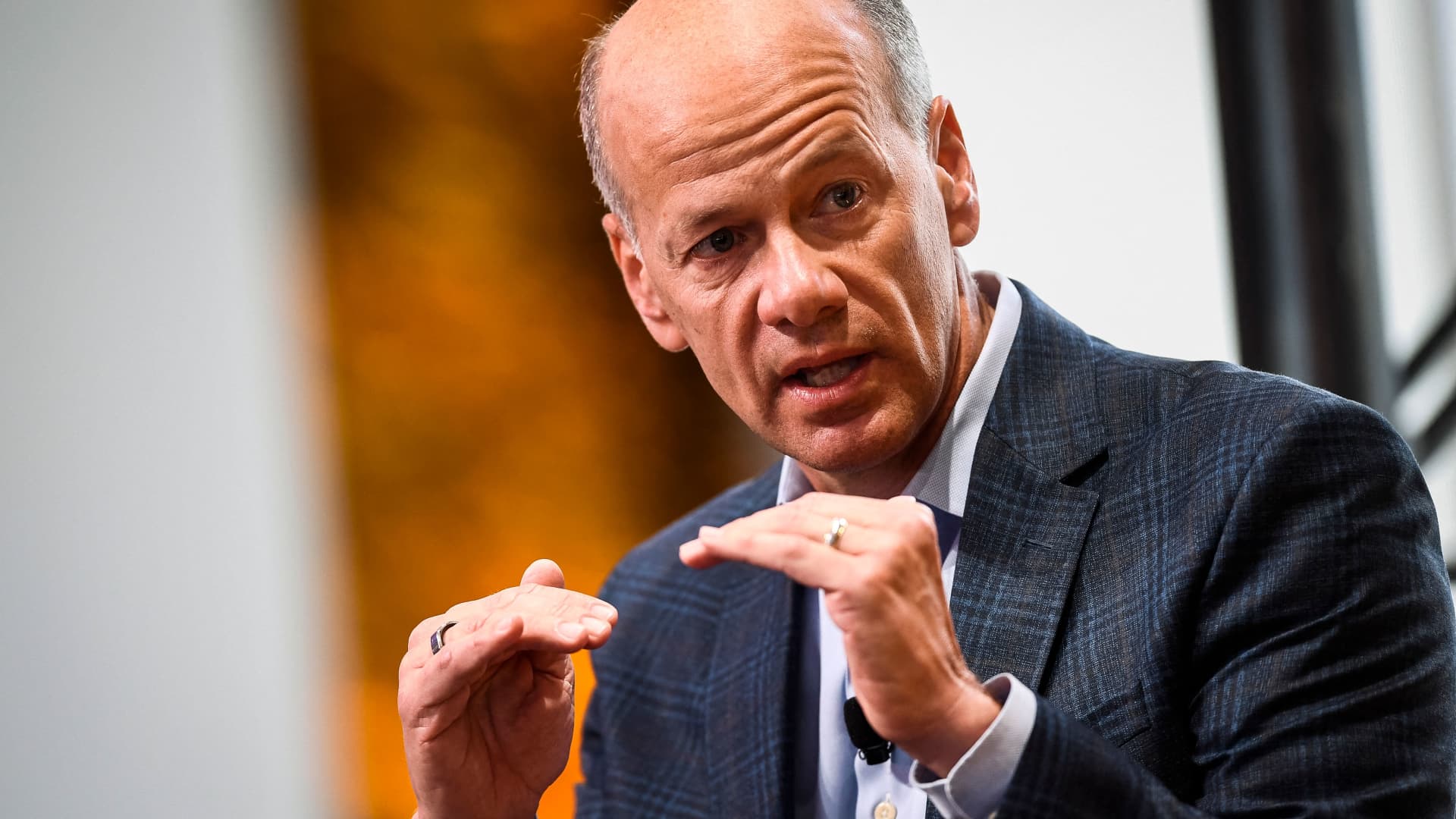

Greg Becker, President and CEO of Silicon Valley Financial institution (SVB), speaks throughout the Milken Institute World Convention on May 3, 2022 in Beverly Hills, California.

