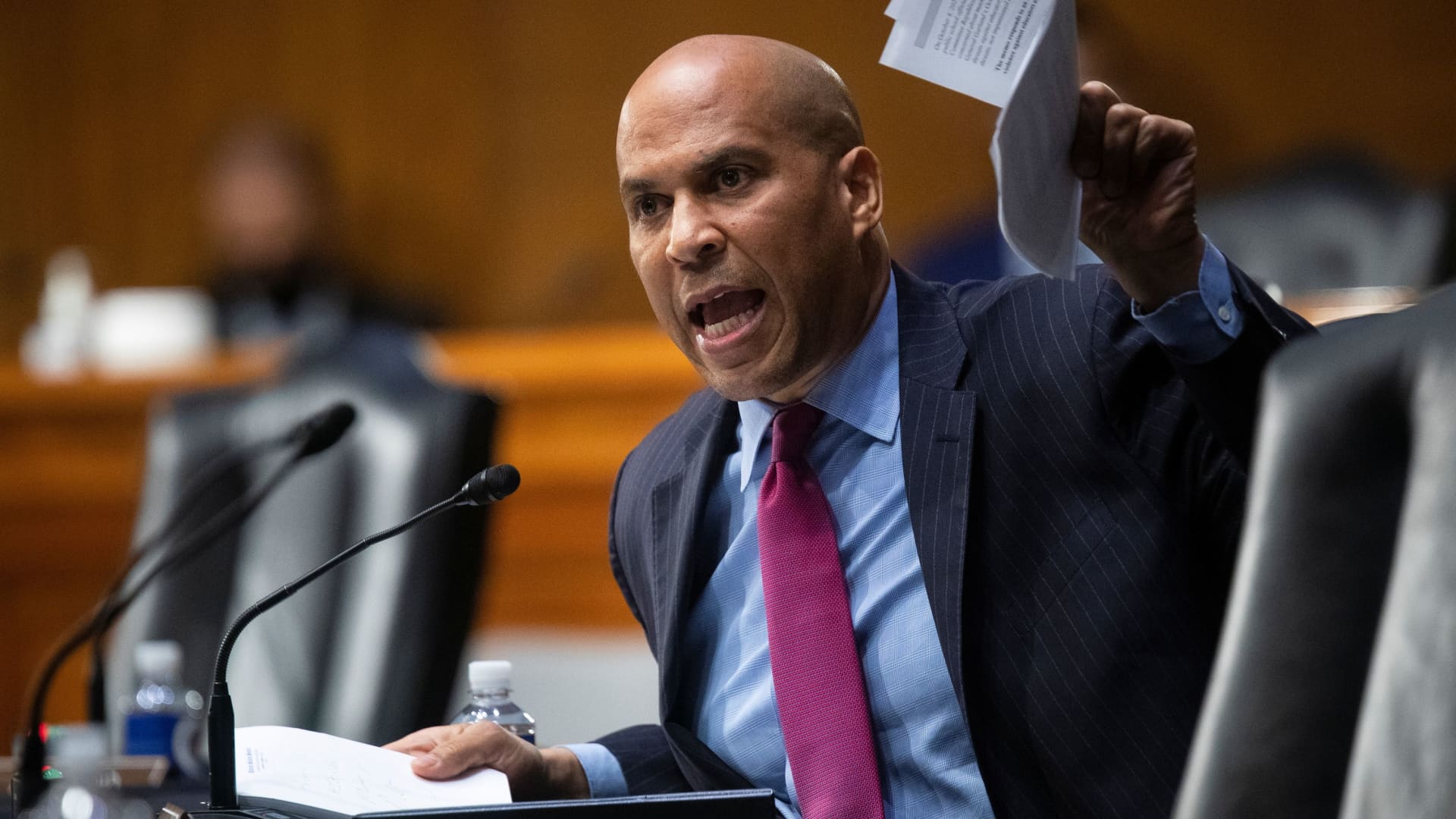

Sen. Cory Booker (D-NJ) speaks all through Attorney General nominee Merrick Garland’s confirmation hearing prior to the Senate Judiciary Committee, Washington, DC, February 22, 2021.

Al Drago | Pool | Reuters

WASHINGTON — Sens. Cory Booker and Raphael Warnock have urged the CEOs of 10 major financial institutions to waive overdraft and nonsufficient fund expenses that could expense some People additional than $100 a working day in the wake of the failures of Silicon Valley Financial institution and Signature Financial institution.

In letters dated Tuesday, the New Jersey and Ga Democrats asked banks to assist prospects whose payments had been delayed or lacking owing to the collapse of SVB and Signature earlier this thirty day period. The letters went to the CEOs of Wells Fargo, U.S. Lender, Truist Fiscal Corp., TD Financial institution, Regions Economical Corp., PNC Bank, JPMorgan Chase, Huntington National Lender, Citizens Lender and Bank of The usa.

“Disruptions across the banking marketplace this thirty day period rattled shoppers and threw into jeopardy the paychecks of hundreds of thousands of American staff,” wrote Booker, who is a member of the Senate Committee on Modest Small business and Entrepreneurship, and Warnock.

The fees, which can get to up to $111 a working day for minimal account balances or up to $175 on lower account charges, “compound the challenging money scenario customers come across on their own in, particularly when their lack of resources is due to an unparalleled, unanticipated delay,” the senators said.

JPMorgan and PNC Lender declined to comment. The other financial institutions that gained the letters did not quickly react to requests for comment.

The Federal Deposit Insurance Corp. closed SVB on March 10 just after the lender announced a approximately $2 billion decline in asset gross sales. The company explained SVB’s official checks would keep on to obvious and assets would be available the subsequent day.

Regulators shuttered New York-primarily based Signature Bank times afterwards in an work to stall a prospective banking disaster. A lot of of its property have since been sold to Flagstar Financial institution, a subsidiary of New York Neighborhood Bancorp.

Booker and Warnock stated banking shoppers whose paydays fell between March 10 and March 13 were being not able to get or deposit checks from payroll suppliers banking with SVB and Signature Lender. They also mentioned that on the net service provider Etsy notified prospects of payment delays simply because it made use of SVB payment processing.

The senators also cited an unrelated, nationwide specialized glitch on the March 10 that prompted missing payments and incorrect balances for Wells Fargo clients.

“These delays will disproportionately harm the impacted clients who are element of the sixty-four % of Us citizens living paycheck-to-paycheck, who are often ‘minutes to several hours absent from possessing the money required to cover’ expenditures that guide to overdraft nonsufficient fund costs,” Booker and Warnock wrote.

They praised methods taken by the Treasury Section and the FDIC to stem a doable financial catastrophe by making certain access to depositor cash over the $250,000 FDIC-assurance threshold and producing a new, 1-calendar year personal loan to monetary institutions to safeguard deposits in instances of strain.

Treasury Secretary Janet Yellen on Tuesday stated the division is organized to assurance all deposits for economic establishments over and above SVB and Signature Bank if the crisis worsens.

“In line with brief, decisive federal government reaction to support the businesses and folks who were being assisted instantly in purchase to include the broader fallout of these lender failures, we urge you to act with comparable urgency to backstop American families from unforeseen and undeserved rates,” the senators wrote to the financial institution CEOs.