Government taxation and revenue

The IRS has issued nearly 8 million tax refunds. Here’s the average payment

Bill Oxford | E+ | Getty Images The tax season is underway, and the IRS has issued nearly 8 million refunds worth about $15.7 billion as of Feb. 3, the agency reported. The average refund amount was $1,963, down from last year’s payment of $2,201 at the same point in the filing season. Of course, […]

Read More

Appeals court upholds $110,000 contempt high-quality for Trump in New York legal professional general situation

A New York appeals courtroom panel on Tuesday upheld a $110,000 high-quality on former President Donald Trump that a decide imposed final spring just after he was discovered in contempt for failing to flip around files to the condition legal professional general’s business office as section of an investigation of his firm. The panel of […]

Read More

House lawmakers relaunch the SALT caucus. Here’s what to know about the $10,000 deduction limit for state and local taxes

Rep. Bill Pascrell, D-N.J., speaks at a news conference announcing the state and local taxes caucus outside the Capitol on April 15, 2021. Sarah Silbiger | Bloomberg | Getty Images A group of bipartisan House representatives relaunched the SALT caucus last week, calling for relief from the $10,000 limit on the federal deduction for state […]

Read More

Pre-tax vs. Roth 401(k): Deciding which to use for retirement is trickier than you think

Prathanchorruangsak | Istock | Getty Images Whether you’re starting a new job or updating retirement savings goals, you may need to choose between pre-tax or Roth 401(k) contributions — and the choice may be more complex than you think. While pre-tax 401(k) deposits offer an upfront tax break, the funds grow tax-deferred, meaning you’ll owe […]

Read More

IRS: Residents of more than a dozen states do not need to report ‘special payments’ for welfare, disaster relief on their federal return

The IRS on Friday issued federal tax guidance for millions of Americans who received state rebates or payments in 2022. The announcement came about a week after the agency had urged those taxpayers to hold off on filing while it determined if the funds are taxable on federal returns. “The IRS has determined that in […]

