The Ebba Maersk container ship, operated by A.P. Moeller-Maersk A/S, leaves Suez port and heads in the direction of the Purple Sea right after passing through the Suez Canal in Suez, Egypt on Saturday, April 6, 2013.

Kristian Helgesen | Bloomberg | Getty Visuals

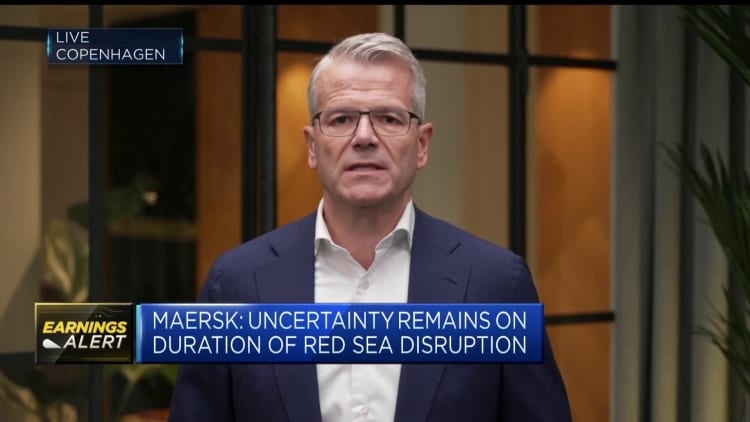

A.P. Moller-Maersk, the next-largest world-wide ocean carrier, is advising clients to put together for a Red Sea disaster that could stretch properly into the 2nd 50 percent of this yr.

“Sad to say, we really don’t see any alter in the Purple Sea going on whenever before long,” Charles van der Steene, regional president for Maersk North The usa, tells CNBC. “We’re advising them the extended transit routes could last by Q2 and likely Q3. Shoppers will will need to make confident they have the longer general transit time developed into their offer chain.”

On January 5, Maersk introduced that it was suspending voyages as a result of the Pink Sea and Gulf of Aden for the “foreseeable foreseeable future” right after the attack on the Maersk Hangzhou. Immediately after attacks on two U.S.-flagged Maersk vessels on January 24, the Maersk Detroit and Maersk Chesapeake, Maersk Line, Confined — a U.S. subsidiary of Maersk, which operates U.S.-flagged vessels independently — introduced it would no longer traverse the Crimson Sea.

The world shipping and logistics company’s careful check out of the Crimson Sea security problems comes inspite of a U.S.-led multinational armed service operation in the region, Procedure Prosperity Guardian. According to U.S. defense details, Houthi rebels have possibly attacked or threatened professional vessels at minimum 46 times because November. Even with multiple strikes by the U.S. and allies versus rebel targets, Houthis have warned that their attacks “will go on until finally the aggression from Gaza stops.”

The more time transits close to the Cape of Excellent Hope are delaying the arrival of the vacant vessels likely back again to Asia to decide up much more U.S. imports. The delays are impacting the regularity of trade which can impression the source chain. Van der Steene reported he is urging U.S. organizations to continue to be vigilant in their assessment of the Pink Sea situation and be nimble in their provide chain logistics tactics.

Maersk was the biggest ocean provider for U.S. exports in 2023, based mostly on customs facts. Maersk Line, Limited’s U.S.-flagged vessels are enrolled in the Maritime Safety Method and VISA (Voluntary Intermodal Sealift) with the U.S. authorities. It has the largest amount of U.S. flagged vessels serving the country, in addition to its international-flagged fleet which transports ocean freight for U.S. businesses.

“Our assistance to our prospects is precisely about setting up upon the uncertainty by being agile,” claimed van der Steene. “Customers have to have to have the capability to enter the North American industry from distinctive endpoints. Be it the West Coast, Gulf, or the East Coast. Our preparing of services really considerably relies upon on a single-to-one particular operate with our customers to determine what is their most effective substitute.”

Facts from maritime advisory organization Sea-Intelligence displays that the normal delay for late vessel arrivals has “deteriorated,” and as a end result, vessel ability has diminished, with impacts for U.S. East Coastline-sure ocean freight from Asia going around the Horn of Cape Hope.

To continue to keep the flow of trade going, van der Steene told CNBC, Maersk has extra about 6 percent of excess vessel capacity to its schedule, adding to operational costs. All through its new earnings simply call, Maersk executives flagged “superior uncertainty” in its 2024 earnings outlook, citing the Purple Sea disruptions and an oversupply of shipping and delivery vessels.

“U.S. enterprises are worried about delivery timing,” said van der Steene. “Merchant decisions are based on how responsible and how regular their supply chain will be for the future three, 6, 12, 24 months.”

In addition to shipping, van der Steen stated shippers need to quantify the expense for their source chain to the real fees for their source chain.

“Quite a few of our buyers factor a price tag for every device price tag for their provide chain into their budgeting, which basically is what they require to make their results function,” he mentioned. “If that basically shifts and improvements, it could have a fairly considerable impact on their overall prices.”

Ocean freight price ranges have jumped as a consequence of the more time voyage, prices not planned in shippers’ budgets, but latest knowledge has suggested that inflation related to the Pink Sea may possibly be peaking currently. Maersk officials stated during its the latest earnings phone that the circumstance will not compare to the Covid offer chain inflation interval because of to the existing overcapacity of vessels ensuing from a post-Covid freight business recession.

U.S. corporations, van der Steene claims, are confronted with a few source chain headwinds: Pink Sea diversions, East Coast port labor negotiations, and the Panama Canal drought. Shippers are looking for options to slash both equally the time and rising charge of transit.

Ports in Mexico, the Pacific Northwest, and Los Angeles and Extensive Seashore will be ports getting some East Coast certain freight, van der Steene explained. He explained Mexico as a “major” chance owing to the expansion of nearshoring of merchandise when produced in China. The latest trade facts from the U.S. governing administration confirmed that for the very first time in a long time, Mexico surpassed China as the nation’s premier trade companion.

For East Coast trade originating from the Oceania (Australia and New Zealand) region and likely by way of the Panama Canal, Maersk recently announced it was expediting freight move by going all those containers through rail alternatively of waiting around to traverse the canal, which has drought constraints reducing the range of vessels permitted for each day transit.

“The worry of Panama has not gone absent,” reported van der Steene. “It has stabilized in the perception that men and women know what to be expecting, but we you should not know if this may possibly be recurring on an ongoing foundation in the foreseeable future. As a consequence, we are actively hunting to probably have a improved West Coast solution that would someway mitigate the threat of the throughput staying lowered on an ongoing basis.”