Federal Reserve Bank

Market jump after Fed rate hike is a ‘trap,’ Morgan Stanley’s Mike Wilson warns investors

Morgan Stanley is urging investors to resist putting their money to work in stocks despite the market’s post-Fed-decision jump. Mike Wilson, the firm’s chief U.S. equity strategist and chief investment officer, said he believes Wall Street’s excitement over the idea that interest rate hikes may slow sooner than expected is premature and problematic. “The market […]

Read More

Here’s how advisors are shifting clients’ portfolios as the Federal Reserve again hikes rates by 75 basis points

The Good Brigade | DigitalVision | Getty Images Here’s how portfolio allocations have shifted “We’re attempting to address both inflation and recession concerns,” said certified financial planner John Middleton, owner of Brighton Financial Planning in Flemington, New Jersey. For stock allocations, he likes companies paying a high dividend, and value stocks, which typically trade for […]

Read More

Fed hikes interest rates by 0.75 percentage point for second consecutive time to fight inflation

The Federal Reserve on Wednesday enacted its second consecutive 0.75 percentage point interest rate increase as it seeks to tamp down runaway inflation without creating a recession. In taking the benchmark overnight borrowing rate up to a range of 2.25%-2.5%, the moves in June and July represent the most stringent consecutive moves since the Fed […]

