Breaking News: Economy

'Past prospect saloon': United kingdom finance minister envisioned to pledge pre-election tax cuts

British Finance Minister Jeremy Hunt explained before this thirty day period the U.K. would not enter a economic downturn this calendar year. Hannah Mckay | Reuters LONDON — Economists assume U.K. Finance Minister Jeremy Hunt to use a tiny fiscal windfall to supply a modest bundle of tax cuts at his Spring Finances on Wednesday. […]

Read More

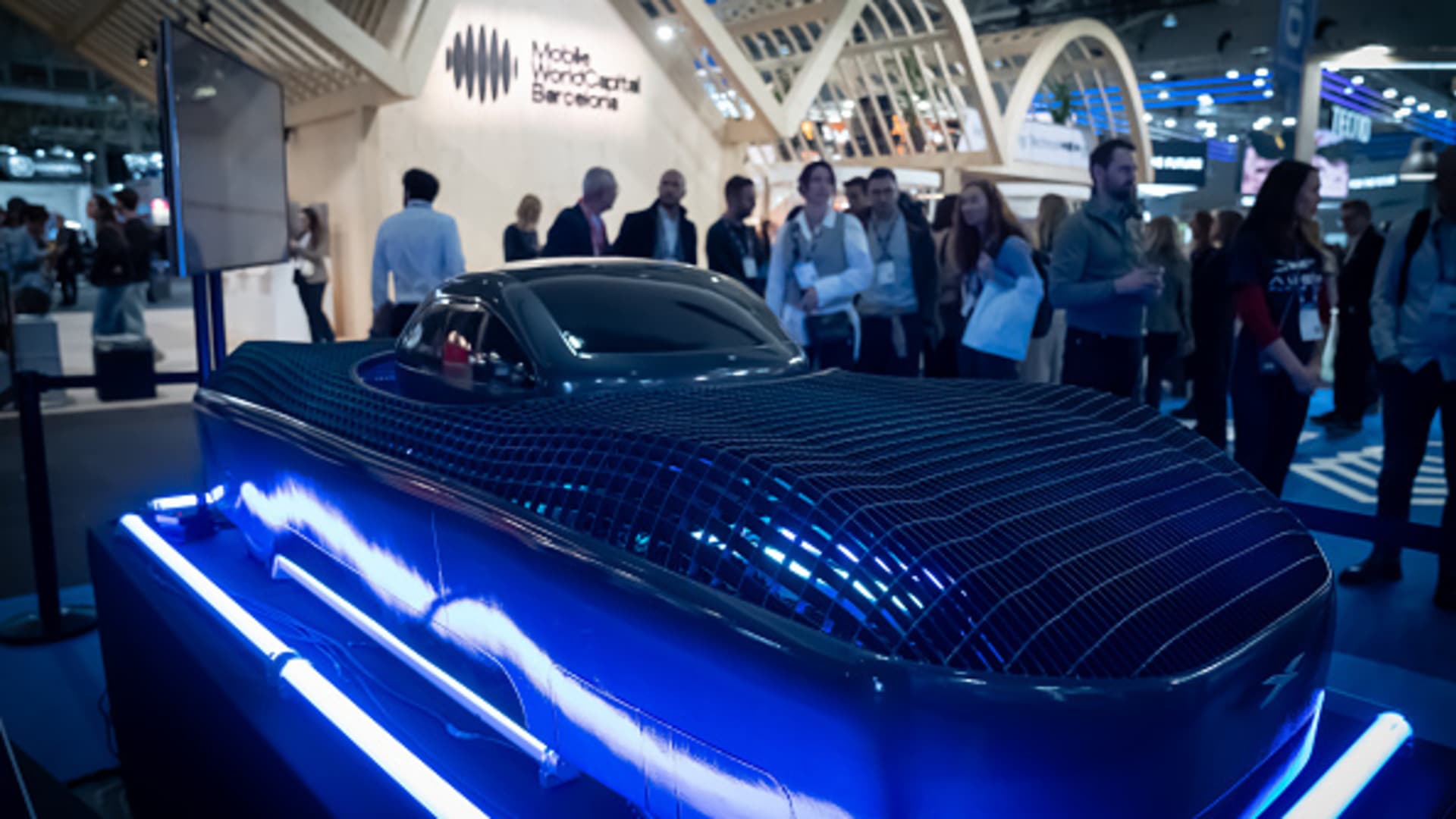

SpaceX-backed startup claims preorders for its $300,000 futuristic traveling vehicle have arrived at 2,850

