Bonds

10-calendar year Treasury generate dips as investors weigh the 2024 outlook for desire rates

U.S. Treasury yields were being mixed on Wednesday, as investors viewed as the outlook for financial plan and economical marketplaces for the coming calendar year. At 3:56 a.m. ET, the generate on the 10-year Treasury was down by in excess of a person foundation factors to 3.8667%. The 2-calendar year Treasury produce was just about […]

Read More

Japan's government to elevate very long-phrase charge estimate in spending plan for up coming fiscal calendar year: Reuters, citing resources

Professional and household structures at dusk in the Minato district of Tokyo, Japan. Bloomberg | Bloomberg | Getty Illustrations or photos Japan’s governing administration will raise its long-term interest rate estimate used to compile the state budget to 1.9% for the subsequent fiscal 12 months from the present-day year’s 1.1%, two people with understanding of the subject advised Reuters. It would be the initial […]

Read More

Treasury yields fall as traders continue on to evaluate potential clients of futures Fed level cuts

The 10-12 months U.S. Treasury produce retreated on Tuesday, reversing training course from the former day’s trade and continuing a basic downward craze about the past 7 days. The produce on the benchmark 10-12 months take note was down 5 basis factors at 3.907%, having fallen below 4% on Thursday to strike its least expensive […]

