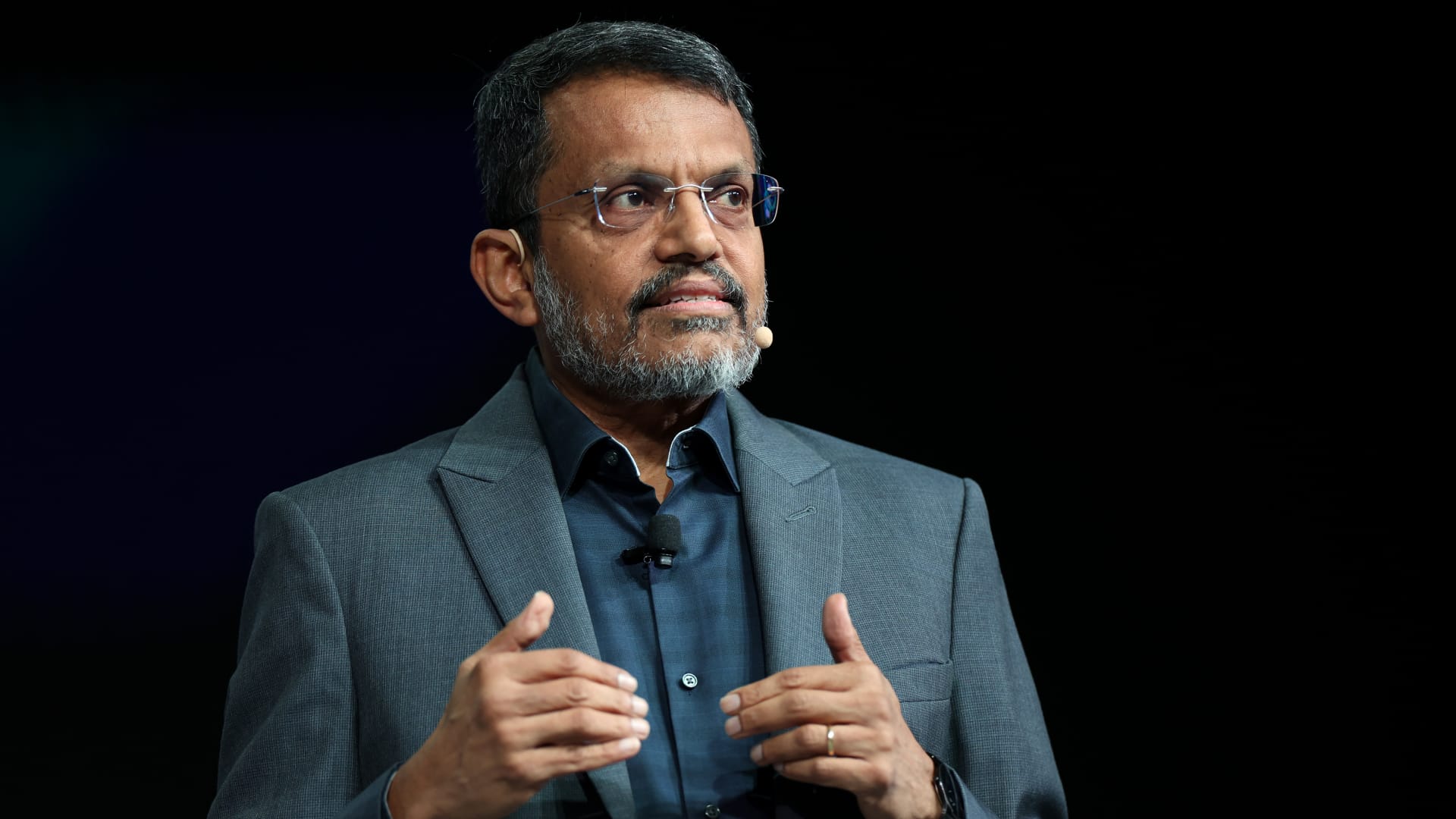

Ravi Menon, controlling director of Monetary Authority of Singapore, speaks throughout the Singapore FinTech Pageant in Singapore, on Thursday, Nov. 16, 2023. The festival operates through Nov. 17.

Lionel Ng | Bloomberg | Getty Illustrations or photos

SINGAPORE — Arrive 2024, Singapore will pilot the reside issuance and use of wholesale central financial institution electronic currencies, claimed Ravi Menon, running director of the Monetary Authority of Singapore.

“We will take our experiments a phase further upcoming calendar year,” mentioned Menon at Singapore FinTech Competition 2023 on Thursday, devoid of specifying a lot more facts on the timeframe.

“I am delighted to announce that MAS will pilot the reside issuance of wholesale CBDCs to instantaneously help payments across professional banking institutions below,” Menon explained. MAS is the town-state’s central financial institution and economical regulator.

Wholesale CBDC is a digital forex issued by a central lender, which is utilized completely by central banks, professional banks or other monetary establishments to settle substantial-price interbank transactions. It is really unlike retail CBDCs which cater to folks and firms, facilitating day-to-day transactions.

“Considering the fact that 2016, the MAS has done many experiments with other central financial institutions and the monetary marketplace to examine the use of wholesale CBDCs on distributed ledgers to facilitate serious time cross border payments and settlements,” claimed Menon, referring to the databases spread throughout a community that is available from several geographical places.

Just one such pilot undertaking is Undertaking Ubin, which was started out in 2016 to discover the use of blockchain and digital ledger technology for the clearing and settlement of payments and securities.

Project Ubin was properly finished in 2021 just after five phases of experimentation. Some of the associates integrated Singapore’s major lender DBS and sovereign prosperity fund Temasek.

MAS announced Ubin+ in November previous year to progress cross-border connectivity with wholesale CBDCs by way of collaborations with global partners.

Through the pilot, Singapore’s central bank will lover with regional banking companies to check the use of wholesale CBDCs to facilitate domestic payments, stated Menon.

Financial institutions will challenge tokenized financial institution liabilities in the kind of statements in equilibrium sheets. Retail customers can then use the tokenized lender liabilities in transactions with retailers, who will then credit history these bank liabilities with their respective banking institutions. Tokenization refers to the course of action of issuing a electronic variety of an asset on a blockchain.

The CBDC will then be immediately transferred to the service provider as a sort of payment throughout the transaction.

“So clearing and settlement occurs in a solitary step on the very same infrastructure, contrary to the recent technique in which clearing and settlement get location on diverse units and settlement occurs with a lag,” reported Menon.

On Wednesday, the Worldwide Financial Fund’s running director urged the public sector to keep planning to deploy CBDCs and similar payment platforms in the foreseeable future.

“We have not however achieved land. There is so significantly much more place for innovation and so a lot uncertainty about use-instances,” reported Kristalina Georgieva.

Menon is set to retire from general public assistance and phase down as handling director of MAS on Dec. 31 considering that remaining appointed to the posture in 2011. He will be succeeded by Chia Der Jiun who formerly spent 18 several years at MAS.