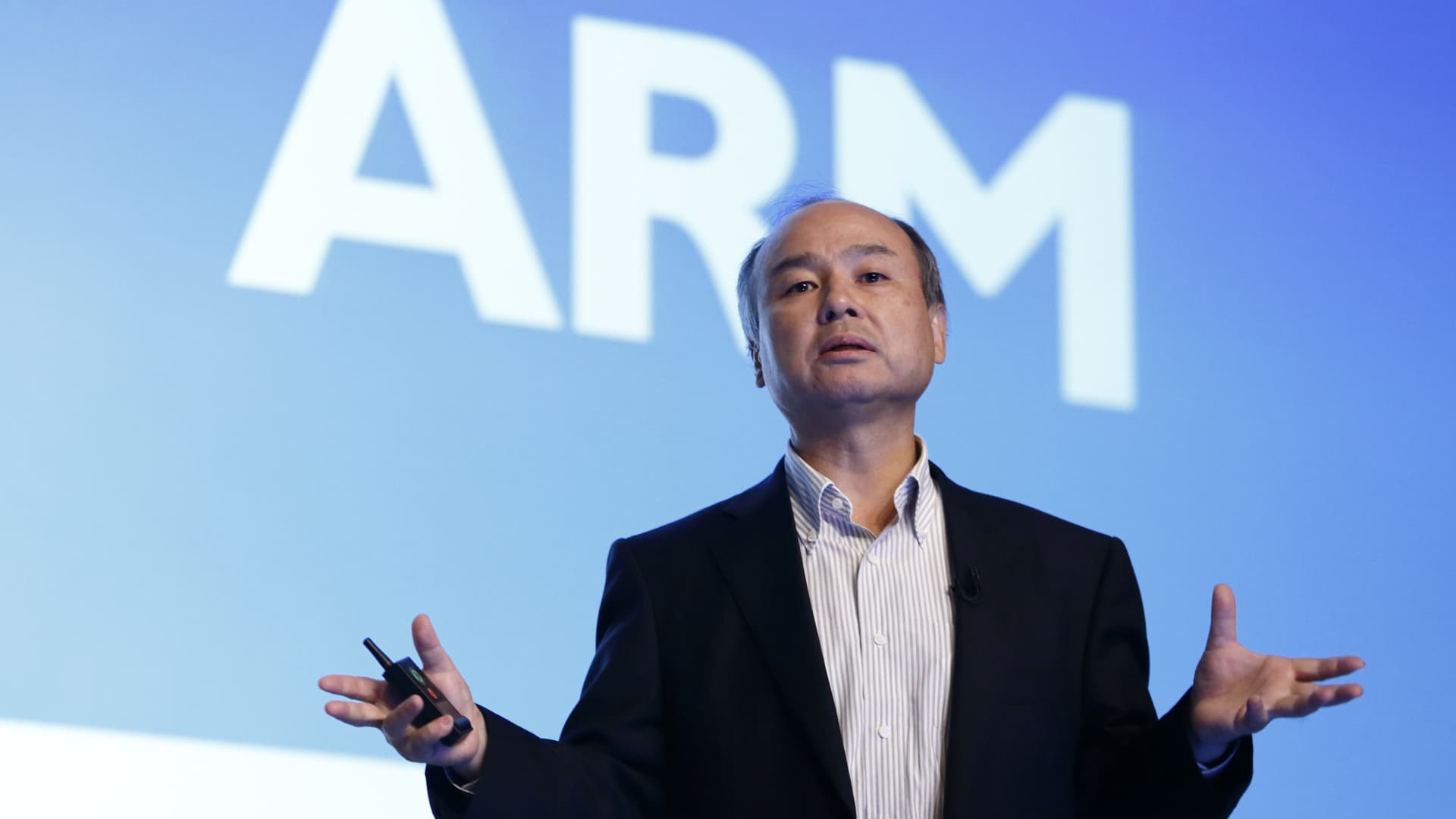

Billionaire Masayoshi Son, chairman and main executive officer of SoftBank, which owns Arm, speaks for the duration of a information meeting in Tokyo, July 28, 2016.

Tomohiro Ohsumi | Bloomberg | Getty Images

Masayoshi Son’s SoftBank built much more in Arm’s following-hrs buying and selling on Wednesday than the total amount of money the business dropped from its disastrous bet on now-bankrupt WeWork.

Arm shares rocketed as significantly as 41% late Wednesday after the chip designer claimed earnings and earnings that sailed past analysts’ estimates. SoftBank took Arm community in September and nonetheless owns about 930 million shares, or approximately 90% of the chip designer’s excellent stock.

Arm pared its first gains, but SoftBank’s stake continue to jumped by pretty much $16 billion — from near to $71.6 billion to $87.4 billion — soon after the earnings report. Softbank obtained Arm in 2016 for $32 billion, and its shares ended up truly worth just over $47 billion at the time of the IPO past yr.

The Arm windfall follows a rough extend for SoftBank’s expenditure portfolio.

The firm’s most significant-profile wager was in WeWork, which spiraled into bankruptcy in November immediately after the office-sharing firm expended many years burning by way of billions of pounds in funds from SoftBank at sky-superior valuations. The Vision Fund, SoftBank’s enterprise arm, posted a $6.2 billion loss in the second quarter of 2023, tied to WeWork and other soured bets.

SoftBank advised traders in November that its cumulative loss on WeWork exceeded $14 billion. In 2022, right after a $32 billion reduction in the Vision Fund, Son instructed that SoftBank would change away from intense investments and into “protection” method, offering down stakes in Alibaba and planning to get Arm community. A little far more than a 12 months later on, as hype over synthetic intelligence mounted, Son claimed Softbank would swap back again into “offense” method, pursuing investments in AI.

Son can’t nonetheless income in on his firm’s gains from Arm.

SoftBank is underneath a lock-up provision which helps prevent it from providing its Arm shares, with particular exceptions, for 180 times after the inventory market debut. Arm went community in September, which means that the lock-up restriction expires in mid-March.

Enjoy: Masa Son flexes Arm