Patrick T. Fallon | AFP | Getty Images

Right before Silicon Valley Bank’s failure, its former CEO Greg Becker backed two tech field lobbying teams that tried out to affect the Dodd-Frank economical reform legislation and pushed to lower corporate taxes, in accordance to documents reviewed by CNBC.

In the buildup to the bank’s collapse, Becker chaired a team called TechNet and was a board member of the Silicon Valley Leadership Team, two trade companies that have lobbied government officers on a vary of concerns tied to the business. Becker stepped down as chairman of TechNet at the begin of the calendar year but remained on the group’s executive council till Monday, when he resigned.

related investing information

Both trade organizations incorporated Silicon Valley Lender as a member ahead of its failure, in accordance to archived versions of their websites. Present customers of each corporations consist of tech giants Google, Amazon, Meta, and Apple.

SVB collapsed beneath strain right after prospects withdrew a staggering $42 billion final week. Days just after the financial institution was pressured to close on Friday, regulators backstopped SVB shopper deposits as aspect of many moves to include the destruction from its failure. Regulators afterwards appointed Tim Mayopoulos to run SVB.

The lobbying by trade teams joined to Becker and SVB provides to a string of efforts to impact policy that has drawn lawmakers’ consideration given that the lender unsuccessful. Some associates of Congress have sought a lot more information on the techniques that left the lender vulnerable and its drive to chip absent at rules, along with Becker’s sale of far more than $3 million in inventory in late February.

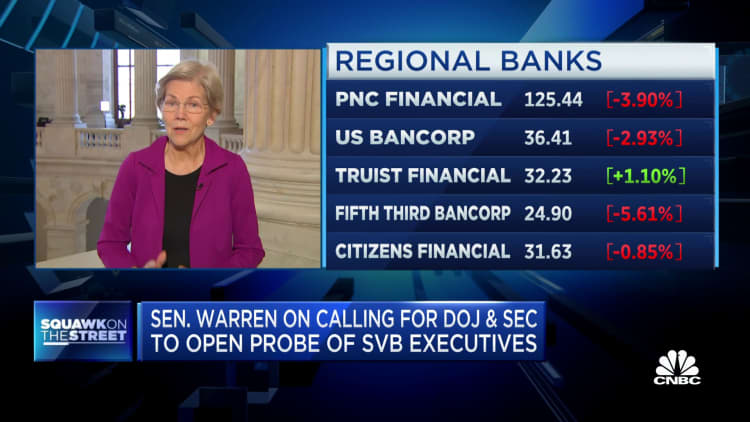

Senate Banking Committee member Sen. Elizabeth Warren, D-Mass., sent a letter to the banking govt inquiring him to “explain the complete scope of your efforts to roll again Dodd-Frank laws in Congress.” Warren and other lawmakers are now pointing to the bank’s failure as justification to tighten safeguards all around the monetary marketplace, such as by rolling again a 2018 legislation that loosened Dodd-Frank regulations.

When Becker led TechNet, the team piled income into shaping federal plan — which includes pieces of Dodd Frank. The business has invested far more than $2 million because the start of 2020 on lobbying Congress, according to its lobbying disclosure studies.

TechNet put in $1.84 million very last 12 months on 20 in-home and exterior lobbyists, the most it invested in lobbying since 2005, in accordance to facts from the nonpartisan watchdog OpenSecrets. The trade group experienced extensive coffers to attract from: it introduced in extra than $4.2 million in membership dues in 2020, according to its most recent monetary disclosure form submitted to the Internal Revenue Provider.

TechNet targeted its lobbying, in portion, on “Area 1033 of the Dodd-Frank Customer Defense Act,” according to its disclosure reports. The group engaged with Home and Senate lawmakers, as very well as Customer Monetary Security Bureau officials, on the provision similar to buyer disclosures, records demonstrate.

Steve Kidera, a spokesman for TechNet, told CNBC that the group’s “disclosed lobbying on Part 1033 was a client facts privacy concern associated to the declared notice of proposed rulemaking at the CFPB on facts privacy, 1 of our industry’s best policy problems.”

Part 1033 was founded under the sweeping money reform legislation, which previous President Barack Obama signed into legislation soon after the 2008 economic disaster.

The CFPB states it is “in the approach of writing laws to put into action” segment 1033 which would involve monetary institutions these as Silicon Valley Bank to “make available to shoppers, upon ask for, transaction information and other info relating to a purchaser economical merchandise or services that the purchaser obtains from the coated entity.”

