Saudi vitality minister Abdulaziz bin Salman on Oct. 5, 2022.

Bloomberg | Bloomberg | Getty Images

Saudi’s condition-controlled oil huge Aramco suspended its potential growth ideas mainly because of the environmentally friendly transition, Strength Minister Abdulaziz bin Salman stated Monday, stressing that the future of energy protection lies with renewables.

“I believe we postponed this [Aramco capacity] expenditure just simply because … we’re transitioning. And transitioning implies that even our oil organization, which made use of to be an oil enterprise, turned a hydrocarbon business. Now it truly is turning into an energy corporation,” the Saudi prince said during a query and respond to panel at the Worldwide Petroleum Technologies Meeting in Dhahran, noting that Aramco has investments in oil, gas, petrochemicals and renewables.

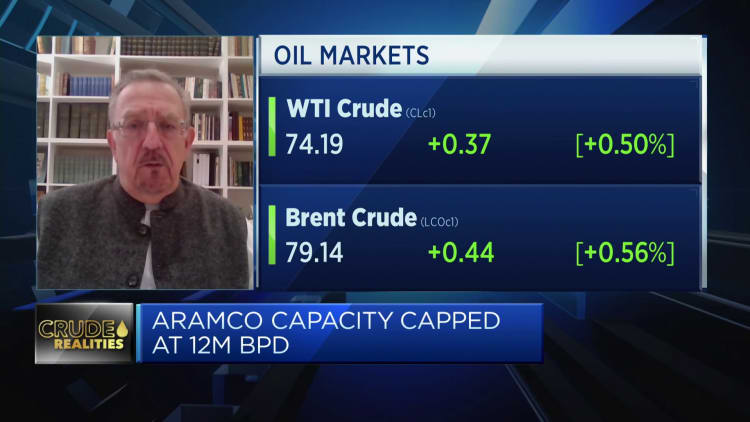

On Jan. 30, the Saudi strength ministry astonished the markets with a directive instructing the Saudi greater part-owned Aramco, which went general public in 2019, to end designs to boost its most crude output capacity from 12 million barrels for every day to 13 million barrels for each day by 2027. The ministry did not disclose the reason guiding its determination at the time, sparking thoughts above possible Saudi worries over the upcoming of oil demand amid a progressing electricity changeover.

The Saudi vitality minister on Monday experienced the determination was not produced rapidly and was the products of a continual critique of industry circumstances.

“We are in [a] ongoing manner of reviewing and reviewing and examining, simply just simply because you have to see the realities [of the market],” he claimed.

Oil prices have spasmed as a result of waves of volatility in the wake of the Covid-19 pandemic, weighed by lessen-than-envisioned recoveries in Chinese demand from customers and inflationary pressures. The global motion to decarbonize and stave off a climate crisis has redirected energy businesses absent from extensive-phrase fossil gasoline jobs in favor of greener investment decision pastures — and may well redefine the outlook for power stability, Abdulaziz bin Salman signaled on Monday.

“Power protection in the 70s, and 80s and 90s was extra dependent on oil. Now, you get what occurred very last calendar year … It was fuel. The long run difficulty on energy stability, it will not be oil. It will be renewables. And the materials, and the mines,” he pressured, noting that there is nevertheless a “huge cushion” of spare ability out there in the party of an crisis scarcity. Earlier, these kinds of supply shocks have struck by way of sanctions or attacks towards oil infrastructure all over the world.

“Why really should we be the previous region to maintain electrical power ability, or crisis potential, when it is not appreciated? And when it is not regarded?” the Saudi vitality minister said. “Electricity stability is not just the duty of Saudi Arabia. It can be the accountability of all electrical power producers and strength ministries,”

Notably, spare capacity has also very long served as a diplomatic instrument in the Saudi-led Business of the Petroleum Exporting Nations, shaping the odds of victory in the fleeting one particular-month price war concerning Riyadh and Moscow in 2020.

Saudi Arabia and its OPEC allies have long championed a blended power changeover tactic that utilizes fossil gas sources until these a time that renewable supplies are obtainable to absolutely address international demands, downplaying worries in excess of marketplaces imminently hitting peak outdated demand from customers. The stance stands in staunch distinction to that of the Worldwide Strength Company, which in a landmark report of 2021 advocated in opposition to further investment decision in new fossil gasoline supply assignments, if humanity is to overcome the climate crisis.

Nevertheless Center East countries have increasingly tried to reconcile their image as stalwart fossil fuel producers with their energy transition ambitions, with critical OPEC producer the United Arab Emirates internet hosting very last year’s U.N. local weather-geared Meeting of the Events (COP).

The world’s most significant crude exporter, Saudi Arabia aims to decarbonize by 2060, with Saudi Aramco concentrating on to arrive at operational net-zero emissions by 2050. Steered by Crown Prince Mohammed bin Salman’s Eyesight 2030 program, the kingdom has also been grappling with diversifying its economic climate away from overreliance on fossil fuels.