Billionaire investor Stanley Druckenmiller discovered Tuesday that he has slashed his massive wager in chipmaker Nvidia earlier this calendar year, declaring the swift synthetic intelligence growth could be overdone in the small run.

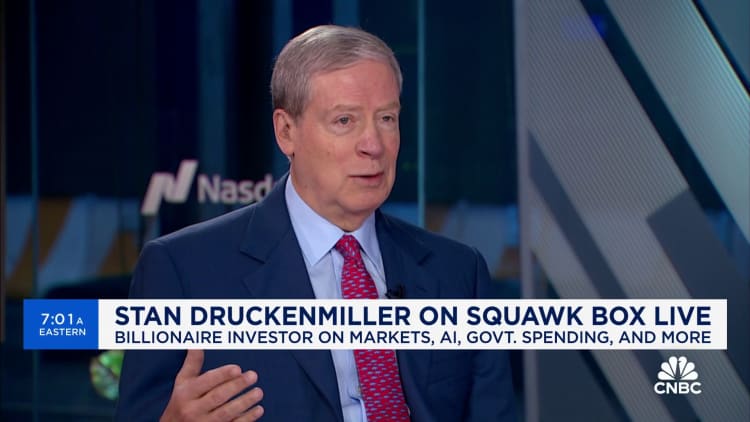

“We did lower that and a large amount of other positions in late March. I just have to have a split. We have had a hell of a run. A good deal of what we recognized has turn out to be identified by the market now.” Druckenmiller explained on CNBC’s “Squawk Box.”

Druckenmiller reported he reduced the wager right after “the inventory went from $150 to $900.” “I am not Warren Buffett I never very own things for 10 or 20 decades. I would like I was Warren Buffett,” he extra.

Nvidia has been the main beneficiary of the modern technology marketplace obsession with big artificial intelligence types, which are formulated on the company’s expensive graphics processors for servers. The inventory was just one of the finest performers very last year, rallying a whopping 238%. Shares are up yet another 66% in 2024.

The noteworthy trader, who now operates Duquesne Household Business, stated he was launched to Nvidia by his youthful spouse in the slide of 2022, who believed that the exhilaration about blockchain was heading to be much outweighed by AI.

“I didn’t even know how to spell it,” Druckenmiller stated. “I acquired it. Then a thirty day period afterwards ChatGPT took place. Even an old guy like me could figure out okay, what that intended, so I greater the place significantly.”

Even though Druckenmiller has slash his Nvidia situation this 12 months, he explained he stays bullish in the extensive phrase on the electricity of AI.

“So AI could possibly be a small overhyped now, but underhyped extended term,” he stated. “AI could rhyme with the Web. As we go by all this money spending we have to have to do the payoff even though it can be incrementally coming in by the working day. The large payoff could possibly be four to 5 years from now.”

The commonly adopted investor also owned Microsoft and Alphabet as AI plays about the earlier yr.

Druckenmiller when managed George Soros’ Quantum Fund and shot to fame right after assisting make a $10 billion bet towards the British pound in 1992. He later oversaw $12 billion as president of Duquesne Cash Management before closing his firm in 2010.