breakingNewsGlobal

The rule capping credit history card late service fees at $8 is on hold — here’s what it means for you

Essential Factors The U.S. banking sector gained a key victory in its effort and hard work to block the implementation of a Consumer Monetary Security Bureau rule that would’ve substantially constrained the fees that credit history card firms can demand for late payment. A federal courtroom on late Friday accepted the industry’s past-minute legal work to pause […]

Read More

Citigroup CEO Jane Fraser suggests minimal-profits customers have turned much far more cautious with spending

Key Details Citigroup CEO Jane Fraser stated Monday that purchaser actions has diverged as inflation for goods and solutions would make everyday living tougher for numerous People. Fraser, who leads one of the largest U.S. credit score card issuers, said she is observing a “K-formed buyer.” That implies the affluent proceed to shell out, when […]

Read More

Berkshire Hathaway’s big mystery stock wager could be revealed soon

Warren Buffett tours the grounds at the Berkshire Hathaway Annual Shareholders Meeting in Omaha Nebraska. David A. Grogan | CNBC Berkshire Hathaway, led by legendary investor Warren Buffett, has been making a confidential wager on the financial industry since the third quarter of last year. The identity of the stock — or stocks — that […]

Read More

NYCB shares soar just after new CEO presents two-calendar year system for ‘clear route to profitability’

Vital Points New York Group Lender on Wednesday posted a quarterly loss of $335 million on a mounting tide of soured commercial loans and better fees, but the lender’s stock surged on its new general performance targets. The first-quarter reduction, equivalent to 45 cents per share, as opposed to net revenue of $2.0 billion, or $2.87 […]

Read More

JPMorgan Chase is caught in U.S-Russia sanctions war following abroad court docket orders $440 million seized from lender

JPMorgan Chase CEO and Chairman Jamie Dimon gestures as he speaks during the U.S. Senate Banking, Housing and City Affairs Committee oversight hearing on Wall Street firms, on Capitol Hill in Washington, U.S., December 6, 2023. Evelyn Hockstein | Reuters A Russian court sided with state-operate financial institution VTB Lender in its endeavours to recoup […]

Read More

Jamie Dimon claims AI could be as impactful on humanity as printing press, electrical power and computers

Key Points JPMorgan Chase Jamie Dimon chose AI as the very first matter in his update of issues facing the most significant U.S. lender by belongings. In his annual letter to shareholders released Monday, Dimon claimed he was certain that synthetic intelligence will have a profound affect on culture. Source

Read More

Why private equity has been involved in every recent bank deal

Federal Reserve Chair Jerome Powell fist-bumps former Treasury Secretary Steven Mnuchin after a House Financial Services Committee hearing on “Oversight of the Treasury Department’s and Federal Reserve’s Pandemic Response” in the Rayburn House Office Building in Washington, D.C., on Dec. 2, 2020. Greg Nash | Reuters The $1 billion-plus injection that New York Community Bank […]

Read More

Some NYCB deposits may be a flight risk after Moody’s downgrades ratings again

A sign is pictured above a branch of the New York Community Bank in Yonkers, New York, U.S., January 31, 2024. Mike Segar | Reuters Regional lender New York Community Bank may have to pay more to retain deposits after one of the company’s key ratings was slashed for the second time in a month. Late […]

