A logo on the UniCredit SpA headquarters in Milan, Italy, on Saturday Jan. 22, 2022.

Bloomberg | Getty Images

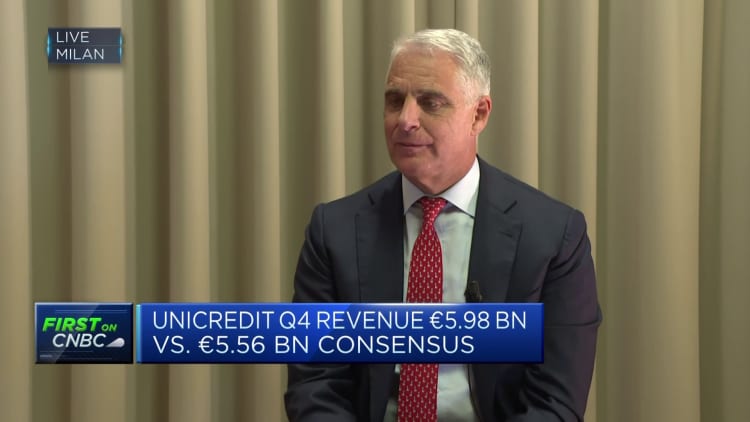

Shares of Italian lender UniCredit hit their maximum level since 2015 on Monday, following saying it would return 8.6 billion euros ($9.2 billion) to investors on the back again of higher-than-anticipated income.

The Milan-primarily based lender shared information of the planned payout soon after reporting fourth-quarter profit of 1.9 billion euros, practically three instances analysts’ expectations.

Shares of the stock were up 10% by 11 a.m. London time.

The payout, which will be shipped through a mixture of buybacks and dividends, follows a powerful calendar year for the financial institution, which has been buoyed by increased curiosity premiums.

UniCredit added that it would adopt a 90% payout policy from this year. The company’s “stated” internet cash flow in the Oct-December period of time came in at 2.8 billion euros, additional than double a 1.2 billion euro typical analyst consensus forecast presented by the bank.

Income also surpassed anticipations, whilst UniCredit booked reduce-than-forecast fees and provisions versus loan losses.

Italy’s next-most significant financial institution has tripled its worth considering that Main Executive Andrea Orcel took the reins in 2021, primary gains amongst European financial institutions.