European oil sanctions are due to kick in on December 5. The concept is to minimize oil revenues for Russia given its war in Ukraine.

Andrey Rudakov | Bloomberg | Getty Visuals

Forthcoming sanctions on Russian oil are set to be “actually disruptive” for strength markets if European nations are unsuccessful to set a cap on price ranges, analysts warned.

The 27 countries of the European Union agreed in June to ban the invest in of crude oil from Dec. 5. In simple phrases, the EU — alongside one another with the United States, Japan, Canada and the U.K. — want to greatly slice Russia’s oil revenues in a bid to drain the Kremlin’s war chest following its invasion of Ukraine.

connected investing information

Even so, issues that a total ban would ship crude selling prices soaring led the G-7 to consider placing a cap on the quantity it will pay out for Russian oil.

An outright ban on Russian imports could be “actually disruptive” to marketplaces, according to Henning Gloystein, director of power, climate and sources at political danger consultancy Eurasia Group.

The probable for increasing oil prices is “why there’s force from the U.S.” to agree on a cap, Gloystein told CNBC Wednesday.

A price limit would see G-7 nations purchase Russian oil at a reduce value, in an work to reduce Russia’s oil earnings with out increasing crude price ranges throughout the globe.

On the other hand, EU nations have been in dispute for several times around the proper amount to cap rates.

The correct oil cap

A proposal discussed previously this 7 days proposed a limit of $62 a barrel, but Poland, Estonia and Lithuania refused to agree to it, arguing it was far too high to dent Russia’s revenues. These nations have been among the most vocal in pushing for motion from the Kremlin for its aggressions in Ukraine.

Speaking to CNBC’s Julianna Tatelbaum Wednesday, the Dutch vitality minister said a cap on Russian oil charges was “a very essential future stage.”

“If you want successful sanctions that are really hurting the Russian routine, then we will need this oil cap mechanism. So with any luck , we can agree on it as quickly as feasible,” Rob Jetten mentioned.

On Wednesday, Russian oil traded at about $66 a barrel. Officials at the Kremlin have frequently explained that a selling price cap is anti-competitive and they will not promote their oil to nations around the world that have implemented the cap.

They are hoping that other significant prospective buyers — such as India and China — will not likely agree to the restrict and so will carry on to order Russian oil.

China and India

G-7 nations agreed to impose a restrict on Russian oil back in September, and have been performing on the particulars at any time considering the fact that. At the time, the EU’s electrical power chief, Kadri Simson, told CNBC she was hoping China and India would support the value cap way too.

Equally nations stepped up their buys of Russian oil following Moscow’s invasion of Ukraine, benefiting from discounted fees. Their participation is viewed as crucial if the restrictions on Russian oil are to perform.

“China and India are important as they acquire the bulk of Russian oil,” Jacob Kirkegaard, senior fellow at the Peterson Institute For International Economics, instructed CNBC.

“They will not likely dedicate, nonetheless, for political motives, as the cap is a U.S.-sponsored policy and [for] industrial factors, as they currently get a whole lot of inexpensive oil from Russia, so why jeopardize that? Pondering they would voluntarily be a part of was normally naive as Ukraine is not that critical to them.”

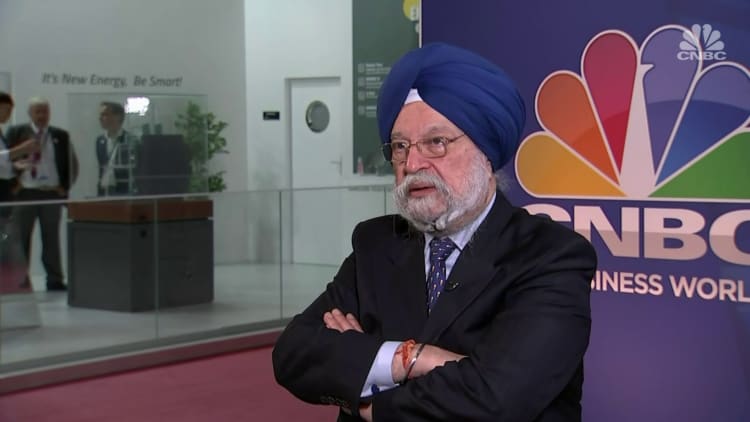

India’s Petroleum Minister Shri Hardeep S Puri informed CNBC in September he has a “ethical responsibility” to his country’s shoppers. “We will acquire oil from Russia, we will purchase from anywhere,” he included.

As such, there are expanding uncertainties about the genuine effect of the restrictions on Russia.

“Power sanctions in opposition to Russia have arrive as well late and are too timid,” Guntram Wolff, director at the German Council on Foreign Relations, reported by way of email.

“This is just a continuation of an unfortunate series of timid conclusions. The more time and later on the sanctions arrive, the easier it will be for Russia to circumvent them.”