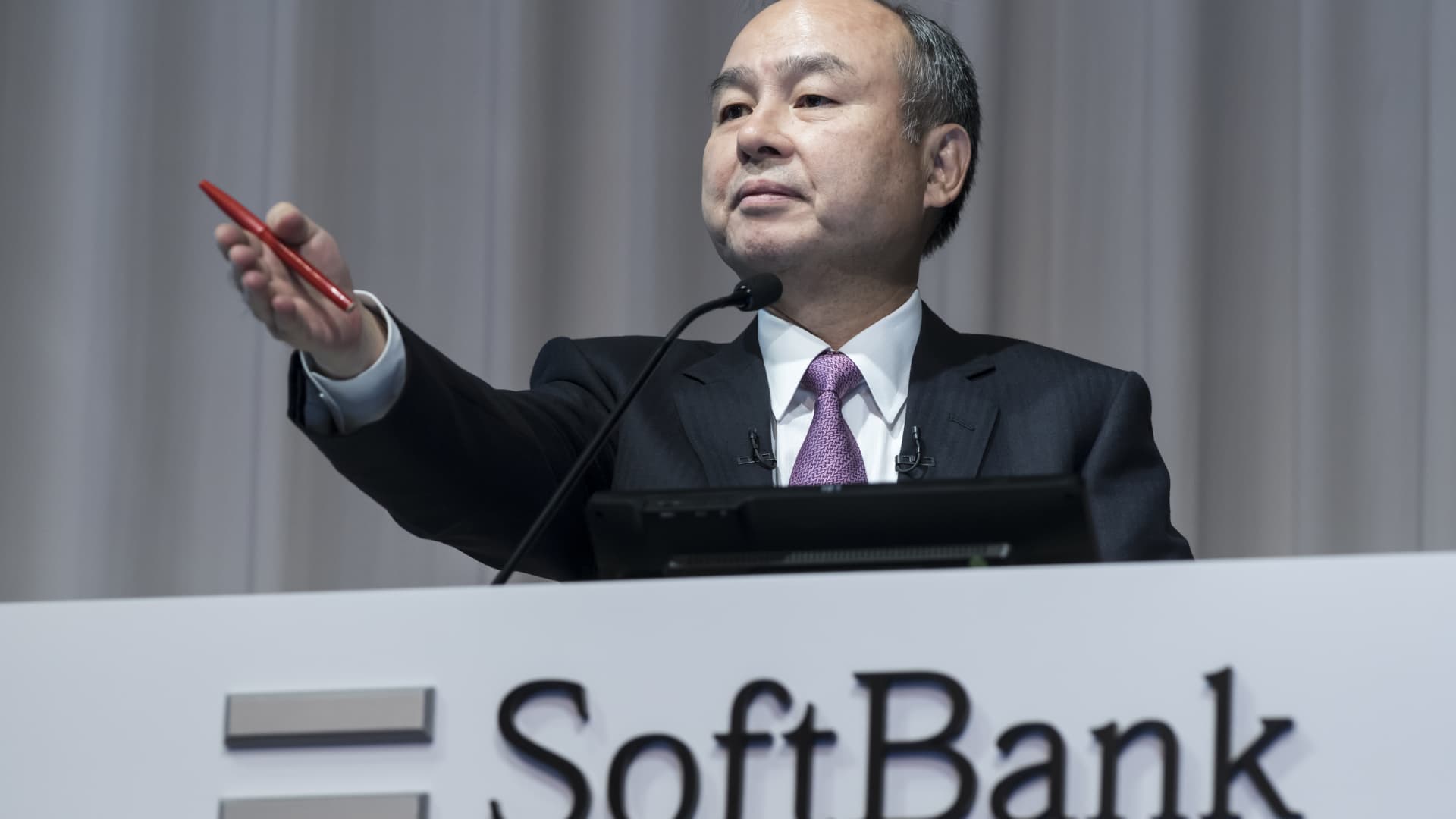

In the course of a latest earnings presentation, SoftBank Founder Masayoshi Son (pictured in this article in 2019) reported the firm will go into “protection” mode as a result of myriad headwinds that have roiled international markets.

Tomohiro Ohsumi | Getty Photos

Softbank’s Vision Fund filed suit versus the founders of 1 of its portfolio organizations on Monday, alleging that they artificially inflated consumer metrics, lied to the fund about general performance and bilked the fund for tens of millions.

Buzzy social media startup IRL released in Apr. 2021 and was seemingly “just one of the swiftest rising social media applications for Generation Z,” the complaint in San Francisco federal court alleges.

Softbank was invested in the firm many thanks to its seemingly very low charge, “potent” person engagement that left it “properly positioned for even more viral progress” in the very same way that Fb and Twitter exploded.

In Could 2021, a thirty day period following the organization released, SoftBank invested $150 million in IRL through the one particular of the conglomerate’s higher-investing Eyesight Cash, obtaining $125 million in shares from the corporation and a different $25 million from insiders together with CEO Abraham Shafi as perfectly as Noah Shafi and Yassin Aniss, the complaint states.

SoftBank considered that IRL had 12 million monthly active buyers, or MAUs.

But these quantities have been a lie, the criticism alleges. IRL was secretly swarming its possess platform with an military of bots, according to the criticism, building the veneer of a flourishing social network which was, in fact, a include to “defraud investors.”

The plot started to unravel when Securities and Exchange Commission opened an investigation into IRL in late 2022. In Apr. 2023, Abraham Shafi was suspended as CEO, and the firm dissolved in June.

The accommodate raises major issues about the amount of scrutiny that SoftBank used to its portfolio providers. When a 3rd-social gathering evaluation of consumer quantities arrived in appreciably under IRL’s own sales pitch, SoftBank reps acknowledged Abraham Shafi’s explanations that they have been “absolutely not precise,” according to the suit.

Past missteps from SoftBank incorporate significant positions in allegedly fraudulent crypto trade FTX and devalued assets business WeWork. SoftBank’s Eyesight Funds have faltered drastically considering the fact that the marketplace highs of 2021, and the conglomerate posted a whole 12 months decline of $32 billion for the fiscal yr ended March 31, 2023.