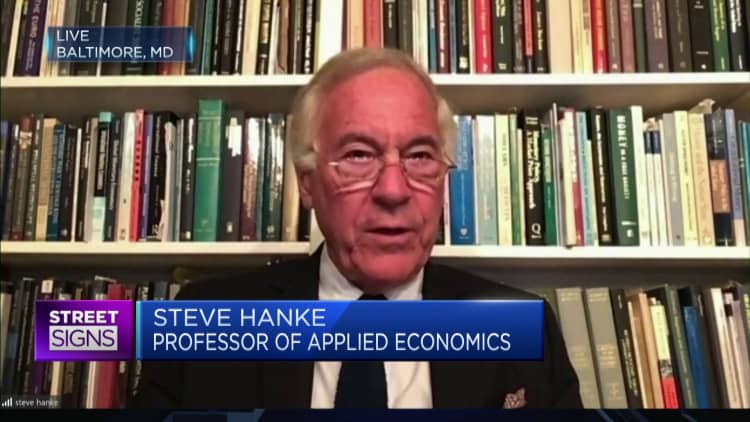

You will find an 80% likelihood of the U.S. slipping into a economic downturn — substantially better than beforehand predicted, in accordance to Steve Hanke, a professor of used economics at Johns Hopkins University.

In accordance to CNBC’s September Fed survey of economists, fund supervisors and strategists, those people surveyed mentioned there is a 52% opportunity that U.S. could enter into economic downturn about the next 12 months.

“The likelihood of economic downturn, I consider it is a lot higher than 50% — I think it can be about 80%. Possibly even larger than 80%,” Hanke explained to CNBC’s “Avenue Signs Asia” on Friday.

“If they continue on the quantitative tightening and go that progress price and M2 (cash supply) into negative territory, it’s going to be intense.”

They have actually been looking for inflation and the will cause of inflation in all the incorrect spots. They’re wanting at every thing below the sunlight, but the dollars supply.

Steve Hanke

Professor of utilized economics, Johns Hopkins University.

Hanke was vital, and has been in the previous, of the Federal Reserve’s failure to regulate inflation as a result of keeping an eye on the big provide of revenue sloshing around in the U.S. economic system.

“They have actually been browsing for inflation and the causes of inflation in all the improper sites. They are wanting at every little thing beneath the sun, but the revenue provide,” Hanke said.

“And in fact, they have doubled and tripled down on the argument that revenue has no romance to economic exercise or not a dependable romance to economic action and inflation.”

A purchaser outlets at a supermarket in Oregon. There’s an 80% prospect of the U.S. falling into a economic downturn — a lot greater than earlier predicted, according to Steve Hanke, a professor of used economics at Johns Hopkins College.

Wang Ying | Xinhua News Company | Getty Pictures

He blamed the U.S. central lender for soaring inflation.

“The motive for that is for the reason that the Fed exploded the cash provide, starting off early 2020 at an unparalleled rate and they do not want this duration to be noticeable in between the cash supply and inflation.”

“Simply because if it is, the noose around their neck, and which is the genuine problem.”

An improve in cash supply drives up price ranges as buyers are prepared to fork out far more for items.

Classical economics, as put forward by Milton Friedman and other individuals, have pointed to money supply as the perpetrator for out-of-command inflation, Hanke extra.

The Fed flooded the U.S. economic climate with huge quantities of stimulus and liquidity to continue to keep it afloat in the course of the pandemic, but did not target on meticulously decreasing that revenue supply above time, the professor mentioned.

The M2 offer of revenue, a wide evaluate of dollars supply which includes income and deposits, has been expanding by double digits in the previous three yrs.

Now the expansion of M2 revenue source is slowing way too promptly and that could send the financial state into a economic downturn, Hanke warned.

“They are not addressing it effectively,” he stated. “In the five months, we’ve observed broad income main in the United States flatline. It truly is not increasing at all.

“And now they are going to introduce quantitative tightening and what which is likely to do that will drive the income source down, that will generate it down into adverse territory if they keep this up.”

Hanke mentioned the appropriate financial move would be to preserve income offer increasing at a “golden development level” of 5% to 6% to get inflation to about 2%.

“Now it really is zero. And it will likely go destructive,” the professor mentioned. “And that’s which is why we will see a recession in 2023.”