Check out the corporations generating the largest moves in premarket buying and selling:

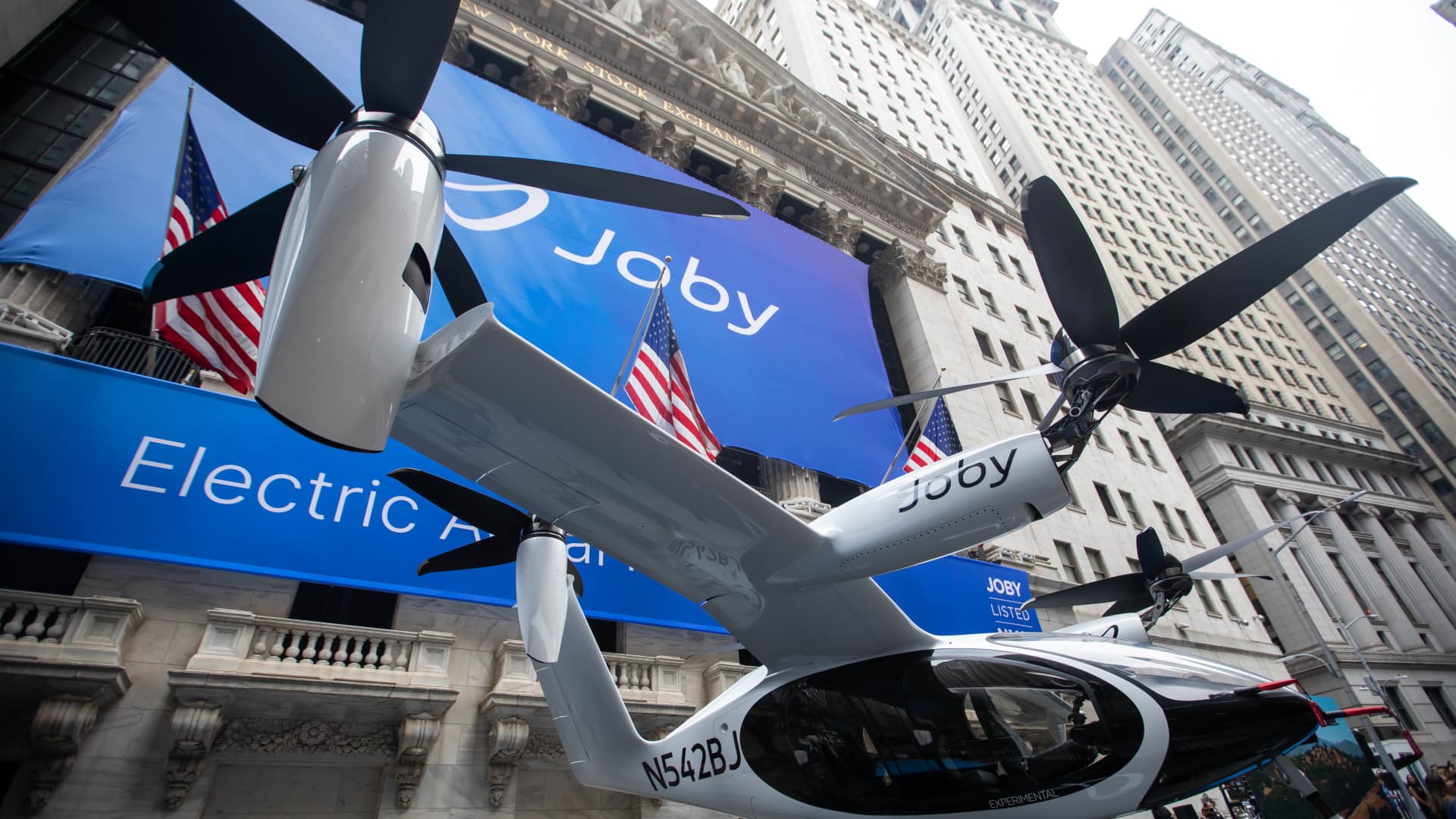

Joby Aviation — Joby shares received another 17% premarket. The aviation firm announced a $100 million fairness expense from South Korea’s SK Telecom, growing an present partnership. On Wednesday, shares surged 40% right after the company mentioned it gained a permit to commence flight screening its very first electrical car takeoff and landing car (eVTOL).

Micron Technologies — Shares added 2.3% right after most recent quarter revenue topped analyst estimates postmarket Wednesday. Micron profits of $3.75 billion beat the $3.65 billion envisioned by analysts, for every Refinitiv. Micron reported it believes the memory chip marketplace has passed its trough in earnings and now expects gain margins to boost.

Wells Fargo, JPMorgan Chase, Financial institution of The us — The financial institutions moved larger following passing the Federal Reserve’s once-a-year worry exam Wednesday. Wells Fargo and Bank of The us gained virtually 2%, while JPMorgan rose 1.6%.

Charles Schwab — Shares jumped 2.7% pursuing the Fed’s strain exams. The brokerage company experienced the most affordable level of complete personal loan losses, at 1.3%.

Citizens Money — The regional lender shed 1.6% premarket. JPMorgan downgraded the Providence, Rhode Island-based mostly loan provider just after the Fed worry assessments to neutral from chubby, citing improved capital necessities that will put further stress on profitability.

Freyr Battery — Shares popped just about 11% following currently being upgraded by Morgan Stanley to chubby from equivalent fat. Analyst Adam Jonas said he believes the business can exhibit “meaningful development on business milestones.” His $13 price goal implies a 72% rally from Wednesday’s near.

Occidental Petroleum — Occidental Petroleum rose a lot more than 1% just after Berkshire Hathaway on Wednesday reported it bought more shares of the oil big. In between June 26 and June 28, the Warren Buffett conglomerate purchased a full of 2.1 million shares, in accordance to a regulatory filing, brining its situation to 25%.

Overstock — Shares of the retailer rose 9% premarket after Overstock closed its offer to invest in the Bed Bathtub & Outside of brand name out of personal bankruptcy. Overstock will change to working with the Mattress Bathtub & Further than title in the coming months.

Virgin Galactic — Shares of Richard Branson’s spaceflight firm climbed additional than 1% premarket. Virgin Galactic is established to launch its initial business spaceflight later Thursday.

— CNBC’s Tanaya Macheel, Jesse Pound, Sarah Min, Michael Bloom and Brian Evans contributed reporting.