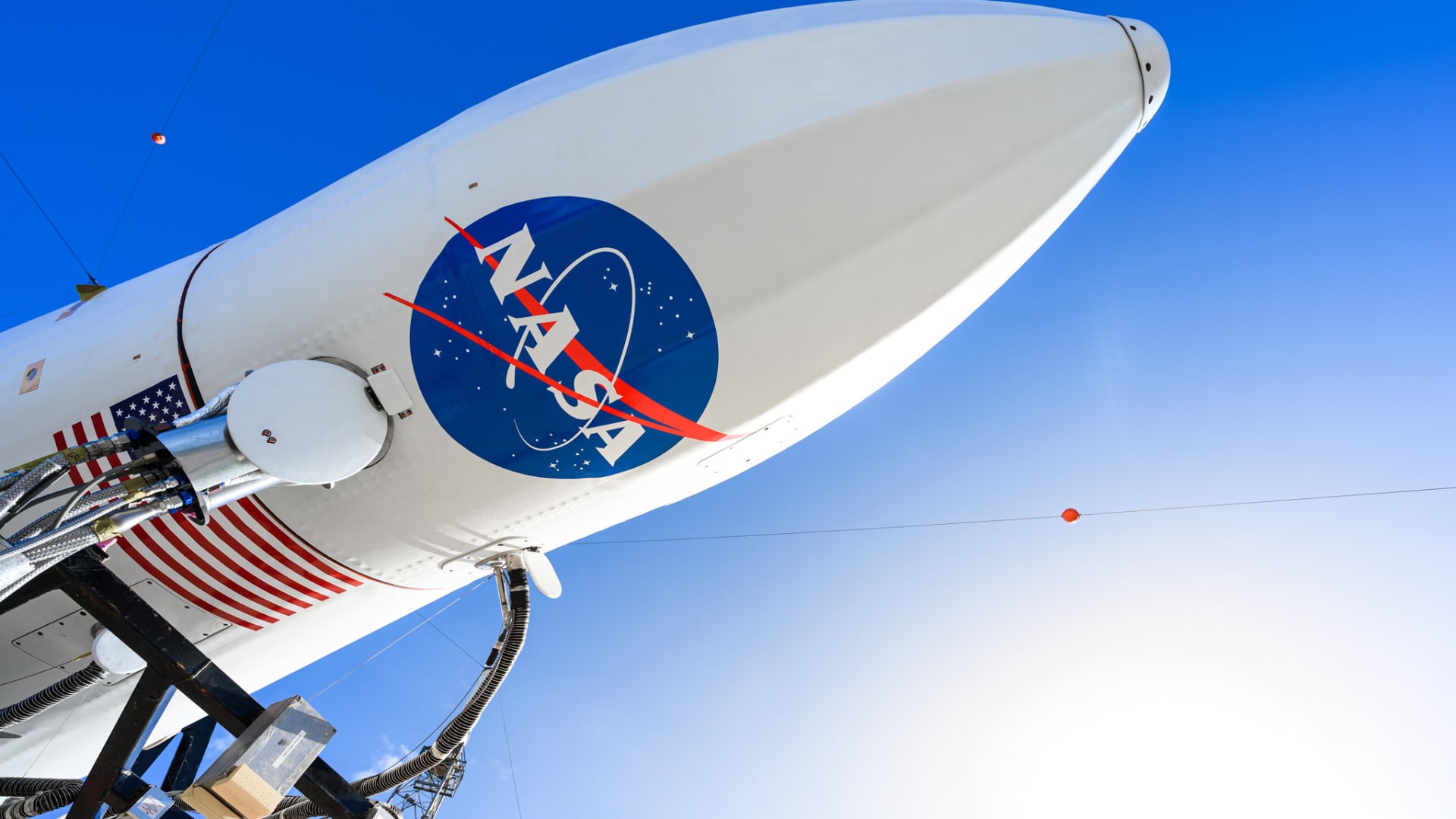

A near up seem at Astra’s LV0008 rocket at LC-46 in Cape Canaveral, Florida.

John Kraus / Astra

Embattled modest rocket-builder Astra exposed Friday that it received a delisting warning from the Nasdaq after its stock spent 30 consecutive times beneath $1 for each share, a violation of the exchange’s specifications.

The organization has 180 days to carry its share cost or deal with delisting, in accordance to a regulatory submitting.

Astra inventory closed Friday at 59 cents for every share, down far more than 90% this 12 months and far more than 95% off its 52-week significant of $13.58. The enterprise debuted on the Nasdaq in July 2021 by means of a merger with a exclusive purpose acquisition company.

Astra did not immediately return request for remark Friday on the delisting warning.

The rocket builder has been saddled with quarterly losses and in August mentioned it was pausing flights for the remainder of the 12 months.

“Whether or not we are going to be in a position to start industrial launches in 2023 will rely on the achievements of our examination flights” for a new rocket system, CEO Chris Kemp mentioned in the course of the firm’s next-quarter conference simply call.

Astra is also dealing with a Federal Aviation Administration investigation into a unsuccessful rocket start in June that was carrying a pair of satellites for NASA’s TROPICS-1 mission. The corporation was unable to produce the satellites to orbit, and NASA put the remaining two launches it experienced contracted from Astra on maintain.

— CNBC’s Michael Sheetz contributed to this report.