The Reddit emblem is found shown on a smartphone.

Sopa Photos | Lightrocket | Getty Illustrations or photos

Reddit, the 18-year-outdated social media and information aggregation site, is demanding builders fork out 1000’s of dollars to straight obtain the firm’s information and written content, a go that could help pull in a more diversified source of income.

The enterprise, which 1st disclosed programs for an IPO in late 2021, is asking builders to pay $12,000 per just about every 50 million requests, in accordance to a article from the creator of a well-liked 3rd-social gathering application called Apollo. The developer explained the variety was “deeply” disappointing.

associated investing information

“Apollo made 7 billion requests last month, which would place it at about 1.7 million dollars for each month, or 20 million US bucks for each 12 months,” the developer stated in a Reddit put up about the modify.

Reddit is the vast majority owned by Progress Publications, the mum or dad business of Conde Nast and a key shareholder in Charter Communications and Warner Bros. Discovery.

Software programming interfaces have prolonged been the way third get-togethers access info from significant internet corporations and link to their apps. Reddit has a thriving ecosystem of applications, plugins and products and services made by novice and qualified builders.

API expenditures have attained better consideration since Elon Musk assumed ownership of Twitter and since new artificial intelligence-driven equipment built their way into solutions applied by tens of millions of individuals. Modern AI programs use large language products, which teach themselves on mountains of website-dependent written content, such as from user-produced posts on web sites this kind of as Twitter and Reddit.

People and developers were outraged when Twitter stated it would demand $42,000 for 50 million requests. Apollo’s developer mentioned even with Reddit’s guarantee to avoid that type of extraordinary pricing, the enterprise cost is “continue to $12,000.”

Apollo explained it paid out about $166 for the exact same amount of API requests from the online picture-sharing service Imgur.

Although many companies cost for API use, Reddit has historically derived the bulk of its profits from promoting. But relative to its peers this sort of as Fb, Snap and Pinterest, Reddit has struggled to monetize its active user base.

With the digital advertisement sector struggling with a slowdown and Reddit now 18 months taken off from the notification of its private IPO filing, the enterprise could be facing pressure to bolster its earnings.

Reddit appears dedicated to the API pricing. The Apollo developer mentioned the firm had no trouble with the put up.

Reddit didn’t promptly reply to a ask for for comment.

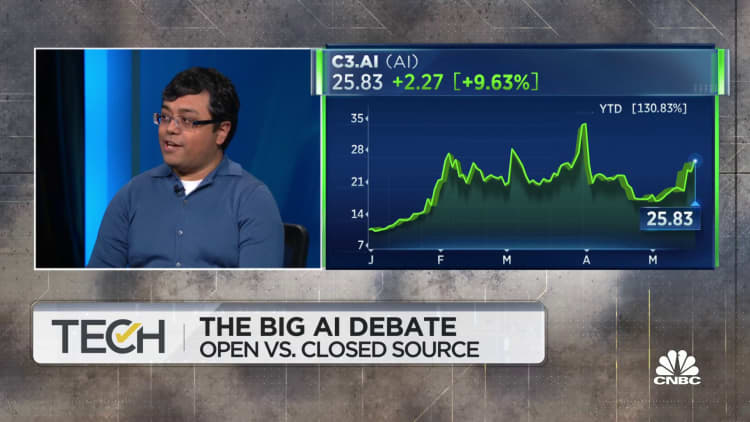

Watch: Security.ai is viewing eight-digit earnings from its API