Read More

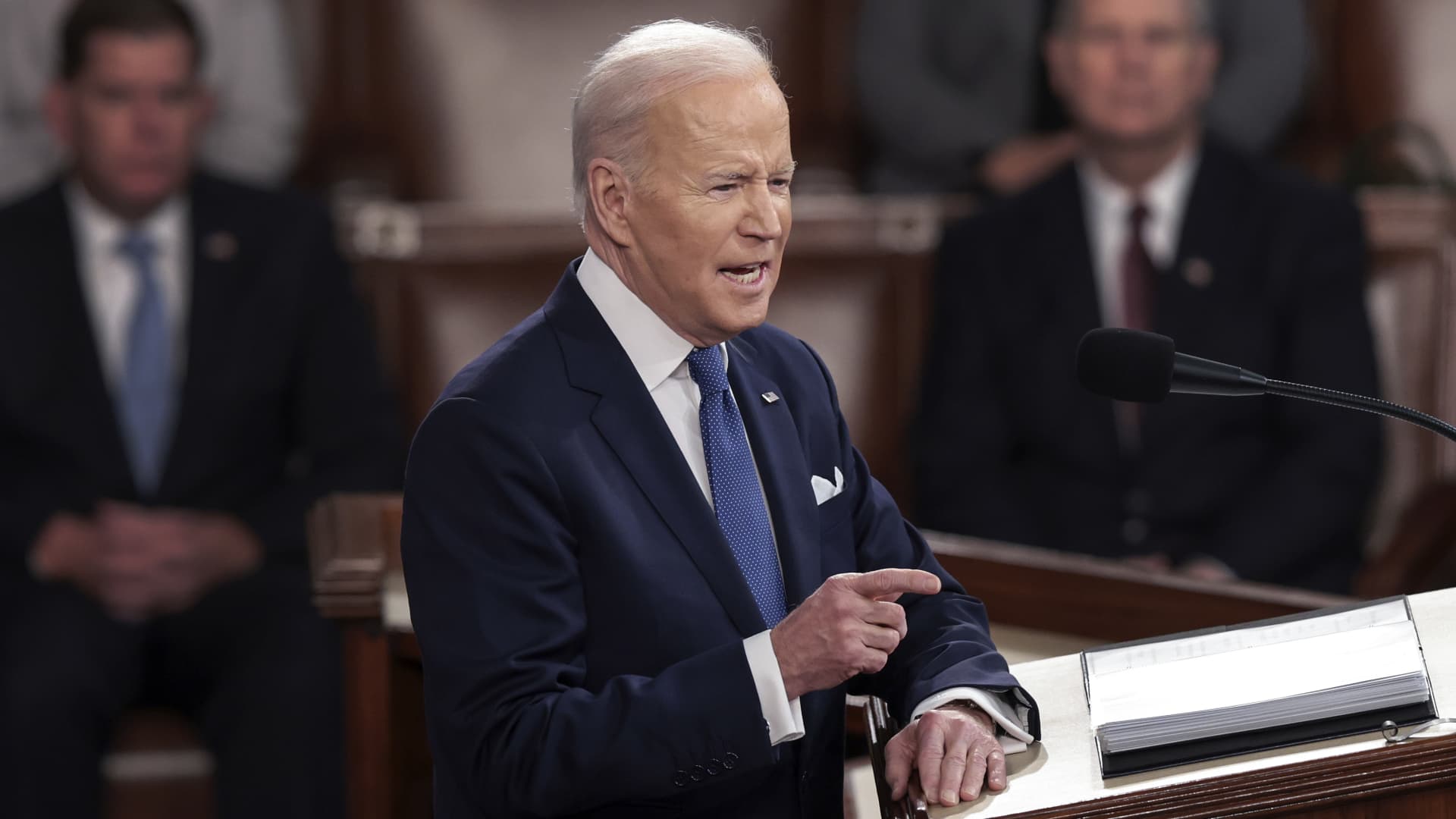

Biden’s billionaire tax is ‘dead on arrival’ in Congress, top rated Wall Avenue backers and Democratic strategists say

Corporate leaders who backed President Joe Biden in the 2020 election conveyed deep skepticism that the so-identified as “billionaire’s tax” Biden proposed in his Condition of the Union handle Tuesday night time would at any time come to be legislation. The plan would require households with a net truly worth earlier mentioned $100 million to […]

Read More

Biden pushed a billionaire minimum tax – here’s what Elon Musk would pay

Elon Musk attends the 2022 Met Gala at the Metropolitan Museum of Art. Angela Weiss | AFP | Getty Images President Joe Biden drew loud cheers during his State of the Union address Tuesday night when he proposed a new tax on the rich. “Pass my proposal for a billionaire minimum tax,” Biden told Congress. […]

Read More

White Property economist Jared Bernstein defends Biden’s billionaire tax outlined in Condition of the Union

A prime White Home economist defended tax proposals aimed at the wealthiest Us residents outlined by President Joe Biden during his second State of the Union deal with Tuesday evening. Jared Bernstein, a member of the White Property Council of Economic Advisors, explained Biden’s tax proposal will concentrate on big businesses and the wealthiest Us […]

Read More

Biden to revisit ‘billionaire minimum tax’ in State of the Union address

President Joe Biden delivers the State of the Union address on March 1, 2022. Win Mcnamee | Getty Images President Joe Biden will again call for a “billionaire minimum tax” during his State of the Union address on Tuesday. While details haven’t been released, Biden previously proposed a billionaire minimum tax in his 2023 federal […]

Read More

When it makes sense to buy extra paper Series I bonds with your tax refund, according to experts

Jetcityimage | Istock | Getty Images If you’re trying to max out the yearly purchase limit for Series I bonds, your tax refund offers an opportunity to buy even more. However, you should consider your goals and weigh alternatives first, experts say. An inflation-protected and nearly risk-free investment, I bonds are currently paying 6.89% annual […]

Read More