Breaking News: Investing

Roku downgraded to underperform at MoffettNathanson despite this month’s comeback rally

Sell shares of Roku as the media player manufacturer faces pressure from increasing competition and a worsening macro backdrop, according to MoffettNathanson. The firm downgraded Roku to underperform from market perform, and kept its price target, after the streaming company reported disappointing second-quarter earnings results last month. Roku missed expectations on both the top and […]

Read More

Morgan Stanley downgrades Allbirds, says stock is stuck until ‘path to profitability is more clear’

Shares of Allbirds could see limited upside until the path to profitability becomes more clear, according to Morgan Stanley. Analyst Alex Straton downgraded Allbirds to equal-weight from overweight, and slashed its price target, following a quarterly earnings report that pointed to greater economic uncertainty for retailers. Allbirds lowered its guidance for the year after citing […]

Read More

Citi’s stocks to play the biggest themes of our time like automation and AI

As markets remain saddled with short-term turmoil and recession fears, one top strategist recommends investors start seeking out stocks with long-term structural growth stories. Citi’s Scott Chronert believes stocks that play into the biggest trends of our time, such as artificial intelligence and automation, could start outperforming from here. “Why are we considering themes now? […]

Read More

Apple Card’s rapid growth, outside vendors blamed for mishaps within Goldman’s credit-card business

Apple CEO Tim Cook introduces Apple Card during a launch event at Apple headquarters on Monday, March 25, 2019, in Cupertino, California. Noah Berger | AFP | Getty Images When it was unveiled in 2019, Apple touted its new credit card as a gamechanger with unheard-of levels of simplicity and transparency. Behind the scenes, however, […]

Read More

Investor Sarat Sethi has some stock picks to play inflation and a consumer slowdown

Investors should stick to companies that can keep generating earnings as they navigate high inflation and a consumer slowdown, according to DCLA’s Sarat Sethi. “Earnings are going to drive this market going forward,” Sethi said Monday on CNBC’s “Squawk Box.” “Not multiple expansion, not liquidity, it’s going to be where do we find earnings, and […]

Read More

Berkshire Hathaway reports operating earnings surge, but posts big investment loss amid market rout

An Andy Warhol-like print of Berkshire Hathaway CEO Warren Buffett hangs outside a clothing stand during the first in-person annual meeting since 2019 of Berkshire Hathaway Inc in Omaha, Nebraska, U.S. April 30, 2022. Scott Morgan | Reuters Berkshire Hathaway’s operating profits jumped in the second quarter despite fears of slowing growth, but Warren Buffett’s […]

Read More

These stocks won earnings season and are expected to rally further — including one by nearly 50%

Stocks rose across the board last month on the back of better-than-expected quarterly results, but CNBC Pro found some companies that absolutely won earnings season. These stocks led the rally during earnings season, and are expected to build on that momentum from here. What’s more? They’re adored by analysts, even as Wall Street at large […]

