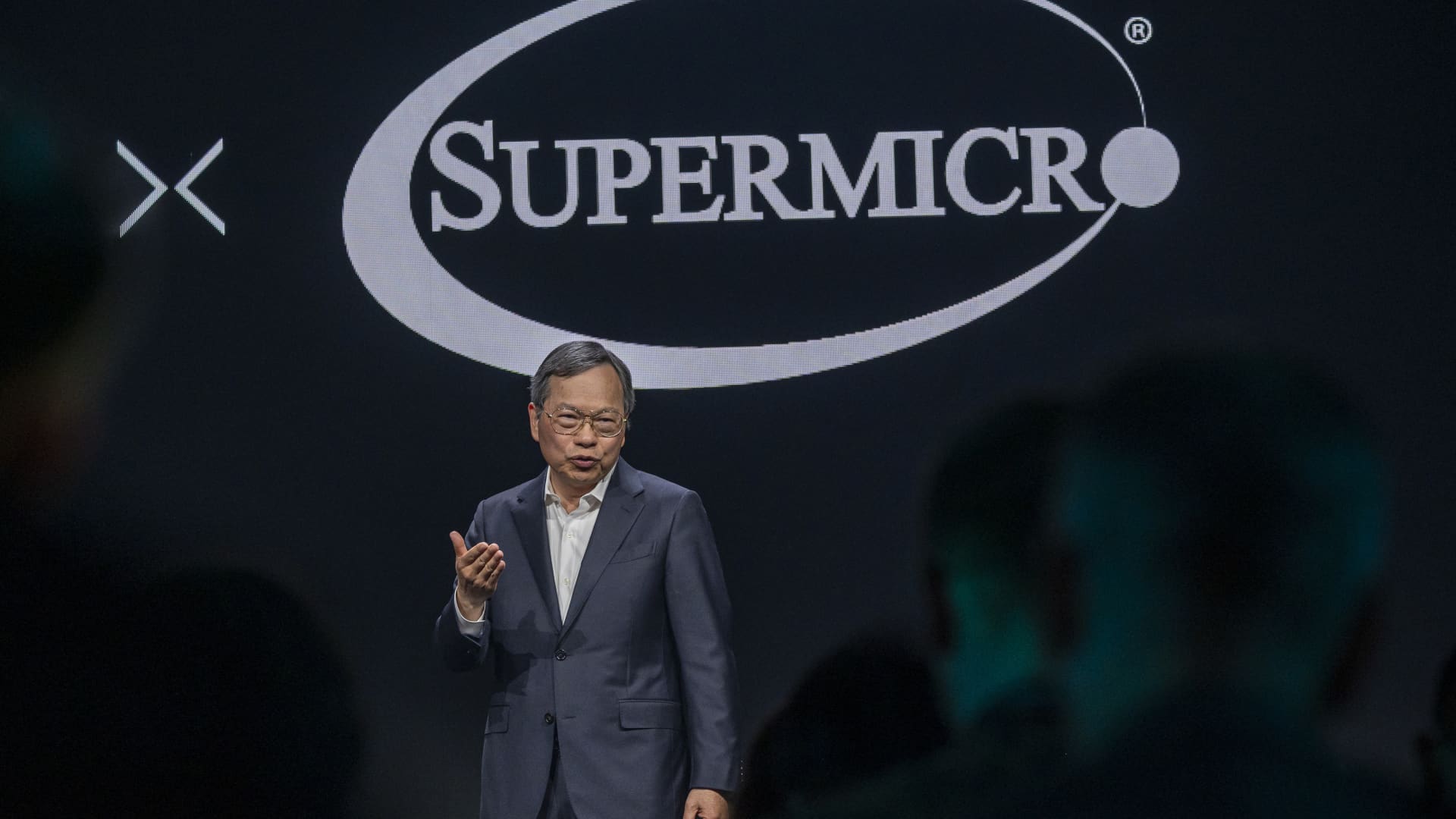

David Paul Morris | Bloomberg | Getty Photographs

Super Micro Laptop or computer shares plunged 18% on Friday as investors scaled back their holdings of one of the market’s best shares in advance of earnings afterwards this month.

Shares of Tremendous Micro, which joined the S&P 500 in March, are nonetheless up about 168% this year just after climbing 246% in 2023. The server and personal computer infrastructure firm is a key vendor for Nvidia, whose technology is the spine for most of modern impressive synthetic intelligence products.

Super Micro said in a temporary press launch on Friday that it will report fiscal third-quarter effects on April 30. The business broke from its pattern of giving preliminary success. In January, Super Micro improved its profits and earnings advice 11 times prior to saying next-quarter financials.

The stock is on tempo for its steepest fall given that Feb. 16, when it fell about 20%.

While Tremendous Micro is receiving a significant strengthen from its ties to Nvidia, the market place continues to be highly contested, with competitors such as Dell and Hewlett Packard Enterprise scheduling to create methods using Nvidia’s most recent technology of Blackwell graphics processing models.