Bank of America Corp

Shares producing the most significant moves midday: Occidental Petroleum, Wells Fargo, Micron, Joby and much more

An personnel scans an get in the shipping and delivery region at the Overstock.com distribution middle in Salt Lake Metropolis, Utah. Ken James | Bloomberg | Getty Visuals Check out the businesses earning headlines in midday buying and selling. Freyr — Freyr Battery surged 18% just after Morgan Stanley upgraded the battery maker to chubby […]

Read More

Stocks earning the most important premarket moves: Joby, Micron, Wells Fargo, Freyr Battery and a lot more

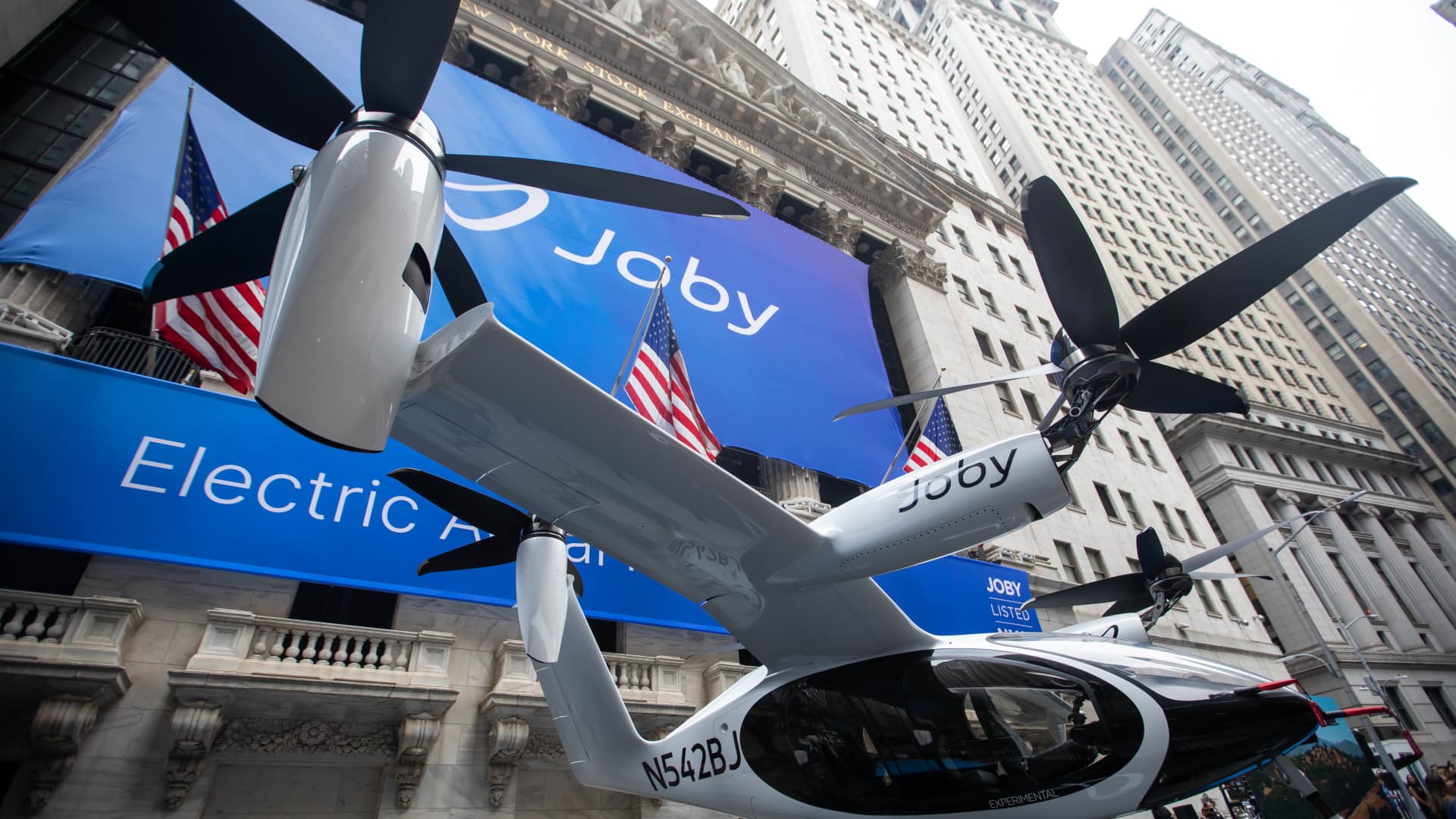

A Joby Aviation Electric powered Vertical Take-Off and Landing (eVTOL) plane exterior the New York Inventory Trade (NYSE) in the course of the company’s initial public offering in New York, U.S., on Aug. 11, 2021. Michael Nagle | Bloomberg | Getty Visuals Check out the corporations generating the largest moves in premarket buying and selling: […]

Read More

Stock futures rise a little bit as the market place nears the stop of quarter and very first 50 percent: Reside updates

Traders on the flooring of the New York Inventory Trade, Aug. 4, 2022. Resource: NYSE Stock futures rose a little in overnight buying and selling Wednesday as the current market techniques the conclusion of the 2nd quarter and the 1st fifty percent of 2023 with strong gains. Futures on the Dow Jones Industrial Typical attained […]

Read More

Robert F. Kennedy Jr.’s presidential run gets support from Wall Street veteran Omeed Malik

Omeed Malik speaks during the SALT conference in Las Vegas Richard Brian | Reuters Robert F. Kennedy Jr., the anti-vaccine activist who’s now running for president, has another wealthy backer in his corner: veteran Wall Street executive Omeed Malik. Last month, Malik took Kennedy to a swanky private dinner at the Bellagio in Las Vegas […]

Read More

Financial institution of The united states tends to make $500 million fairness thrust for minority- and women-led resources

Critical Details Lender of The us has dedicated to supplying far more than $500 million in fairness investments to minority- and females-led fund professionals to guidance diverse entrepreneurs. Far more than 60% of the fund managers who can pull from the equity pool are led by women of all ages. So considerably, much more than […]

Read More

NFL appears to be like to give a increase to Black- and minority-owned financial institutions

Critical Factors The NFL consulted with Bank of The united states and the Nationwide Black Financial institution Basis on its mortgage. The comprehensive terms of the personal loan are not remaining launched. Nevertheless, an NFL executive said the phrases are at “market charges,” and the league ideas to entirely attract on the bank loan around […]

Read More

Stock futures are down somewhat on Monday evening after rally takes a breather: Dwell updates

A trader operates as American flags are displayed on the floor of the New York Stock Trade (NYSE) in New York Michael Nagle | Bloomberg | Getty Photos Inventory futures are modestly reduce Monday night time as buyers are coming off a shedding session that took a tiny chunk out of final week’s advance. Futures […]

Read More

Bank of The united states ranks the greatest A.I. winners in software program shares. Right here are its prime picks

As buyers appear for winners in the artificial intelligence boom, many software program shares stand out, including Microsoft and Oracle, in accordance to Lender of The united states. The burgeoning fascination in AI was further fueled by Nvidia ‘s modern blowout earnings, which briefly propelled the chip inventory to a $1 trillion valuation Tuesday. The […]

Read More