Largely out of necessity, consumers are getting creative about stretching their dollars.

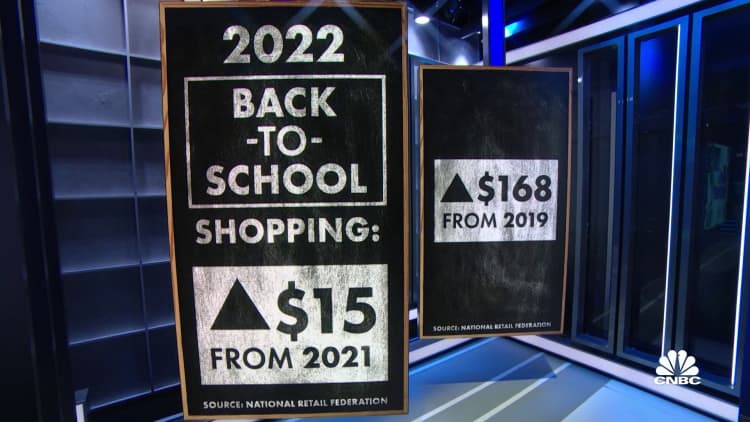

After inflation hit back-to-school budgets hard and as families are feeling the weight of holiday expectations, more are considering thrift shopping as a way to save.

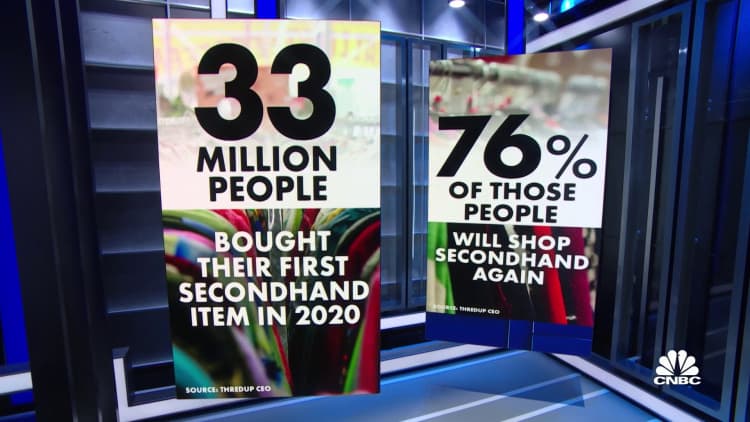

Bargain hunting is certainly not new. But with the Covid pandemic came a surge in “thrifting” and secondhand shopping. Now the resale market is growing even faster than traditional retail.

More from Personal Finance:

More Americans are tapping buy now, pay later services

These steps can help you tackle stressful credit card debt

Inflation fears spur shoppers to get an early jump on the holidays

“Resale continues to provide value in these uncertain times,” said Brett Heffes, CEO of Winmark, the franchisor of stores like Plato’s Closet, Once Upon a Child and Play It Again Sports.

So called recommerce grew nearly 15% in 2021 — twice as fast as the broader retail market and notching the highest rate of growth in history for the industry, according to a 2022 recommerce report by OfferUp.

While dominated by clothing resale, 82% of Americans, or 272 million people, buy or sell pre-owned products, OfferUp found, including electronics, furniture, home goods and sporting equipment, as well as apparel.

Much of the growth has been driven by younger shoppers, particularly teenagers, Heffes said. “We sell a lot of sneakers.”

Thrift store shoppers save nearly $150 a month, or $1,760 a year, on average, by buying secondhand items, according to another report by CouponFollow.

Saving money, however, is not the only driver, CouponFollow found. Shoppers said they were motivated by other factors, as well, such as sustainability and the thrill of the hunt.

Because it is considered eco-friendly, it’s also become more socially acceptable, Heffes said. “When I started in this business, there was a stigma around purchasing previously owned items, and that stigma is gone.”

In fact, sometimes buying secondhand is the only way to score a limited-edition pair of Air Jordans or other highly coveted and exclusive items.

Now, part of the momentum fueling resale is the desire to gain access to a unique item, added Wells Fargo managing director Adam Davis, who works with recommerce retail businesses, whether that’s “a Chanel handbag or Nike sneakers” — even if you end up paying more than the original retail price.

Subscribe to CNBC on YouTube.