Economic events

Fed assembly forward will make your mind up no matter whether stocks can stabilize or fall back again to bear marketplace lows

The Federal Reserve is anticipated to raise fascination rates by yet another 3-quarters of a stage Wednesday, but it is what it signals about long run price hikes that will push marketplaces. The central bank’s two-working day conference Tuesday and Wednesday will come in a week the place investors will also be on superior inform […]

Read More

BlackRock’s Rieder suggests Fed charge mountaineering usually means stocks could get cheaper and short-phrase credit card debt additional interesting

BlackRock’s Rick Rieder claimed increased-quality, shorter-period set revenue investments have become pretty attractive, but the promote-off in shares has a strategies to go and buyers will be in a position to acquire equities at a improved worth from here. “I consider if you reported to me the story of the to start with half was […]

Read More

Biden White Property just place out a framework on regulating crypto — here’s what’s in it

U.S. President Joe Biden walks from Marine One to the White Property subsequent a trip from Michigan, in Washington, U.S., September 14, 2022. Tom Brenner | Reuters The Biden White Home has just produced its to start with-ever framework on what crypto regulation in the U.S. really should glimpse like — such as strategies in […]

Read More

Asia-Pacific markets a little bit up after damaging session China keeps medium-expression premiums steady

CNBC Pro: Want greater returns? Kevin O’Leary states place your revenue in ‘harm’s way’ — and shares his inventory picks Billionaire trader Kevin O’Leary thinks current market volatility is back, and thinks buyers will have to acquire on some hazards to get larger returns. “If you want to get a 6% to 8% return, you […]

Read More

Kevin O’Leary suggests it is really ‘crazy’ to stay clear of Chinese shares, and it ‘makes no perception whatsoever’

Staying away from the Chinese market place is “crazy” and “can make no feeling whatsoever” in light-weight of how low-cost Chinese stocks are ideal now, claimed Kevin O’Leary of O’Shares Investments. According to him, which is many thanks to these aspects: the projected size of China’s economic advancement a foreseeable stop to regulatory disputes with […]

Read More

Position anxieties? Here’s how China stacks up from the U.S. and other international locations

Vital Points In China, 32% of respondents said they were involved about the effect of inflation on their job security, as did 30% of respondents in Brazil, an Oliver Wyman survey uncovered. That is far higher than the share of respondents in the U.S. and U.K. stating they had been fearful about their positions, the […]

Read More

Inventory marketplace could rally large in fourth quarter, but there will be additional agony initially

The inventory industry could nevertheless see a fourth quarter rally, but it’s most likely to very first feel extra suffering. Strategists who follow charts say the huge provide-off Tuesday was a detrimental and indicators much more providing in advance. But the industry also could access a bottom from which to pivot in the upcoming couple […]

Read More

‘Volatility is back’: Kevin O’Leary claims it may well be time to obtain more stocks

Billionaire investor Kevin O’Leary states volatility is back again and it may possibly be a very good time to get much more shares. “It really is very disheartening to fairness markets to eliminate near to 1,000 points in a subject of 40 minutes,” the chairman of O’Shares Investments instructed CNBC’s “Road Indicators Asia” on Wednesday. […]

Read More

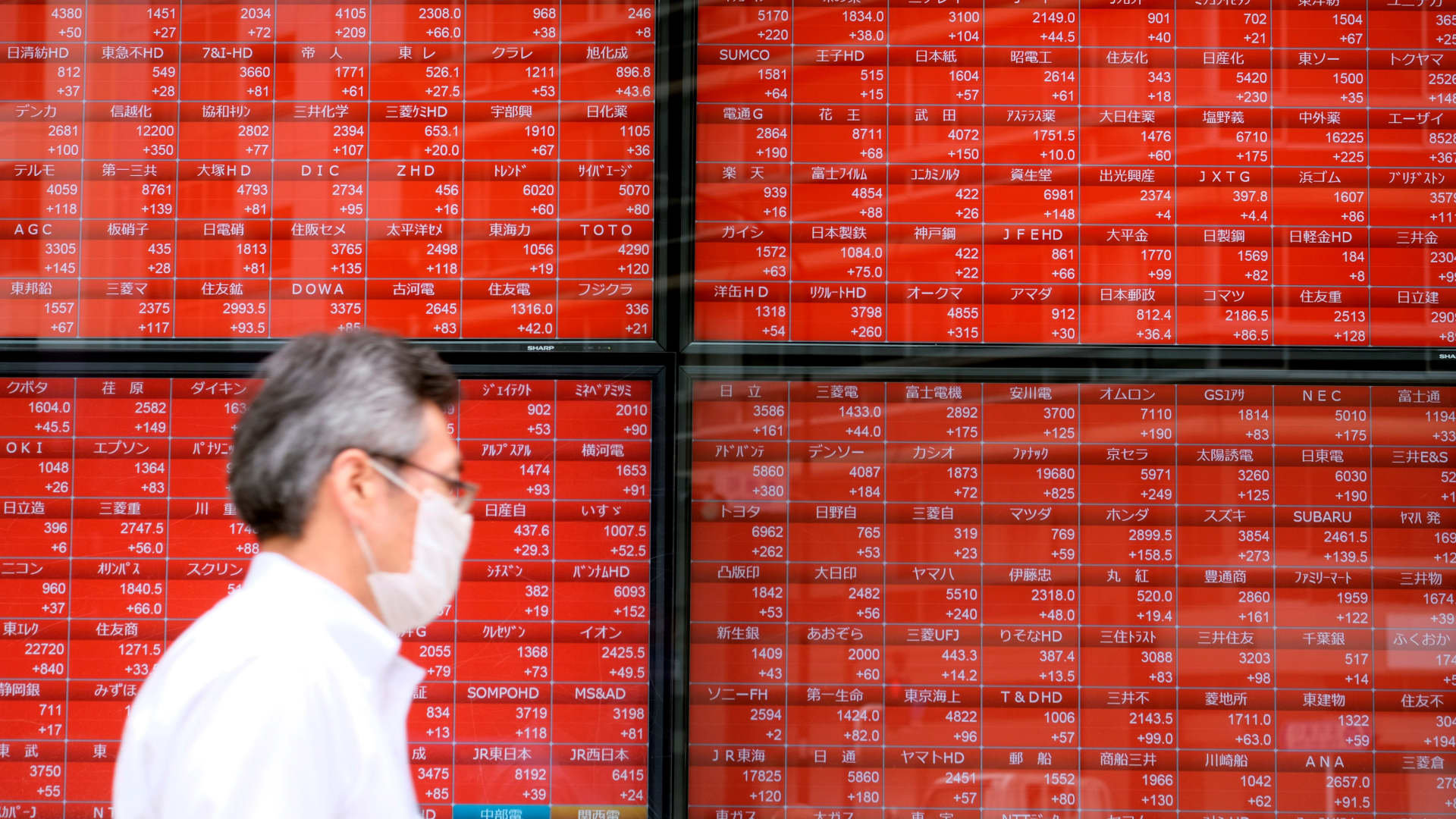

Main Asia-Pacific marketplaces drop 2% adhering to Wall Avenue plunge

A pedestrian walks past an digital quotation board exhibiting share costs of the Tokyo Inventory Exchange in Tokyo on June 16, 2020. Kazuhiro Nogi | AFP | Getty Pictures Shares in the Asia-Pacific dropped sharply on Wednesday after indexes on Wall Road plunged pursuing a bigger-than-predicted U.S. customer price tag index report for August. Japan’s […]

Read More