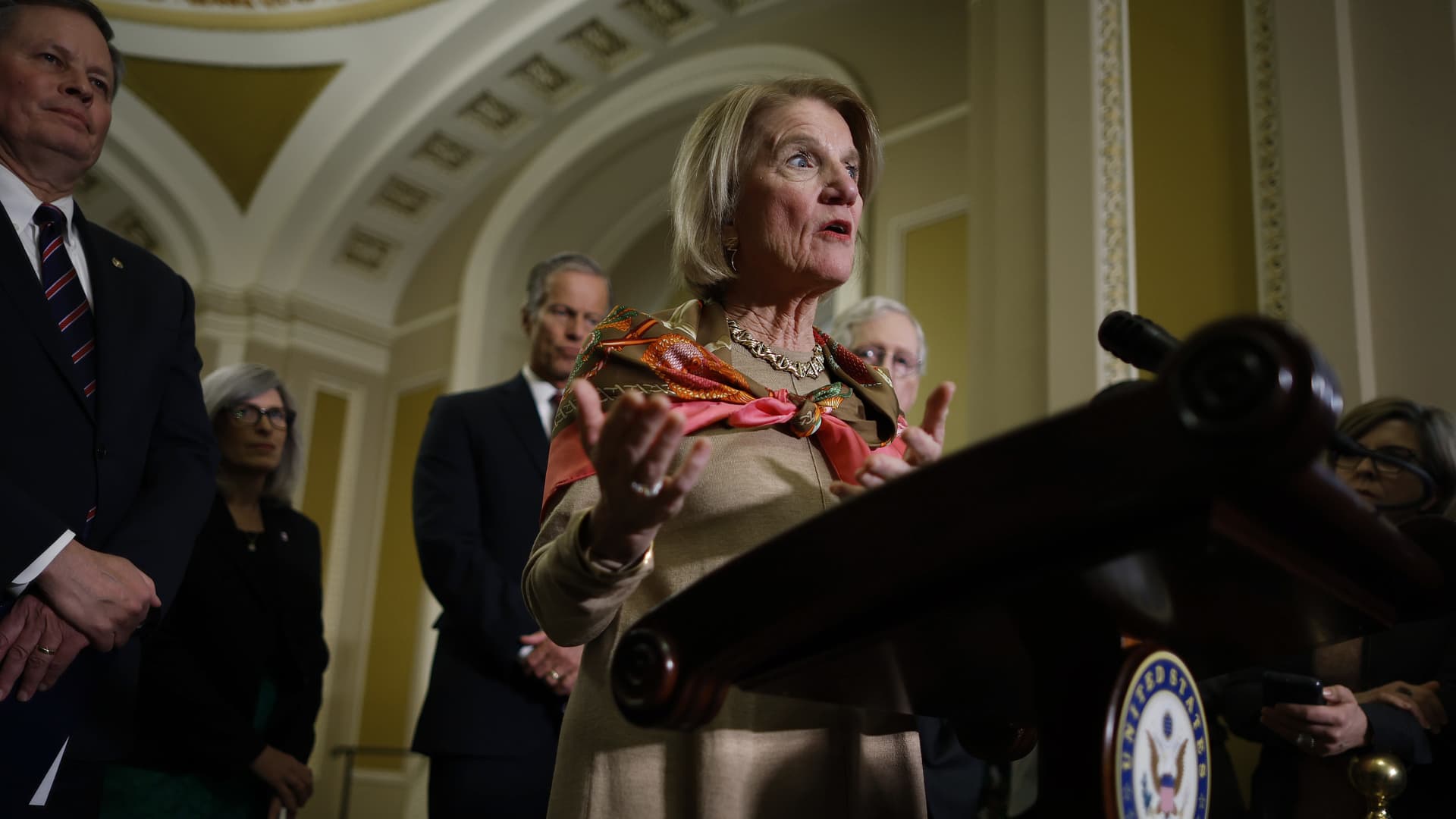

Sen. Shelley Moore Capito (R-WV) talks to reporters through a information conference pursuing the weekly Senate Republican coverage luncheon at the U.S. Capitol on February 28, 2023 in Washington, DC.

Chip Somodevilla | Getty Pictures

WASHINGTON — The Senate on Wednesday voted to overturn a Labor Section rule that permits fiduciary retirement fund professionals to contemplate local climate change and other things when creating investments on behalf of pension plan contributors.

The ultimate vote in the Senate was 50-46, with two Democratic senators crossing bash strains to help the repeal bill: West Virginia Sen. Joe Manchin and Montana Sen. Jon Tester. Both equally are up for reelection upcoming yr in conservative-leaning states.

President Joe Biden mentioned Monday that he will veto the Senate invoice if it will come to his desk — the 1st veto of his presidency.

The Home model of this invoice passed on Tuesday with the assist of just about every Republican and 1 Democrat, immediately after which it advanced astonishingly swiftly to the Senate.

Buoyed by wins in November’s midterm elections, Republicans have vowed to use their new clout in Washington to consider purpose at “woke” capitalism — beginning with an all-out assault on environmental, social, and company governance (ESG) investing policies. ESG funds are designed to catch the attention of socially mindful buyers with stock picks that market renewable strength, inclusive procedures, or very good company governance.

Speaking on the Senate ground Wednesday, Bulk Chief Chuck Schumer, D-NY, defended the Labor Department rule, which went into impact in November of last 12 months.

“This isn’t really about ideological preference — it can be about looking at the most important photograph attainable for buyers to lower chance and maximize returns,” said Schumer. “Why shouldn’t you glance at the risks posed by significantly volatile local weather incidents?”

Democrats also pointed out that the Labor Department rule was voluntary, so it did not involve fund professionals to actually do everything.

In its place, it produced them from the former regulations, enacted all through the Trump administration, which demanded that professionals of federally governed pension resources limit their investment decision choices only to what would crank out the optimum returns, successfully prohibiting them from contemplating other things.

Republican critics of the Labor Department’s new rule say it undermines 401(k) retirement cash by allowing expenditure professionals to place ideological challenges like local climate change ahead of expense returns.

“The previous point we need to do is stimulate fiduciaries to make selections with a reduce level of return for purely ideological causes,” Sen. Mike Braun of Indiana, the Senate’s guide sponsor of the bill, claimed earlier this month.

Republicans say the ESG investing rule is section of a broader development of what they connect with, “woke capitalism,” which contains a selection of stances on social difficulties taken by corporations that they accuse of getting beholden to Democrats.

Republican House committee chairs and presidential hopefuls like Florida Gov. Ron DeSantis have place Wall Street’s ESG investing procedures near the top rated of their political strike lists, element of an work to faucet into the populist economic sentiment championed by former President Donald Trump.