Bonds

Kevin O’Leary says he won’t be buying bonds for now

Investors are “going to get hurt” if they’re in long duration bonds right now, says venture capitalist Kevin O’Leary. His comments come hours after the Federal Reserve raised interest rates by 75 basis points — the central bank’s most aggressive hike since 1994. “I wouldn’t be buying bonds here,” O’Leary, who is chairman at O’Leary […]

Read More

An aggressive Fed has global ramifications. Here are 3 ways the world could be hit

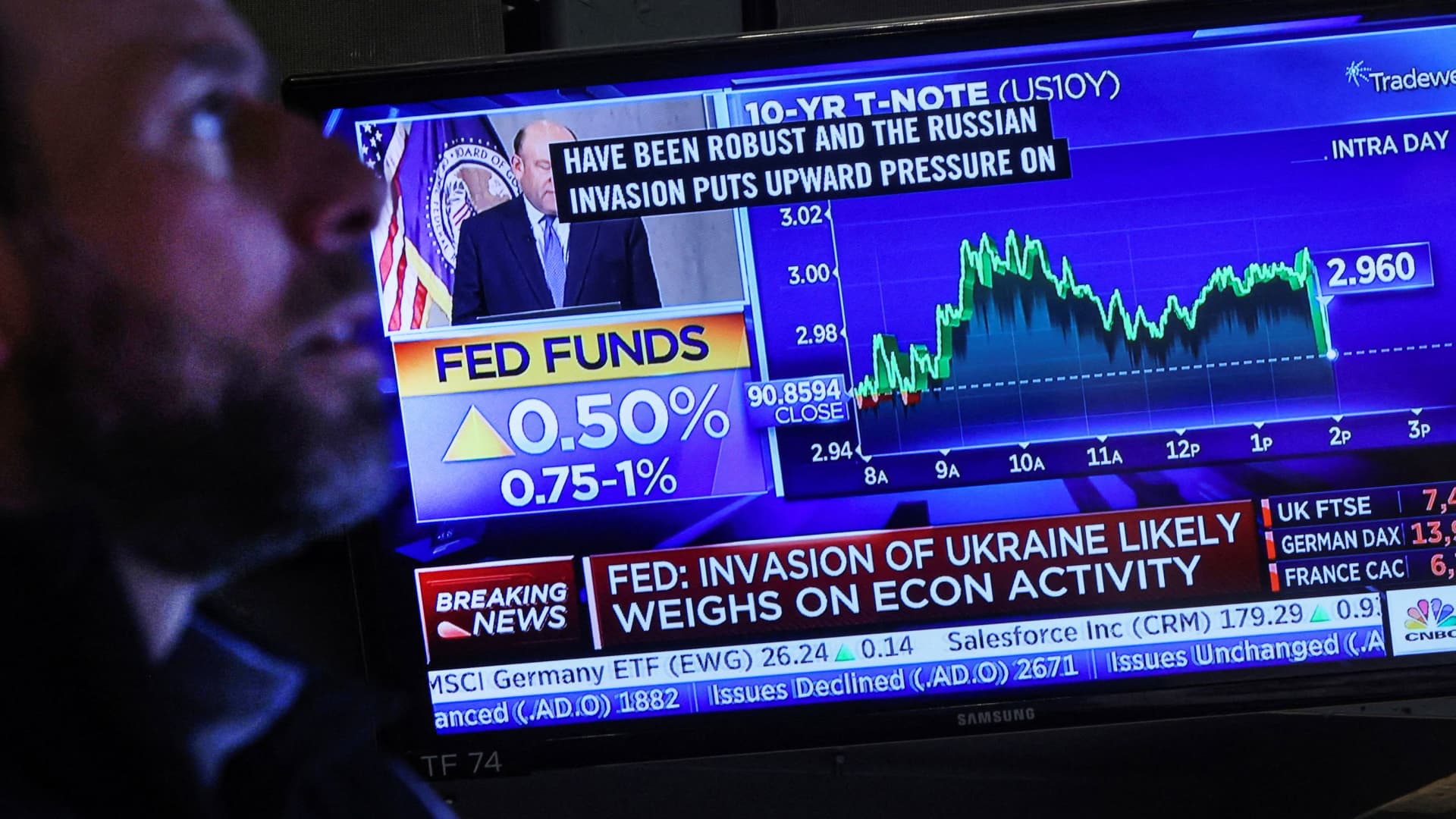

The Federal Reserve is widely expected to hike interest rates by 75 basis points on Wednesday with inflation running at a 40-year high, but aggressive tightening of monetary policy runs the risk of tipping the economy into recession. Brendan Mcdermid | Reuters Global markets took a hammering to start the week as expectations grew that […]

Read More

Wall Street is on a one way trip to misery until Fed hikes stop, market forecaster Jim Bianco warns

Until inflation peaks and the Federal Reserve stops hiking rates, market forecaster Jim Bianco warns Wall Street is on a one way trip to misery. “The Fed only has one tool to bring in inflation and that is they have to slow demand,” the Bianco Research president told CNBC “Fast Money” on Tuesday. “We may […]

Read More

10-year Treasury yield falls after biggest move since March 2020; investors await key Fed meeting

Treasury yields fell on Tuesday as investors assessed the prospect of the Federal Reserve taking the most aggressive step yet in its fight to lower soaring inflation. The yield on the benchmark 10-year Treasury note slipped around 9 basis points to 3.276%, paring gains after climbing to 3.39% and notching its biggest move since 2020 […]

Read More

1980s-era rate hikes designed to fight inflation will create more market turmoil, Canaccord’s Tony Dwyer predicts

Stocks may go into a deeper tailspin. Canaccord Genuity’s Tony Dwyer predicts 1980s-era interest rate hikes will exacerbate the turmoil and make a recession seem increasingly more likely. “Typically, I’ve been bullish over the years. But there’s a money availability problem,” the firm’s chief market strategist told CNBC’s “Fast Money” on Monday. “Ultimately, you have […]

Read More

JPMorgan says Chinese assets are a good diversifier right now

Sign for J.P. Morgan on 7th March 2020 in London, United Kingdom. JPMorgan Chase & Co. is an American multinational investment bank and financial services holding company headquartered in New York. Mike Kemp | Getty Images LONDON – As lockdowns ease and regulatory pressures subside, some of the headwinds facing Chinese stocks are set to […]

Read More

2-year Treasury yield surges above 2.9% on hotter-than-expected inflation report

Short-term U.S. Treasury yields popped Friday, after the release of hotter-than-expected inflation data raised concern over a possible recession. The 2-year rate jumped more than 8 basis points to trade above 2.9%. The benchmark 10-year Treasury yield briefly rose before giving up those gains, last trading at about 3.04%. Short-term rates moved more due to […]

Read More

Annuity sales rise, buoyed by market fears and higher interest rates. What to know before you buy

Svetikd | E+ | Getty Images Annuities are on track for a banner year as consumers flee stock volatility and insurers offer more attractive rates. Limra, an insurance industry group, forecasts annuity sales of $267 billion to $288 billion in 2022, eclipsing the record ($265 billion) set in 2008. Consumers pumped $255 billion into annuities […]

Read More

Russia thinks it has found a way around Washington’s dollar bond payment blockade

Russian Finance Minister Anton Siluanov (seen here with Russian President Vladimir Putin in 2019) reportedly told Russian newspaper Vedomosti that Moscow will continue to service external debts in rubles, but foreign Eurobond holders will need to open ruble and hard currency accounts with Russian banks in order to receive payments. Mikhail Svetlov | Getty Images […]

Read More