A supply particular person drops off pizzas at Silicon Valley Banks headquarters in Santa Clara, California on March 10, 2023.

Noah Berger | AFP | Getty Illustrations or photos

Silicon Valley Financial institution had exclusivity clauses with some of its clients, restricting their potential to tap banking companies from other institutions, SEC filings present.

The contracts, which built it difficult for people purchasers to securely diversify exactly where they retained their revenue, assorted in language and scope. CNBC has reviewed 6 agreements that firms signed with SVB relating to funding or credit history alternatives. All essential the firms to open or sustain lender accounts with SVB and use the organization for all or most of their banking services.

These arrangements are particularly problematic now that SVB has been seized by federal regulators just after last week’s operate on the financial institution. The Federal Deposit Insurance policy Corporation only insures up to $250,000 in deposits for each individual customer, leaving SVB’s client base, which is heavily concentrated in tech startups, fearful that tens of millions of bucks in functioning funds would be locked up for an indefinite interval of time.

Banking regulators devised a prepare Sunday to backstop depositors with dollars at SVB to try and stem a feared worry across the industry after the second-major financial institution failure in U.S. history.

In this photo illustration an Upstart Holdings emblem is witnessed on a smartphone display.

Pavlo Gonchar | SOPA Images | LightRocket | Getty Photos

As portion of a multi-million dollar financing arrangement with on line-lending system Upstart Holdings, SVB expected that the firm preserve all of its “working and other deposit accounts, the Cash Collateral Account and securities/expense accounts” with SVB.

The contract manufactured sure allowances for accounts at other banking companies, but set stringent restrictions on their dimension.

“We haven’t had the exclusivity obligation for yrs and a lot more than 90% of our funds is held at top five US financial institutions,” Upstart claimed in a assertion to CNBC.

Cloud software package vendor DocuSign also had an exclusivity contract with SVB, filings demonstrate, necessitating that the e-signature enterprise keep its “most important” depository, functioning, and securities accounts with the financial institution. That covenant was part of a senior secured credit history facility concerning DocuSign and SVB dated May perhaps 2015. DocuSign was authorized to hold current deposit accounts that were held at Wells Fargo.

Upstart held its IPO in 2020, two several years following DocuSign’s debut.

SVB offered a multi-million greenback bank loan to Sprout Social, which went general public in 2019. The financial institution expected that the social media administration software enterprise keep all of its “key running and other deposit accounts, the Money Collateral Account and securities/financial commitment accounts” with SVB.

As with Upstart, SVB set stringent limitations on the value and type of accounts that Sprout could hold in other places.

In one more financial loan and stability settlement with Limelight Networks, which became Edgio, SVB required that the organization similarly retain all “operating accounts, depository accounts, and extra cash with Lender and Bank’s Affiliates.”

The deal involved an exception for global bank accounts but expected that Limelight use only SVB’s company credit score playing cards.

Established 40 yrs back, SVB grew to turn out to be the 16th major U.S. financial institution by property and a big enterprise personal debt provider, supporting businesses in their infancy and providing the variety of liquidity that startups couldn’t get from most common banking companies.

SVB failed to quickly answer to a request for comment.

Dexcom signed a bank loan and safety agreement with SVB, necessitating the maker of solutions for running diabetes to maintain its accounts at the financial institution and to transfer income held in other places in just 90 times of the contract.

Dexcom’s agreement with SVB also necessary the company to open up a lockbox and preserve the “the greater part” of the company’s securities accounts with the bank.

Also within just the health and fitness-tech industry, SVB had an exclusivity agreement with Hyperion Therapeutics, a drugmaker that was acquired in 2015 for $1.1 billion by Horizon Pharma.

Hyperion was necessary to bank only with SVB, but notably did not have to give the firm command in excess of any accounts it used for “payroll, payroll taxes, and other personnel wage and gain payments.”

Reps from DocuSign, Sprout Social, Edgio, Dexcom and Horizon failed to immediately react to requests for remark.

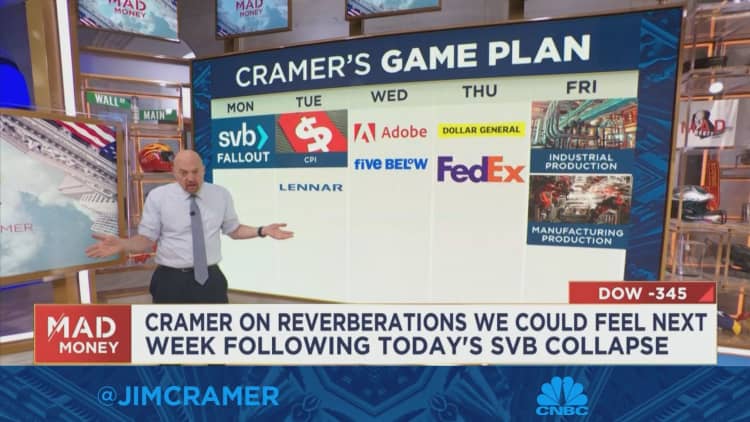

Observe: Cramer on SVB’s collapse