Read More

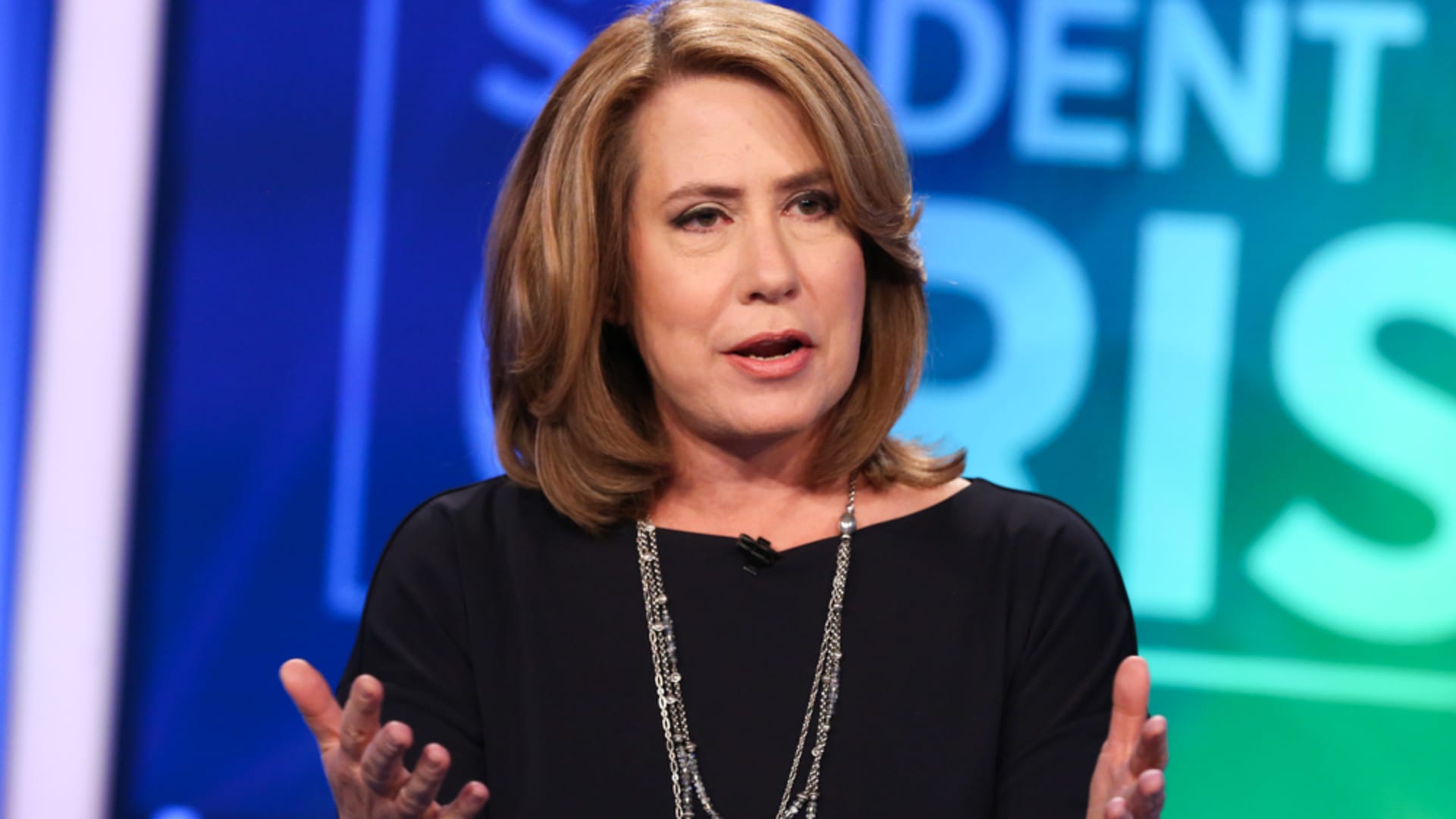

Fed sparking irrational sector optimism more than likely rate cuts, previous FDIC Chair Sheila Bair warns

Market optimism more than the prospective for curiosity price cuts upcoming year is dangerously overdone, in accordance to previous FDIC Chair Sheila Bair. Bair, who ran the FDIC all through the 2008 fiscal crisis, suggests Federal Reserve Chair Jerome Powell was irresponsibly dovish at very last week’s coverage assembly by building “irrational exuberance” among the […]

Read More

10-calendar year Treasury yield slip further just after Fed's 'major shift'

The 10-calendar year Treasury take note yield slipped additional on Monday, as the remaining whole buying and selling 7 days of 2023 will get underway. Traders keep on to digest the unexpectedly dovish tone of the U.S. Federal Reserve past week. The central lender held its critical fascination fee constant and disclosed that policymakers were penciling […]

Read More

10-calendar year Treasury yield slips, adds to this week's steep decline

The 10-yr Treasury notice yield slipped Friday, introducing to its sharp downturn this 7 days, as traders brace for attainable Federal Reserve charge cuts next 12 months. The produce on the 10-yr Treasury was decrease by 2 foundation factors at 3.905%. It had fallen underneath the 4% stage for the to start with time considering […]

Read More

ɻonds are back again' as marketplaces enter a 'new paradigm,' claims HSBC Asset Administration

The HSBC Holdings Plc headquarters building in Hong Kong, China. Paul Yeung | Bloomberg | Getty Photographs LONDON — Marketplaces have entered a “new paradigm” as the world purchase fragments, although heightened economic downturn danger means that “bonds are back again,” in accordance to HSBC Asset Administration. In its 2024 expense outlook, found by CNBC, […]

Read More

Treasury yields inch increased in advance of Fed meeting

U.S. Treasury yields have been fractionally better on Monday, as investors appear ahead to this week’s Federal Reserve policy meeting. The yield on the benchmark 10-calendar year Treasury observe was just in excess of a solitary foundation stage higher at 4.2563%, although the produce on the 30-yr Treasury bond was just underneath a level greater […]

Read More

2-yr Treasury produce rises as traders digest financial data

U.S. Treasury yields ended up mixed on Wednesday as buyers assessed the point out of the financial system immediately after the launch of labor sector facts. At 4:12 a.m. ET, the yield on the 10-year Treasury was down by significantly less than one particular foundation stage to 4.1686%. It had fallen beneath the 4.2% mark […]

Read More

Treasury yields inch bigger as traders consider economic outlook

U.S. Treasury yields were being slightly bigger on Tuesday, as buyers awaited the launch of financial data that could give hints about the economic outlook. At 3:57 a.m. ET, the 2-12 months Treasury produce was up by much more than one particular foundation level to 4.8750%. The 10-12 months Treasury produce was less than one […]

Read More