Container freight premiums, which soared to record prices at the top of the pandemic, have been slipping swiftly and container shipments on routes among Asia and the U.S. have also plunged, logistics info shows.

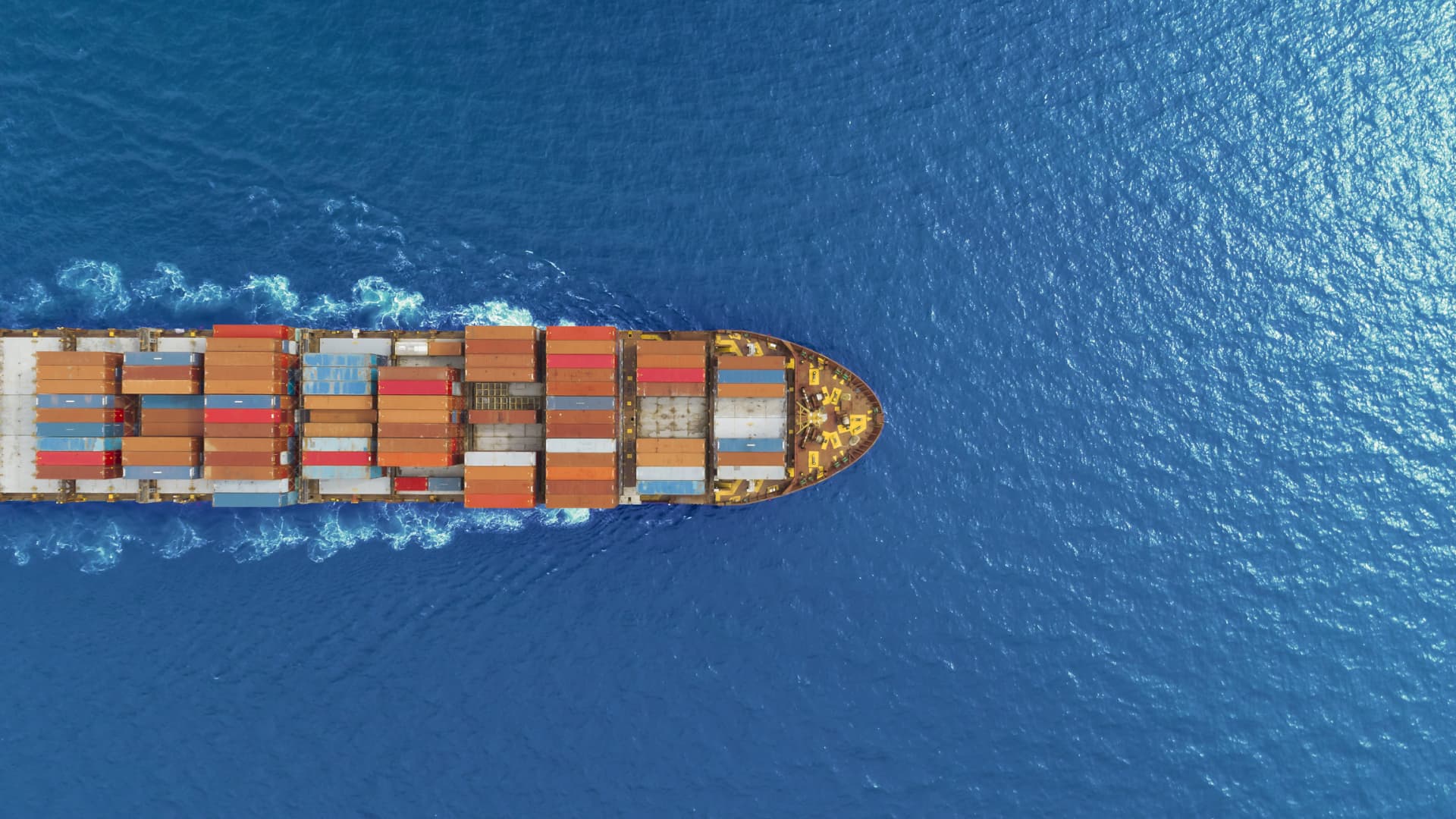

Anucha Sirivisansuwan | Second | Getty Visuals

Right after two yrs of port congestions and container shortages, disruptions are now easing as Chinese exports slow in mild of waning desire from Western economies and softer global economic ailments, logistics info shows.

Container freight fees, which soared to record price ranges at the height of the pandemic, have been slipping fast and container shipments on routes in between Asia and the U.S. have also plunged, details reveals.

“The vendors and the even larger prospective buyers or shippers are extra cautious about the outlook on need and are ordering fewer,” logistics platform Container xChange CEO Christian Roeloffs explained in an update on Wednesday.

“On the other hand, the congestion is easing with vessel waiting moments cutting down, ports functioning at less potential, and the container turnaround periods decreasing which finally, frees up the potential in the market place.”

The hottest Drewry composite Entire world Container Index — a vital benchmark for container charges — is $3,689 per 40-foot container. That’s 64% reduce than the same time past September just after slipping 32 months in a row, Drewry mentioned in a recent update.

The latest index is much reduce than report-superior charges of more than $10,000 in the course of the height of the pandemic but however continues to be 160% larger than pre-pandemic charges of $1,420.

In accordance to Drewry, freight prices on key routes have also fallen. Charges for routes like Shanghai-Rotterdam and Shanghai-New York have fallen by up to 13%.

The slipping freight charges tie in with a “sharp fall” in container shipments that Nomura Financial institution has observed.

Nomura, quoting info from U.S.-based mostly Descartes Datamyne, stated container shipments from Asia to the U.S. for all solutions apart from rubber items in September are down 12 months on calendar year.

“We presume that the sharp fall in container shipments mostly reflects US shops stopping orders and decreasing inventories due to the threat of an economic slowdown,” Nomura analyst Masaharu Hirokane mentioned in a take note on Wednesday, introducing that the lender has yet to see indicators of a sharp slide in U.S. retail profits.

Port throughput around the earth has also dropped. When Shanghai reopened right after its new lockdowns, port targeted visitors volumes lifted but were not more than enough to offset the “broader downturn in port handling concentrations,” Drewry claimed.

What is distinctive now

In Europe, sliding container prices and costs mirror declining buyer self esteem, Container xChange claimed.

“The European current market is discovering by itself flooded with 40-foot substantial-cube containers. As a outcome, the location is encountering a slide in the prices of these packing containers,” Container xChange explained.

The traits in logistics and offer chains from the previous two years have reversed, logistics organizations explained. Throughout that period, container shortages have been consistent as a end result of delays at ports impacted by lockdowns and soaring demand.

In Europe, sliding container price ranges and costs mirror declining customer self-confidence, Container xChange stated.

Nurphoto | Nurphoto | Getty Visuals

But now, demand for containers is slipping and so are their prices, Seacube Containers main gross sales director Danny den Boer stated at the Digital Container Summit held previously this month.

Idle time for containers is also on the increase, Sogese CEO Andrea Monti stated at the exact convention.

“Containers are stacking up at a good deal of import-led ports. Shippers are offering containers away just for the reason that containers are remaining caught there,” said Container xChange account supervisor Gregoire van Strydonck at the conference.

India’s Arcon Containers CEO Supal Shah mentioned factories in China have stopped manufacturing for the foreseeable long term.

“We heard four months,” he reported at the Electronic Container Summit meeting.

“The container depot space is full in China, Europe, India, Singapore and most components of the world.”