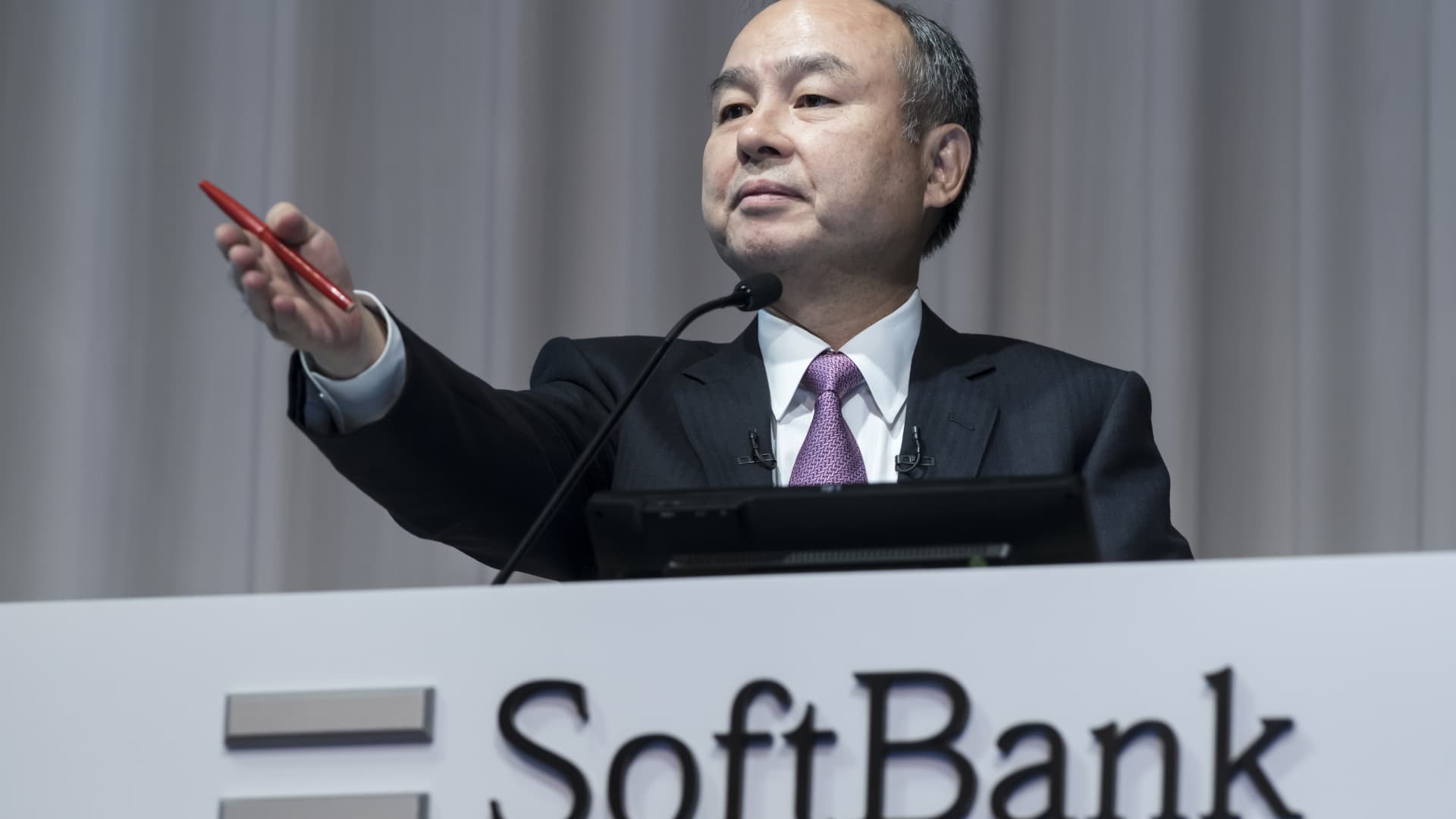

SoftBank Founder Masayoshi Son is pictured listed here in 2019 for the duration of an earnings presentation.

Tomohiro Ohsumi | Getty Photographs

SoftBank posted an financial investment attain on its Vision Fund in the fiscal second quarter but booked a further quarterly reduction.

Here is how SoftBank did in the September quarter against LSEG estimates:

- Web profits: 1.67 trillion Japanese yen ($11 billion) vs . 1.6 trillion yen anticipated

- Net reduction: 931.1 billion yen ($6.2 billion) vs . an anticipated decline of 114.1 billion yen

For the 1st fifty percent of SoftBank’s fiscal 12 months, it posted a 1.41 trillion reduction ($9.3 billion). This compares to a 3 trillion yen gain in the similar period of time previous yr. SoftBank reported a weaker yen strike the business due to the fact it has a whole lot of U.S.-dollar denominated liabilities.

SoftBank’s Eyesight Fund posted an financial commitment achieve of 21.3 billion yen, its 2nd straight quarter of gains. The organization explained this was owing to a obtain arising from the sale of shares in chip designer Arm to a subsidiary of SoftBank.

This offset a decline in the worth of providers SoftBank is invested in, these types of as Chinese artificial intelligence firm SenseTime.

SoftBank’s flagship tech investment decision arm experienced a tough time in the fiscal year that ended in March this year, publishing a report reduction of all around $32 billion. A slump in tech inventory prices and the souring of some of SoftBank’s bets in China were to blame.

In the June quarter, the Eyesight Fund posted its very first investment decision achieve in 5 consecutive quarters, signalling early signs of advancement yet again. This has coincided with recoveries in the price ranges of technological know-how stocks.

Past yr, SoftBank’s higher-profile founder Masayoshi Son pointed out the organization would go into “protection” manner, slowing the tempo of its expense and being more careful. In June, Son flagged a shift into “offense” mode, touting his enjoyment all over the prospective of artificial intelligence technology.

Chip designer Arm went public in the U.S for the duration of SoftBank’s fiscal next quarter. The corporation obtained Arm in 2016 for around $32 billion at the time. The original general public giving of Arm valued the firm at above $50 billion.

Arm on Wednesday noted its first established of benefits due to the fact its IPO, putting up an yearly increase in profits for the September quarter. Nevertheless, the semiconductor company gave guidance for the December quarter that let down investors, sending its shares lessen in immediately after-several hours trade in the U.S.

Correction: The headline of this article has been up to date to mirror a $6.2 billion quarterly decline.