Read More

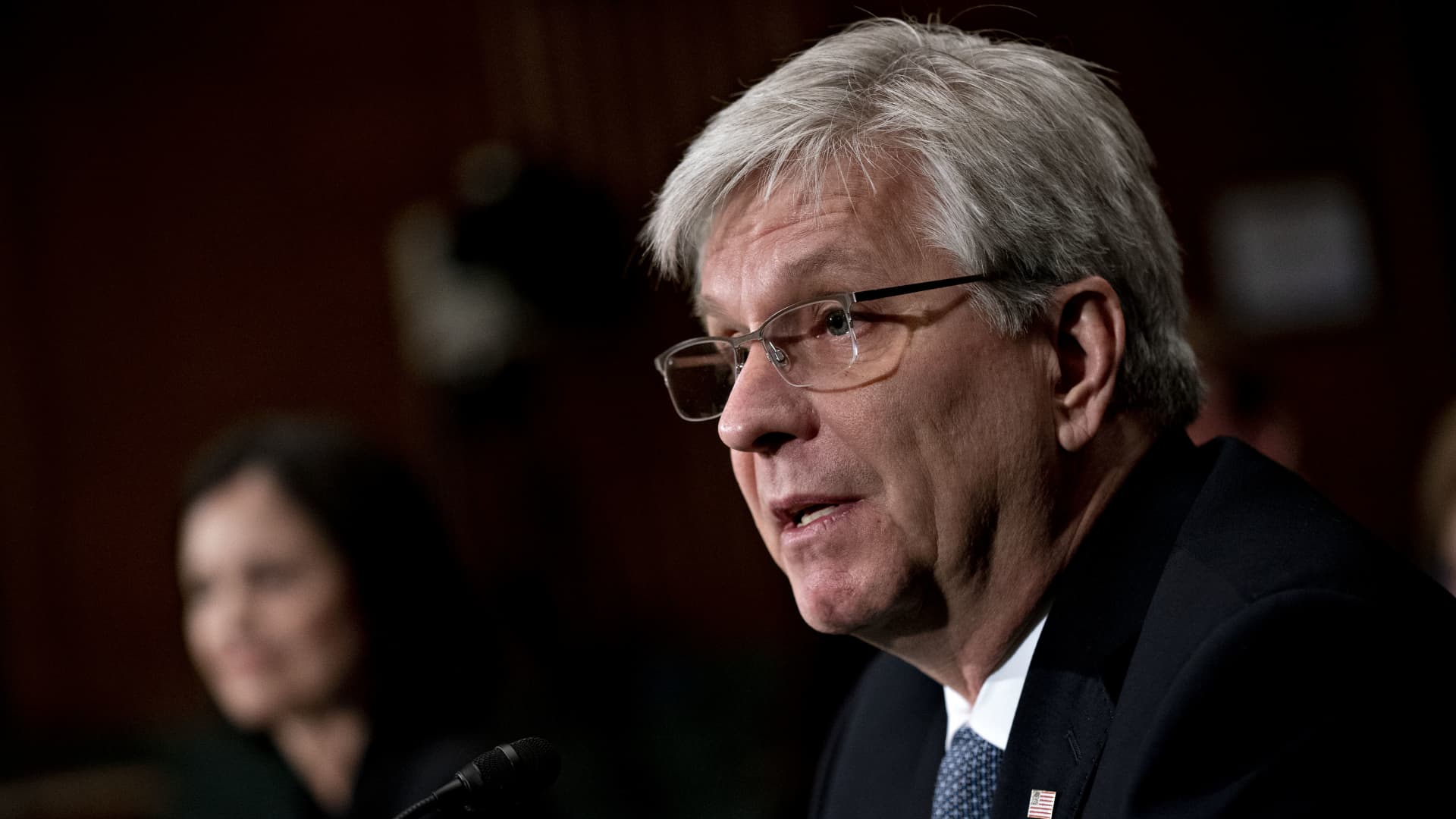

Fed Governor Waller expects 0.75 percentage point hike, but open to a larger one

Christopher Waller, U.S. President Donald Trump’s nominee for governor of the Federal Reserve, speaks during a Senate Banking Committee confirmation hearing in Washington, D.C., U.S, on Thursday, Feb. 13, 2020. Andrew Harrer | Bloomberg | Getty Images Federal Reserve Governor Christopher Waller said he’s willing to consider what would be the most aggressive interest rate […]

Read More

Powell, Clarida cleared of wrongdoing in Fed trading controversy

Controversial trading activities from Federal Reserve Chairman Jerome Powell and former Vice Chairman Richard Clarida didn’t break any rules or laws, the central bank’s Office of Inspector General ruled Thursday. The report covered a period from 2019-21 when the two top-ranking officials traded stocks and funds while the central bank used monetary policy to influence […]

Read More

Stock futures slip after Wednesday’s session as Wall Street awaits bank earnings

Stock futures slipped Wednesday night as traders look ahead to earnings from major U.S. banks. Dow Jones Industrial Average futures shed 117 points, or 0.38%. S&P 500 and Nasdaq 100 futures were down 0.41% and 0.47%, respectively. Stocks slipped during Wednesday’s session after June inflation data came in hotter than expected, hitting its highest level […]

Read More

Fed officials Waller and Bullard back another big interest rate increase in July

The Marriner S. Eccles Federal Reserve Board Building in Washington, D.C. Sarah Silbiger | Reuters The Federal Reserve is well on its way to another sharp interest rate hike in July and perhaps September as well, even if it slows the economy, according to statements Thursday from two policymakers. Fed Governor Christopher Waller left little […]

Read More

Fed sees ‘more restrictive’ policy as likely if inflation fails to come down, minutes say

Federal Reserve officials in June emphasized the need to fight inflation even if it meant slowing an economy that already appears on the brink of a recession, according to meeting minutes released Wednesday. Members said the July meeting likely also would see another 50- or 75-basis point move. A basis point is one one-hundredth of […]

Read More

Wrong time to get bullish: Top investor warns deflating tech ‘bubble’ far from over

The recent tech rally may be doomed. Money manager Dan Suzuki of Richard Bernstein Advisors warns the market is far from bottoming — and it’s a concept investors fail to grasp, particularly when it comes to growth, technology and innovation names. “The two certainties in this world of uncertainty today is that profits growth is […]

Read More

The market’s worst first half in 50 years has all come down to one thing

Traders on the floor of the NYSE, June 29, 2022. Source: NYSE A multitude of factors conspired to generate the stock market’s worst first-half since 1970, but they all emanated from one word: Inflation. The cost of living started the year running at levels the U.S. had not seen since the early 1980s. Worse, Federal […]

Read More