Read More

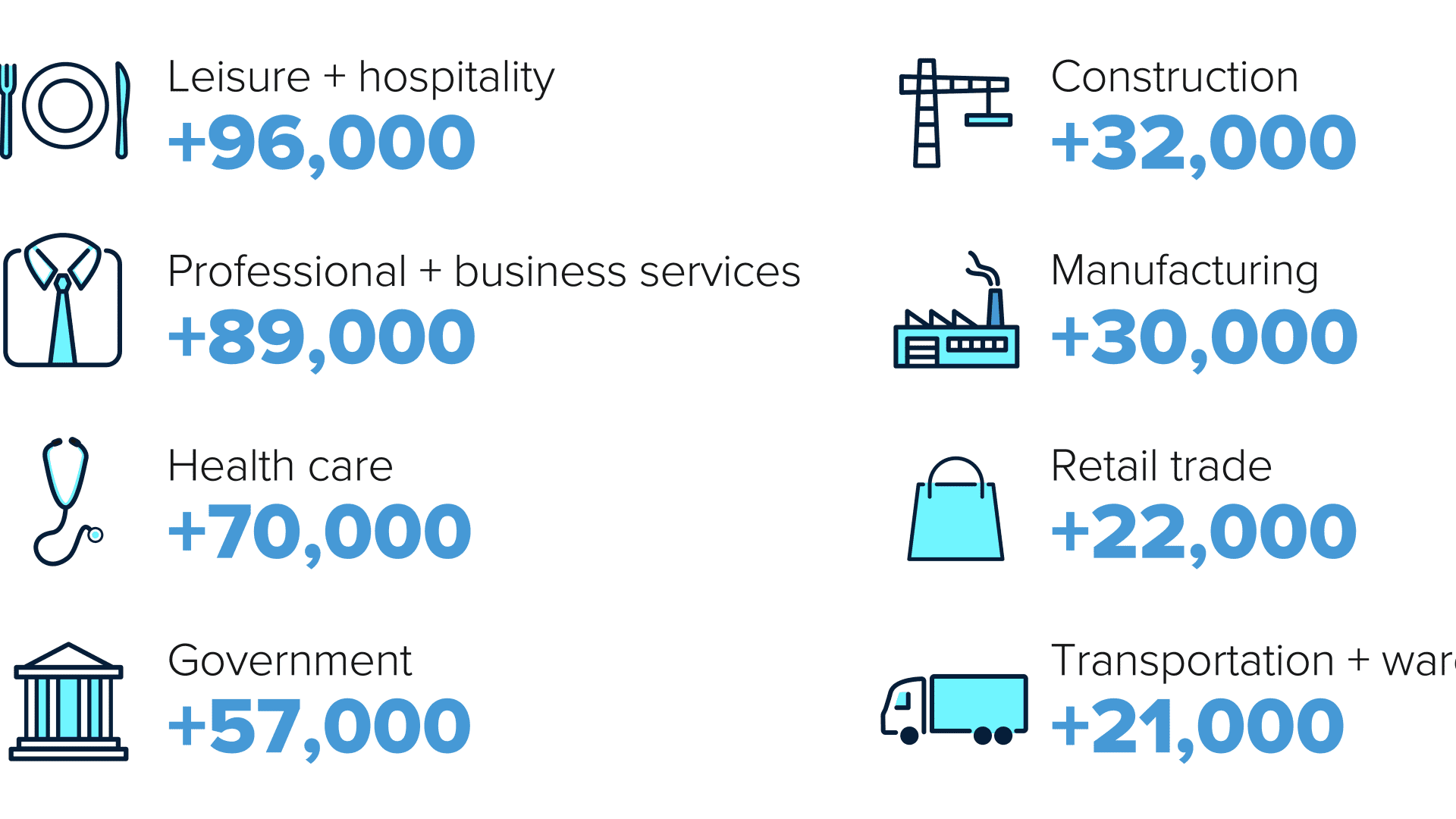

Here’s where the jobs are for July 2022 — in one chart

Zoom In IconArrows pointing outwards Bureau of Labor Statistics The U.S. economy added many more jobs than expected last month, and there was an appetite for workers particularly in the service sector, which has been grappling with labor shortages. The leisure and hospitality sector saw the most jobs growth, with 96,000 payrolls added in July, […]

Read More

Sell Paramount as macro challenges mount, JPMorgan says

It’s time to sell shares of Paramount , as investors can expect greater macro challenges ahead for the legacy media company, according to JPMorgan. “Today we downgrade Paramount to Underweight from Neutral with a $25 price target due to softer DTC revenue and higher losses this year, as well as an expectation of weakening EBITDA […]

Read More

SolarEdge is willing to sacrifice margins today to capture huge demand growth in Europe, CFO says

SolarEdge shares tumbled this week after the company’s second-quarter results showed a hit to margins from factory closures, higher transport costs and currency headwinds from the weakening Euro. But SolarEdge CFO Ronen Faier said lower margins now is the price to be paid for long-term growth in a market where demand is skyrocketing. “We have […]

Read More