BARCELONA, Spain — Alef Aeronautics, a SpaceX-backed traveling car or truck organization, claims it has attained 2,850 preorders for its futuristic electrical vertical takeoff and landing (eVTOL) vehicle. Alef Aeronautics, which is centered in San Mateo, California, stated preorder numbers not long ago hit a fresh new history right after beforehand reporting 2,500 preorders for its […]

Read More

The U.S. countrywide personal debt is rising by $1 trillion about each 100 days

The U.S. Treasury setting up in Washington, D.C., on March 13, 2023. Al Drago | Bloomberg | Getty Pictures The personal debt load of the U.S. is expanding at a more rapidly clip in current months, expanding about $1 trillion almost just about every 100 days. The nation’s financial debt forever crossed around to $34 […]

Read More

Britain to direct 2024 European serious estate boom as global buyers eye opportunities, investigate suggests

Aerial perspective of the roof gardens at Gasholder Park in Kings Cross, London. Richard Newstead | Moment | Getty Visuals The U.K. seems to be poised to guide a European real estate resurgence this yr as worldwide investors return funds to the region’s strained house market place. An anticipated fall in interest prices and modest […]

Read More

All of AMC's earnings advancement arrived from Taylor Swift and Beyoncé movies, theater chain states

Popcorn buckets are pictured all through the “Taylor Swift: The Eras Tour” live performance film environment premiere at AMC The Grove in Los Angeles on Oct. 11, 2023. Valerie Macon | AFP | Getty Pictures Move around, Nicole Kidman. AMC has some new patron saints. In the final 3 months of 2023, AMC observed income […]

Read More

Essential Fed inflation evaluate rose .4% in January as envisioned, up 2.8% from a calendar year in the past

Inflation rose in line with anticipations in January, according to an critical gauge the Federal Reserve takes advantage of as it deliberates cutting fascination rates. The own usage expenditures price tag index excluding food items and electricity costs greater .4% for the month and 2.8% from a yr back, as anticipated in accordance to the […]

Read More

Russia supplying African governments 'regime survival package deal' in exchange for methods, investigate states

OUAGADOUGOU, Burkina Faso – Jan. 20, 2023: A banner of Russian President Vladimir Putin is viewed during a protest to aid the Burkina Faso President Captain Ibrahim Traore and to need the departure of France’s ambassador and navy forces. OLYMPIA DE MAISMONT/AFP by way of Getty Illustrations or photos Russia’s armed service intelligence support is […]

Read More

Goldman Sachs and Abu Dhabi's Mubadala ink $1 billion partnership to commit in Asia Pacific

An Emirati female paddles a canoe past skyscrapers in Abu Dhabi, United Arab Emirates, on Wednesday, Oct. 2, 2019. Christopher Pike | Bloomberg | Getty Photos DUBAI, United Arab Emirates — Goldman Sachs and Abu Dhabi sovereign prosperity fund Mubadala on Monday signed a $1 billion non-public credit score partnership to co-spend in the Asia-Pacific […]

Read More

Economic boost from Taylor Swift's Eras tour could be overstated, Nomura warns

Taylor Swift performs onstage at Lumen Discipline in Seattle on July 22, 2023. Mat Hayward/tas23 | Getty Photos Leisure | Getty Pictures The devil’s in the aspects, but regional economies have a good friend in Taylor Swift. The American pop star has spent approximately a yr crossing the U.S. and world with her higher-flying “Eras” […]

Read More

German central financial institution losses soar, wiping out threat provisions

Joachim Nagel, president of Deutsche Bundesbank, throughout the central bank’s “Annual Report 2023” news conference in Frankfurt, Germany, on Friday, Feb. 23, 2024. Bloomberg | Bloomberg | Getty Pictures Losses incurred by the German central lender rocketed into the tens of billions in 2023 owing to better interest premiums, requiring it to draw on the […]

Read More