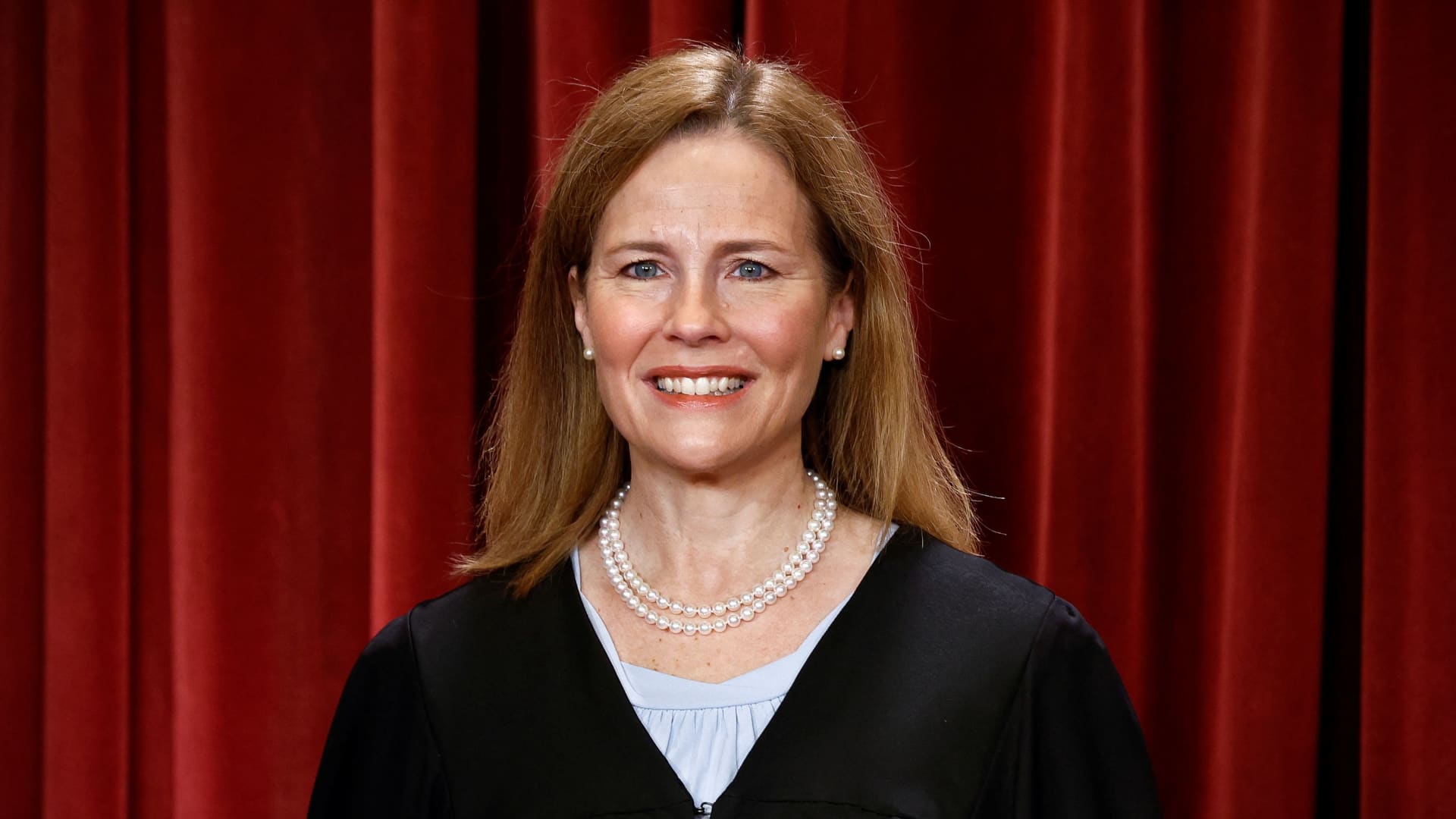

U.S. Supreme Courtroom Affiliate Justice Amy Coney Barrett poses all through a team portrait at the Supreme Court docket in Washington, U.S., October 7, 2022.

Evelyn Hockstein | Reuters

The Supreme Court docket on Thursday rejected a request to block the Biden administration’s college student personal loan debt aid method.

Justice Amy Coney Barrett denied the unexpected emergency software to block the software, which experienced been filed by a Wisconsin taxpayers’ team on Wednesday.

Barrett is accountable for these applications issued from cases in the 7th Circuit U.S. Courtroom of Appeals, which contains Wisconsin. A notation of her denial on the Supreme Court’s docket does not point out that she referred the application to the entire Supreme Courtroom prior to she rejected the request.

The bank loan reduction system, which is established to get started taking impact this weekend, will cancel up to $20,000 in pupil financial debt for hundreds of thousands of borrowers.

A lot more than 8 million individuals submitted purposes for the plan last weekend just after the U.S. Department of Schooling launched a beta examination.

The challenge to the program arrived from the Brown County Taxpayers Association in Wisconsin, which experienced filed a federal lawsuit in that point out as section of that hard work.

Before this month, a U.S. District Court decide dismissed the fit, stating the group lacked lawful standing to stall the program pending the outcome of the scenario.

The group then appealed that ruling to the 7th Circuit. In its ask for Wednesday to Barrett, the team asked that she or the overall Supreme Courtroom suspend implementation of the personal debt relief application pending the final result of its charm.

Dan Lennington, deputy counsel of Wisconsin Institute for Legislation & Liberty, Inc., which acted as legal professionals for the taxpapers’ team, in a assertion stated, “Of program, we are unhappy that the court docket denied us emergency reduction.”

“But that does not make the application lawful,” Lennington claimed. “College student financial loan forgiveness will continue being underneath critique by the courts and could possibly nonetheless be paused as we advocated for this week.”

– CNBC’s Annie Nova contributed to this report