Inflation closed out 2022 in a modest retreat, with buyer prices in December posting their greatest regular decline considering that early in the pandemic, the Labor Department claimed Thursday.

The consumer price tag index, which actions the value of a wide basket of products and services, fell .1% for the thirty day period, in line with the Dow Jones estimate. That equated to the greatest thirty day period-in excess of-thirty day period minimize since April 2020, as substantially of the region was in lockdown to combat Covid.

linked investing information

Even with the drop, headline CPI rose 6.5% from a 12 months in the past, highlighting the persistent stress that the rising charge of residing has placed on U.S. households. Even so, that was the smallest annual maximize considering that Oct 2021.

Excluding risky food items and power selling prices, co-known as core CPI rose .3%, also meeting expectations. Core was up 5.7% from a year in the past, when once again in line.

A steep fall in gasoline was dependable for most of the regular monthly decrease. Prices at the pump tumbled 9.4% for the thirty day period and are now down 1.5% from a calendar year back right after surging previous $5 a gallon in mid-2022.

Fuel oil slid 16.6% for the month, also contributing to a full 4.5% decrease in the electricity index.

Food stuff selling prices amplified .3% in December though shelter also saw a different sharp achieve up .8% for the month and now 7.5% higher from a yr in the past. Shelter accounts for about a single-third of the whole CPI index.

Utilised automobile costs, also in vital original driver of inflation, had been off 2.5% for the thirty day period and are now down 8.8% year above yr.

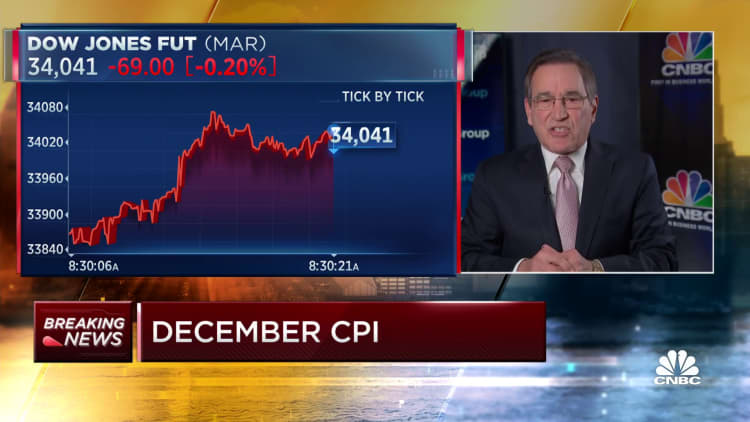

Marketplaces reacted little to the information, with futures tied to the Dow Jones Industrial Normal up modestly and Treasury yields down throughout most maturities.

The two annual boosts continue to be very well above the Federal Reserve’s 2% target, but have been regularly transferring reduced.

“Inflation is swiftly moderating. Certainly, it truly is however painfully higher, but it is really swiftly moving in the appropriate route,” explained Mark Zandi, chief economist for Moody’s Analytics. “I see nothing at all but fantastic information in the report other than for the best-line selection: 6.5% is way also large.”

CPI is the most intently watched inflation gauge as it requires into account moves in almost everything from a gallon of gas to a dozen eggs and the price of airline tickets.

The Federal Reserve prefers a distinctive gauge that adjusts for adjustments in buyer conduct. Having said that, the central financial institution takes in a wide array of data when measuring inflation, with CPI staying part of the puzzle.

Markets are watching the Fed’s moves intently as officers struggle from inflation that at its peak was the optimum in 41 decades. Supply chain bottlenecks, the war in Ukraine and trillions in fiscal and monetary stimulus helped add to surging rates that spanned throughout most locations of the financial state.

Policymakers are weighing how considerably further they need to have to go with curiosity amount hikes made use of to sluggish the economic system and tame inflation. The Fed so significantly has raised its benchmark borrowing amount 4.25 proportion points to its best degree in 15 years. Officials have indicated the price is possible to exceed 5% in advance of they can action back again to see the impression of the plan tightening.

This is breaking information. Remember to test back here for updates.