Reddit CEO Steve Huffman hugs mascot Snoo as Reddit starts investing on the New York Inventory Trade (NYSE) in New York on March 21, 2024.

Timothy A. Clary | AFP | Getty Pictures

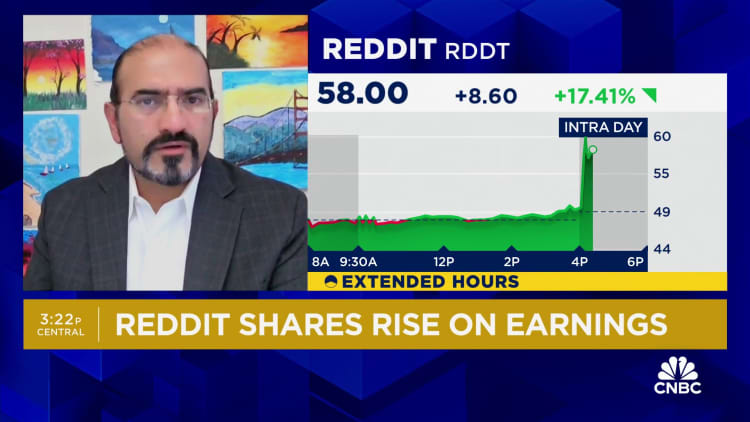

Reddit shares rallied 14% in prolonged trading on Tuesday soon after the firm produced quarterly final results for the initially time since its IPO in March.

This is how the company did:

- Decline for each share: $8.19 loss per share. That may perhaps not look at with the $8.71 reduction anticipated by LSEG

- Revenue: $243 million vs. $212.8 million predicted by LSEG

Profits climbed 48% from $163.7 million a calendar year before. The company claimed $222.7 million in advert revenue for the period, up 39% calendar year about yr, which is a quicker level of development than at its prime competitors.

Digital marketing businesses have started expanding once again at a nutritious clip right after makes reeled in shelling out to cope with inflation in 2022. Meta‘s ad profits jumped 27% in the initially quarter, followed by 24% growth at Amazon and 13% expansion at Google mother or father Alphabet.

Reddit documented a internet decline of $575.1 million. Inventory-based mostly payment fees and related taxes ended up $595.5 million, mostly driven by IPO costs.

For the second quarter, Reddit expects income of $240 million to $255 million, topping the $224 million predicted by analysts, according to LSEG. The midpoint of the steering variety suggests development of about 32% for the second quarter, up from $183 million from a yr previously.

Reddit, which hosts millions of on the web discussion boards on its platform, was founded in 2005 by Alexis Ohanian and Steve Huffman, the firm’s CEO.

“We see this as the commencing of a new chapter as we perform in direction of building the upcoming generation of Reddit,” Huffman claimed in a release Tuesday.

Reddit began trading beneath the ticker image “RDDT” on the New York Inventory Exchange in March. The company priced its IPO at $34 per share, which valued the firm all around $6.5 billion. When tech valuations ended up red sizzling in 2021, Reddit’s personal market valuation attained $10 billion.

The stock climbed previous $58 in right after-hours buying and selling on Tuesday right before coming back again a little bit. Really should the stock shut previously mentioned $57.75 on Wednesday, it would be at its best because March 26, its fourth working day of investing. The shares shut that day at $65.11, their best nonetheless.

The corporation reported 82.7 million every day active users for its 1st quarter, up from the 76.6 million anticipated by StreetAccount. Average profits per person globally rose 8% to $2.94 from $2.72 a year in the past.

Reddit will maintain its first quarterly connect with with traders at 5 p.m. ET.

Enjoy: Reddit shares climb right after earnings