Read More

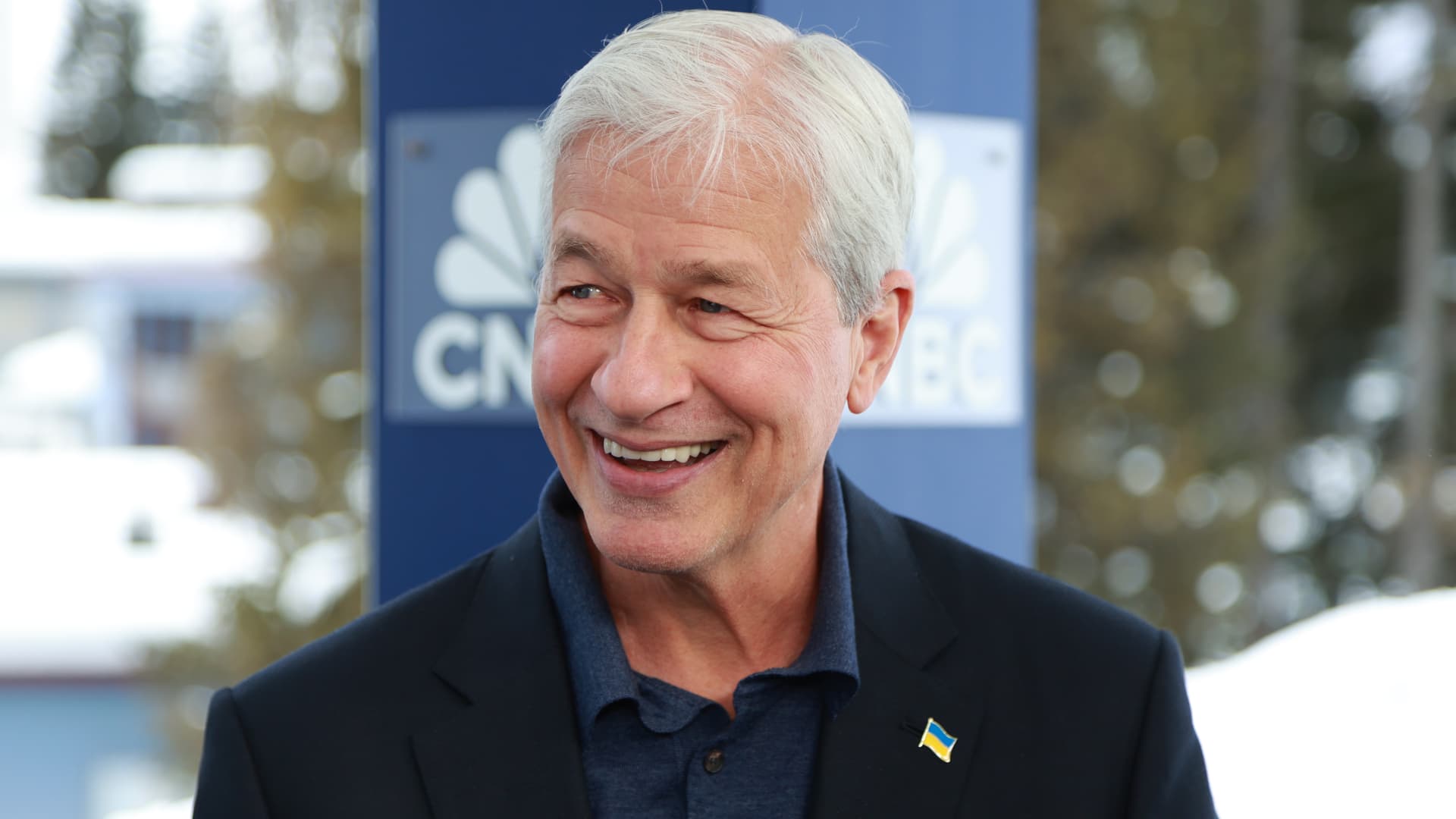

Jamie Dimon on Capital One's $35.3 billion Discover acquisition: 'Let them compete’

Jamie Dimon, President & CEO,Chairman & CEO JPMorgan Chase, speaking on CNBC’s Squawk Box at the World Economic Forum Annual Meeting in Davos, Switzerland on Jan. 17th, 2024. Adam Galici | CNBC JPMorgan Chase CEO Jamie Dimon isn’t worried about the added competition from a bulked-up Capital One if its $35.3 billion takeover of Discover […]

Read More

Capital One’s acquisition has $1.4 billion breakup fee if rival bid emerges, but none if regulators kill deal

Capital One headquarters in McLean, Virginia on February 20, 2024. Brendan Smialowski | AFP | Getty Images Capital One‘s blockbuster takeover proposal for Discover Financial includes a $1.38 billion breakup fee if Discover decides to go with another buyer, but no such fee if U.S. regulators kill the deal, people with knowledge of the matter […]

Read More