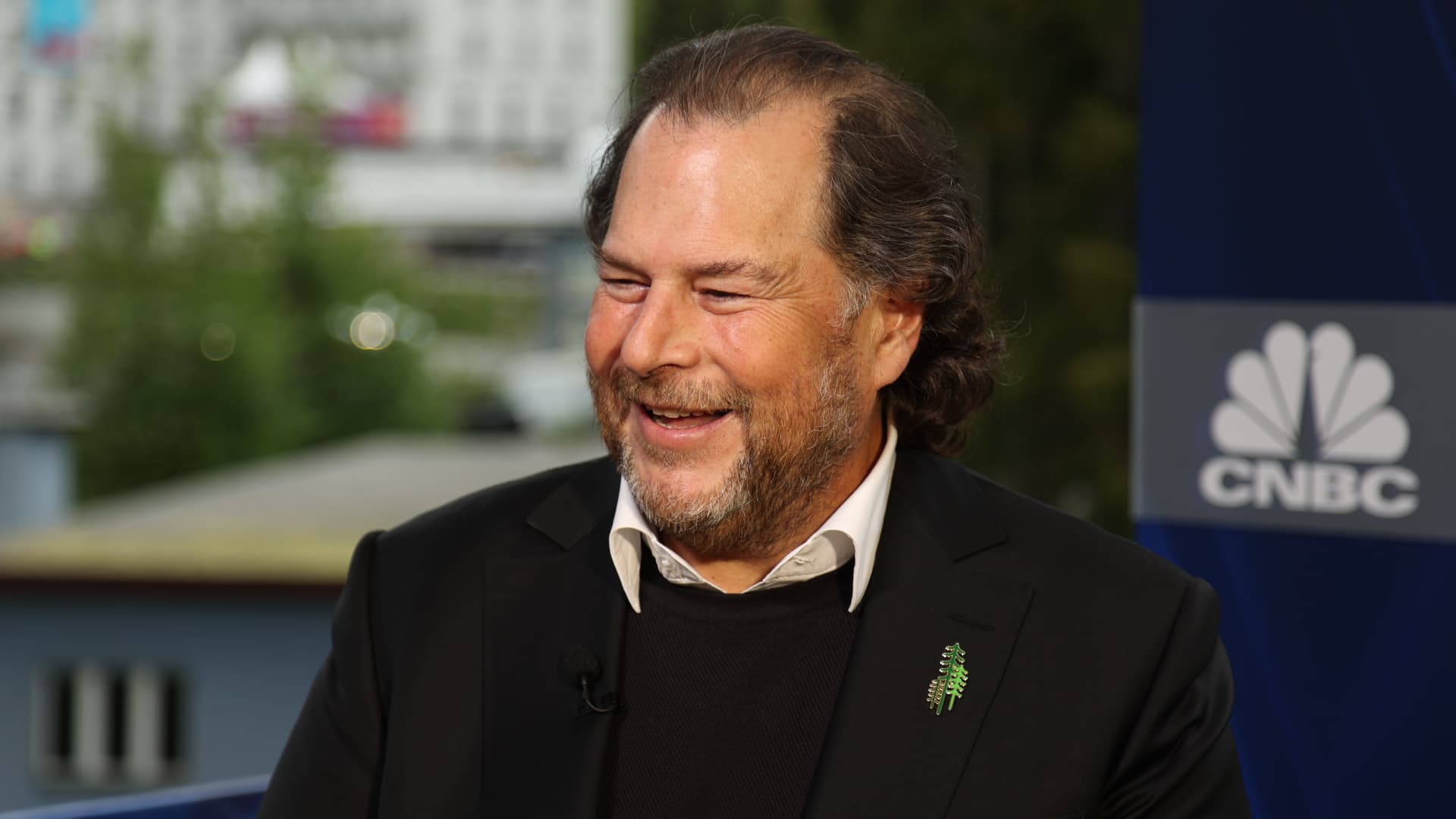

Marc Benioff, CEO of Salesforce, at the WEF in Davos, Switzerland on May 25th, 2022.

Adam Galica | CNBC

Salesforce shares jumped as much as 15% on Wednesday, after the cloud software vendor maker issued better-than-expected quarterly results and lifted its full-year profit forecast.

On a day when most tech stocks and the broader equity markets were trading lower, investors were optimistic about Salesforce’s ability to withstand rising interest rates, inflation, supply shortages and ongoing disruptions from Covid-19.

“While there was nothing stellar in the quarter we believe that investors were relieved by that revenue was in-line and commentary was positive on conditions and pleased with the FY margin increase leading to the stock up in the aftermarket,” Bernstein analysts Mark Moerdler and Firoz Valliji wrote in a note to clients on Wednesday.

Still, Moerdler and Valliji, who have the equivalent of a hold rating on the stock, trimmed their 12-month price target to $181 from $230. The stock traded as high as $184.42 on Wednesday.

The analysts said the target change was a matter of bringing the estimate “in line with multiple compression across software,” as worries intensify about slowing growth in cloud computing and software broadly.

Revenue for the quarter rose 24% to $7.41 billion, topping the $7.38 average analyst estimate, according to Refinitiv. Salesforce lowered its revenue guidance for the full 2023 fiscal year while boosting its profit view. It now sees $4.74 to $4.76 per share in adjusted earnings and $31.7 billion to $31.8 billion in revenue. Previously Salesforce had expected earnings of $4.62 to $4.64 per share on $32.0 billion to $32.1 billion in revenue.

Analysts at Evercore focused on the 18% growth in Salesforce’s longstanding Sales Cloud business for tracking sales leads. They cited comments from Gavin Patterson, the company’s president, who said at Davos that Salesforce has more importance to customers now than in prior cycles.

“We believe that this speaks to the stickiness of demand even with a more uneven macro backdrop,” wrote the analysts, who have the equivalent of a buy rating on the stock. They maintained their $250 price target.

Analysts at Piper Sandler dropped their price target on the stock to $250 from $330, but said they were encouraged to hear Patterson say on Tuesday that the number of deals involving five or more of Salesforce’s clouds increased 21% from a year earlier.

“Vendor consolidation could play into CRM’s hand if business conditions tighten further,” said the Piper Sandler analysts, who have the equivalent of a buy rating on the stock. “Last week, we spoke with a CFO that now plans to more closely scrutinize the number of IT suppliers with the intent to move off an existing service cloud to the Salesforce Sales and Service Clouds going forward as part of a plan to rationalize costs after a small layoff. Multi-cloud could help insulate the model next year.”

WATCH: Spending on enterprise software is very durable, says Evercore ISI’s Materne