Breaking News: Investing

Sell Virgin Galactic as it delays space tourism flights and burns through cash, Truist says

Sell shares of Virgin Galactic as the space tourism company continues to push back commercial flights and burns through cash, according to Truist. Analyst Michael Ciarmoli downgraded shares of Virgin Galactic to sell from hold, citing a disappointing second-quarter report. The company postponed commercial flights to the second quarter of 2023. It also reported a […]

Read More

Stifel downgrades Twilio, slashes price target by 55%, citing weak outlook

There’s trouble ahead for Twilio after the communications software company issued weak guidance, according to Stifel. Analyst J. Parker Lane downgraded shares of Twilio to hold from buy, and slashed the target price by more than half, citing the company’s recent earnings report that came out Thursday. Twilio reported a revenue beat but offered up […]

Read More

A ‘shakeout’ among mortgage lenders is coming, according to CEO of bank that left the business

A sign hangs from a branch of Banco Santander in London, U.K., on Wednesday, Feb. 3, 2010. Simon Dawson | Bloomberg via Getty Images Banks and other mortgage providers have been battered by plunging demand for loans this year, a consequence of the Federal Reserve’s interest rate hikes. Some firms will be forced to exit […]

Read More

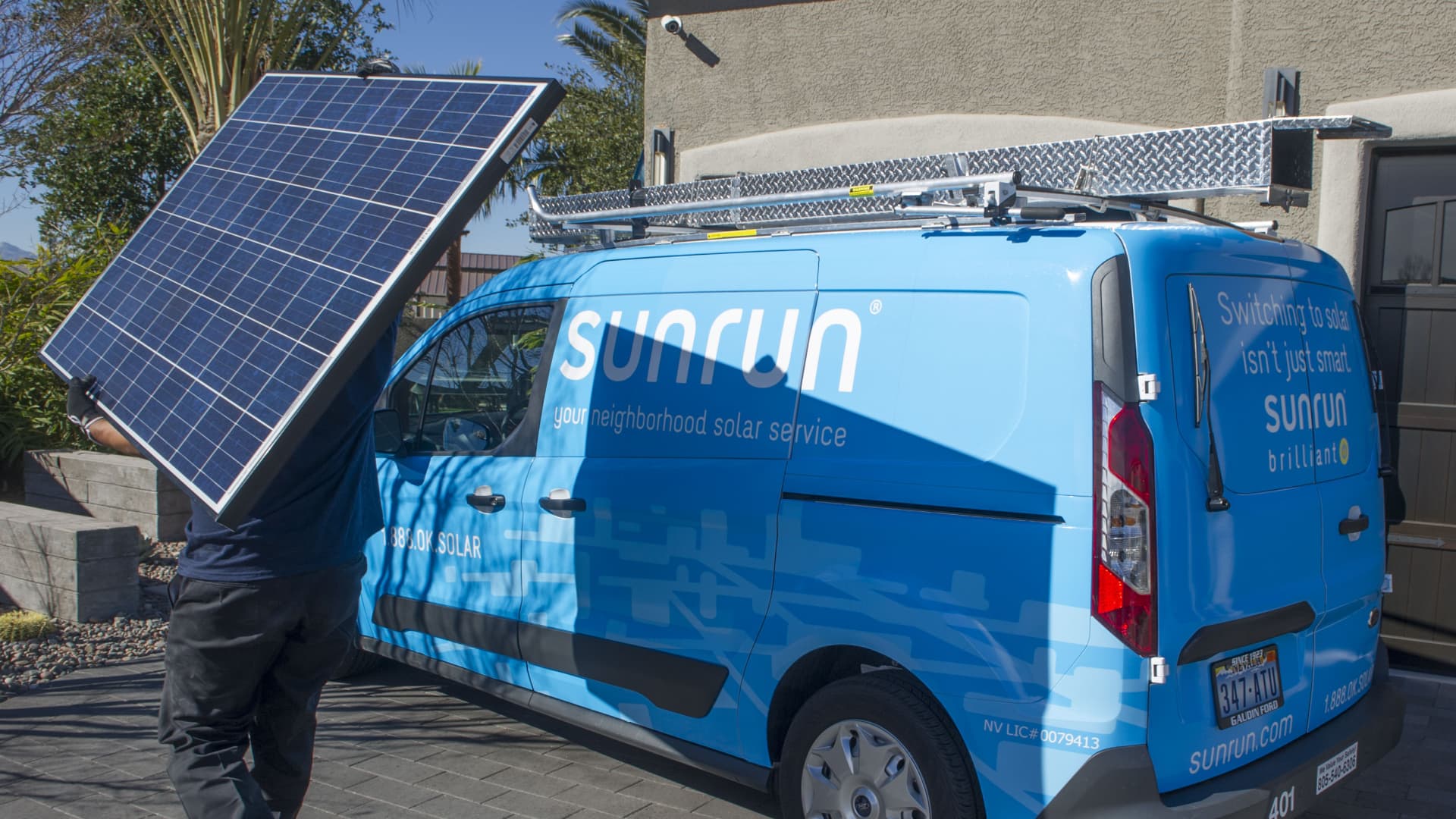

Sunrun could surge 45% if lawmakers approve climate spending boost, Barclays says

Shares of residential solar installer company Sunrun could surge about 45% from here should an ambitious spending package pass, according to Barclays. Solar stocks got a boost last week following an announcement that Senate Majority Leader Chuck Schumer, D-N.Y., and Sen. Joe Manchin, D-W.V., reached a deal on the “Inflation Reduction Act of 2022.” The […]

Read More

Goldman Sachs, bank behind the Apple Card, says regulators are investigating its credit card practices

Goldman Sachs CEO David Michael Solomon attends a discussion on “Women Entrepreneurs Through Finance and Markets” at the World Bank on October 18, 2019 in Washington, DC. Olivier Douliery | AFP | Getty Images Goldman Sachs said that its credit-card business is being investigated by the Consumer Financial Protection Bureau over a range of billing […]

