an IRS audit than other taxpayers, according to a new study. While there isn’t evidence of explicit discrimination from the IRS or its revenue agents, the findings show the disparity stems from a faulty software algorithm […]

Read More

Tax credits vs. tax deductions: How they vary, and what to know ahead of you file

Clever Tax Setting up Tax credits vs. tax deductions: How they vary, and what to know in advance of you file Published Tue, Jan 31 20233:06 PM ESTUpdated Tue, Jan 31 20233:40 PM EST Greg Iacurci@GregIacurci Observe Live Supply

Read More

Tax season starts with boosted IRS workforce, new technology as agency begins to deploy $80 billion in funding

kate_sept2004 | E+ | Getty Images Tax season kicked off for individual filers Monday with a bigger IRS customer service team and enhanced technology as the agency begins to deploy its nearly $80 billion in funding. Over the past several months, the IRS has hired 5,000 new customer service staff, aiming to “significantly increase” the […]

Read More

Roth IRA conversion taxes may be trickier than you expect. Here’s what to know before filing — or converting funds in 2023

If you made a Roth individual retirement account conversion in 2022, you may have a more complicated tax return this season, experts say. The strategy, which transfers pretax or non-deductible IRA funds to a Roth IRA for future tax-free growth, tends to be more popular during a stock market downturn because you can convert more […]

Read More

Google bonus delay has a windfall lesson for personnel: ‘Don’t have it expended before it receives there,’ states advisor

A pedestrian strolls on the Google campus in Mountain Watch, California, on Jan. 27, 2022. David Paul Morris/Bloomberg by way of Getty Photographs Improve to bonuses addresses 2023 uncertainty Google workers who qualify for bonuses will get 80% of the sum in January, with the remainder coming in March or April, according to a memo […]

Read More

Over 200 millionaires urge Davos elite to up taxes on the ultra-rich

Over 200 millionaires are urging the elite echelons in attendance at this week’s World Economic Forum in Davos to “tackle extreme wealth” and “tax the ultra-rich” to help relieve the cost-of-living strain off ordinary households. The Patriotic Millionaires — self-described as “a group of high-net worth Americans who share a profound concern about the […]

Read More

There’s still time to avoid a penalty for fourth-quarter estimated taxes — but the clock is ticking

Constantine Johnny | Moment | Getty Images There’s still time to avoid a penalty if you didn’t pay enough taxes in 2022 — but the clock is ticking. If you are self-employed or receive income from gig economy work, investments and more, the deadline for your 2022 fourth-quarter estimated tax payment is Jan. 17. Your […]

Read More

Trump Firm strike with $1.6 million fine for felony tax fraud plan

The entrance to Trump Tower on 5th Avenue is pictured in the Manhattan borough of New York City, May well 19, 2021. Shannon Stapleton | Reuters The Trump Business, previous President Donald Trump’s business enterprise empire, was strike with a $1.6 million fine Friday for tax fraud and other crimes committed as component of a […]

Read More

Tax season opens for individual filers on Jan. 23, says IRS

It’s official: The tax season kicks off for individual filers on Jan. 23, the IRS announced Thursday. For most taxpayers, you must file your federal return and pay your balance by April 18 this year to avoid racking up penalties and interest. “This filing season is the first to benefit the IRS and our nation’s […]

Read More