While the lobbying disclosures do not explain whether or not TechNet supports or opposes portion 1033 as prepared, the firm plainly desires to have a say in how the rule is implemented.

The group’s 2023 policy rules say it desires to create a “robust buyer info appropriate by means of a Portion 1033 rulemaking that promotes the free circulation of purchaser licensed information throughout the economical ecosystem.” TechNet additional that it supports “a versatile, consent-dependent framework for notifying shoppers of how their facts will be shared, transmitted, stored, and utilized.”

The other trade group for which Becker held a board seat has reached into its very own deep pockets to impact coverage. The Silicon Valley Management Group in 2020 elevated $1.3 million in contributions and brought in an extra $2.9 million as a result of membership dues, according to the records submitted to the IRS.

Its 2021 information, which had been delivered to CNBC by the group right after an inquiry, shows they brought in practically the same total in membership dues that calendar year. The group elevated about $940,000 through contributions in 2021, according to the information.

The corporation offers on its website that it “supported thorough corporate tax reform, like lowering the company cash flow tax fee and relocating towards a hybrid/territorial global tax program.”

The corporate tax amount most lately dropped in 2017. Former President Donald Trump signed GOP tax cuts into legislation, slicing the charge to 21% from 35%.

Laura Wilkinson, a spokeswoman for Silicon Valley Management Group, told CNBC that Silicon Valley Financial institution executives were portion of their group’s coalition of dozens of member companies that met with House and Senate lawmakers in 2017 on Capitol Hill to advocate for slicing the corporate tax level.

“We’re concentrated on strengthening competitiveness by combating for a fair company tax process at the regional, state, and federal ranges,” Wilkinson explained. “In 2017, this included joining the broad coalition of key road corporations and innovation leaders that advocated for a simpler and fairer tax procedure as part of extensive tax reform to assistance financial expansion and American jobs.”

Federal records demonstrate that the Silicon Valley Financial institution Leadership Team has not filed lobbying disclosure stories since 2009.

Becker was chairman of the Silicon Valley Leadership Team from 2014 via 2017, in accordance to an archived version of his SVB bio site. Becker could not be reached for remark.

SVB and Becker again Democrats

Even as it pursued policy objectives that often clashed with Democrats’ priorities, SVB and Becker typically gave revenue to the party’s candidates for workplace.

Becker’s only federal donation in the 2022 election cycle went to Senate Bulk Leader Chuck Schumer, D-N.Y., according to Federal Election Fee filings. Schumer is supplying the contributions his campaign been given from the two Becker and the bank’s PAC to charities.

Considering that 2011, the 12 months Becker became CEO and president of SVB, its political action committee has provided the vast majority of its donations in every single election cycle to Democrats, in accordance to OpenSecrets. The exception came in 2012, when Republicans taken care of handle of the House even as Obama won reelection.

Senate Banking Committee member Sen. Mark Warner, D-Va., also received contributions from Becker. Warner acquired $11,400 from the ex-bank CEO about the training course of the 2020 and 2022 election cycles, according to Federal Election Commission data. Sen. Jon Tester, D-Mont., been given $3,000 from the bank’s PAC in 2017, in accordance to FEC data.

Becker also hosted Warner for a fundraiser in 2016 at his California dwelling, in accordance to an invite to the accumulating. Representatives for each Warner and Tester will not say regardless of whether they system to donate any of the cash they gained from Becker or the bank’s PAC.

The veteran lawmakers voted for the 2018 legislation that rolled again parts of Dodd Frank.

The monthly bill they backed reclassified the “as well massive to are unsuccessful” typical under Dodd Frank, which arrived with enhanced regulatory scrutiny. By raising the regulatory threshold for banks from $50 billion in belongings to $250 billion, medium-dimensions financial institutions were being exempted from individuals laws. Becker, in testimony he submitted to a Senate panel in 2015, manufactured a equivalent contact for his and other medium sized banking institutions to be exempt from the Dodd Frank restrictions.

The Federal Deposit Insurance policy Company, which helped variety the protections for SVB depositors, stated before the lender shut that the company had approximately $209 billion in total belongings — which would have built it topic to all those guidelines ahead of 2018.