Read More

Job cuts and smaller bonuses loom for Wall Street bankers amid deals slowdown, consultant says

People walk by the New York Stock Exchange on May 12, 2022 in New York City. Spencer Platt | Getty Images News | Getty Images Investment bankers hit with a collapse in equity and debt issuance this year are in line for bonuses that are up to 50% smaller than 2021 — and they are […]

Read More

As most streaming stocks struggle, Spotify stands out as a subscription success story

Spotify does not deserve the same treatment as other streaming companies, according to a growing number of people on Wall Street. “I think that is the most interesting name that people have completely written off,” LightShed Partners’ Rich Greenfield said last week on CNBC’s ” Squawk Box .” Shares of the streaming company are down […]

Read More

Paul Britton, CEO of $9.5 billion derivatives firm, says the market hasn’t seen the worst of it

(Click here to subscribe to the Delivering Alpha newsletter.) The market has seen tremendous price swings this year – whether it comes to equities, fixed income, currencies, or commodities — but volatility expert Paul Britton doesn’t think it ends there. Britton is the founder and CEO of the $9.5 billion derivatives firm, Capstone Investment Advisors. He sat […]

Read More

SPAC market hits a wall as issuance dries up and valuation bubble bursts

Traders on the floor of the NYSE, August 1, 2022. Source: NYSE The SPAC boom is officially a thing of the past. Not a single special purpose acquisition company was issued in July as the market slowdown turned into a screeching halt, according to CNBC calculations of SPAC Research data. Sponsors who once took advantage of […]

Read More

Evercore ISI’s Julian Emanuel doesn’t think we’ve seen the bottom yet in the bear market

Evercore ISI’s Julian Emanuel doesn’t think we’ve seen the bottom yet in the bear market, pointing to more volatility in September. The strategist believes investors may be overly optimistic following July’s rally in which risk-on sentiment returned to Wall Street. He pointed to slowing growth, as well as troubling signs in bond yields, that could […]

Read More